|

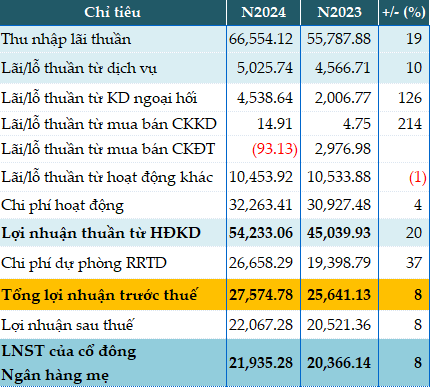

Agribank’s 2024 Business Results

Source: VietstockFinance

|

In 2024, Agribank achieved a remarkable pre-tax profit of nearly VND 27,575 billion, reflecting an 8% increase compared to its 2023 performance. This impressive result sets the bar high for the bank’s 2025 targets, with estimated profit goals ranging from VND 28,402 billion to VND 28,954 billion.

For the year 2025, Agribank is expected to witness a harmonious growth in its total assets, aligning with the expansion of its capital sources. Market 1 capital mobilization is projected to increase by 7-10%, carefully adjusted to match the growth in outstanding loans.

The bank’s outstanding loans to the economy are anticipated to surge by a minimum of 11%, adhering to the plan approved by the State Bank of Vietnam.

Agribank has also set ambitious targets for its agricultural and rural lending ratio, aiming for 65%, while striving to maintain a bad debt ratio of below 1.5% as per Circular 31. Additionally, the bank is committed to achieving a minimum ROE of 18% and ensuring compliance with all other operational safety ratios.

Furthermore, Agribank is dedicated to enhancing the welfare of its employees, aligning with the guidelines provided by the State Bank of Vietnam.

At the 6th Agribank Typical Exemplary Emulation Conference held on May 13, General Director Pham Toan Vuong proudly shared that as of April 2025, Agribank’s total assets had surpassed VND 2.3 quadrillion. The bank’s outstanding loans to the economy reached nearly VND 1.8 quadrillion, with agricultural loans accounting for approximately 65%. Additionally, the bank successfully mobilized capital exceeding VND 2 quadrillion.

– 09:51 16/05/2025

What’s the Story: Pawn Shop Takes in Over 1.6 Million Motorcycles from Vietnamese Citizens

“With an impressive portfolio, this company has taken on a substantial number of assets, totaling over 2.148 million. This includes an extensive 1.682 million motorcycles and a notable 159,000 automobiles. Their expertise and reach are evident in these figures, showcasing their ability to manage and oversee a vast range of vehicles with efficiency and success.”

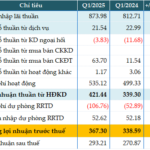

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

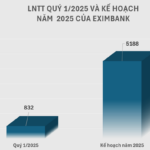

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.