It’s not just a prominent post-pandemic trend, but also an essential need of the new era – as people pay more attention to their holistic health, demand enhanced living experiences, and expect real value from their real estate investments.

VARS’s research data reveals that while the residential, industrial, and commercial real estate sectors have entered a new growth cycle, the recovery of the tourism and resort real estate market is slower than expected, even though the tourism industry has rebounded robustly post-COVID-19.

Specifically, the supply of tourism and resort real estate in Q1/2025 continued to improve but remained limited. The market only recorded 950 new product launches in the quarter, 2.4 times higher than the previous quarter and nearly three times higher than the same period in 2024, but only 18% of the same period in 2022. Of these, 78% of the new supply came from projects in Central Vietnam. The new projects launched were relatively well absorbed, with a 51% absorption rate, equivalent to more than 400 transactions. Thanks to improved supply quality and recovering demand due to positive signals from the macro environment and legal policies.

Notably, the new products launched are developed to enhance practical usage value, optimize functionality, and elevate experiences to meet the increasingly sophisticated demands of customers. Most of the projects launched are already operational or ready to be operated in key locations such as Vung Tau, Da Nang, Nha Trang, Phu Quoc, and the outskirts of Hanoi like Hoa Binh, Vinh Phuc, and Phu Tho.

Some developers even proactively halted sales to restructure their products, adjust their communication strategies, and refine their business models to better cater to market demands. This positive move reflects the determination of developers to transform their product offerings and market approach, thereby enhancing sales effectiveness and gradually fostering the sustainable recovery of the tourism and resort real estate segment instead of chasing short-term growth. Simultaneously, it instills confidence in investors.

However, the market is also facing strong polarization. Many projects remain closed, and previously launched projects with unsold inventory continue to offer their products without any changes in product attributes or pricing, resulting in stagnant sales. Meanwhile, the pressure of rising input costs, especially land and financial expenses incurred during the “freeze,” makes restarting many projects challenging. To ensure profitability, some developers have no choice but to increase selling prices, making it difficult to compete with the secondary market.

VARS believes that investment demand for tourism and resort real estate still exists in the market but is in a “wait-and-see” state. As soon as the market presents legally compliant products with attractive features to ensure efficient operational potential, investors will confidently invest.

In this context, wellness-focused resort real estate is emerging as a segment leading new investment flows. Instead of mere accommodations, modern resort offerings must blend rest, physical recovery, and spiritual rejuvenation – aligning with the globally spreading “wellness living” philosophy. Notably, projects endowed with unique natural attributes, such as hot springs, temperate climates, lush ecosystems, or natural therapeutic resources, are becoming critical differentiators that confer a competitive edge.

In Vietnam, several provinces, including Hoa Binh, Vinh Phuc, Phu Tho, Quang Binh, Khanh Hoa, and Quang Ninh, are deemed highly promising for the development of this segment due to their hot spring systems, mountainous landscapes, and distinctive sceneries, coupled with well-planned infrastructure.

Therefore, VARS anticipates that tourism and resort real estate projects integrating wellness and healthcare, particularly in the provinces surrounding major cities, will become the new investment hotspots.

Consequently, tourism and resort real estate projects that incorporate wellness and healthcare not only fulfill the criteria of “healthy living, joyful living, and safe living” – the primary concerns of individuals post-COVID-19 – but also offer therapeutic solutions, hot springs, meditation, detox programs, spa services, and mental health care.

Secondly, this segment appeals to diverse customer segments, ensuring stable cash flow for the projects. Specifically, it caters not only to the affluent and elderly willing to pay a premium for superior living and elevated wellness experiences but also to the younger generation, who are increasingly prioritizing physical and mental well-being.

“Shareholder Meeting of SCID: Application Filed to Annul VIAC Ruling on An Phu and NVL Projects”

“At the annual general meeting held on May 16, 2025, the management of Saigon Co.op Investment and Development Joint Stock Company (SCID) provided insights into their strategic direction amidst the ongoing global trade tensions. This meeting also addressed the company’s response to the legal proceedings initiated by Novaland regarding the An Phu project.”

“Tariff Turbulence Curtails Industrial Real Estate Investors’ Bond Issuance in 2025”

In the major bond-issuing sectors, the industrial real estate industry will be the most affected by the tariff risks.

Market Beat 20/02: Shakeout at Resistance, Foreigners Resume Net Selling

The VN-Index experienced some volatility during the afternoon session, but overall, the fluctuations were not significant. The index closed on February 20th at 1,292.98, a gain of 4.42 points. The HNX-Index and UPCoM-Index also witnessed some volatility but managed to end the day in the green at 238.02 and 100.08, respectively. Foreign investors made a notable return to net selling.

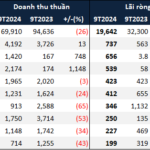

The Long and Winding Road to Recovery: Real Estate’s Nine-Month Journey Back to the Starting Line

As of Q3, several residential real estate firms have exceeded their annual targets. However, many are still lagging behind. A significant number of companies reported declining profits, causing the industry’s overall performance to regress compared to the same period last year.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)