Bank stocks have outperformed real estate, driving the Vn-Index past the 1,300 mark in recent sessions. A slew of stocks saw decent gains, with LPB up 12% in the past week, TCB up 9.12%, VIB up 6.1%, and SHB up 6.2%. Other banks, including MBB, ACB, and CTG, also posted solid gains.

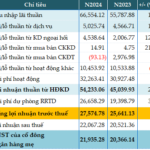

According to KIS Securities, the combined pre-tax profit of 27 listed banks in Q1 2025 rose 14.5% year-on-year. Excluding extraordinary income from SSB’s sale of its entire stake in the Postal Finance Company, the pre-tax profit of the banking sector increased by only 10.9%. This result was driven by robust loan growth, higher non-interest income, controlled operating expenses, and a slight decrease in provisioning costs – with private joint-stock banks outperforming their state-owned counterparts.

Impressive performances in Q1 2025 were recorded by several private banks: large private banks like MBB (+44.7%), STB (+38.4%), and VPB (+19.9%); medium-sized private banks such as HDB (+33%), SSB (+188.8%), EIB (+25.8%), and NAB (+22.5%); along with some other smaller private banks.

Total credit disbursement in Q1 2025 rose 3.93% from the beginning of the year (equivalent to a 17.9% increase year-on-year, higher than the 1.42% rise in Q1 2024), driven by corporate lending.

Several banks took the lead in Q1 2025: CTG increased by 4.5% from the beginning of the year in the state-owned bank group; SHB rose 7.8%, and VPB grew by 5% in the large private bank group; EIB (+9.2%), MSB (+8.9%), LPB (+6.2%), and NAB (+6%) in the medium-sized private bank group; and NVB (+10.6%), KLB (+10.6%), and PGB (+10%) among small private banks.

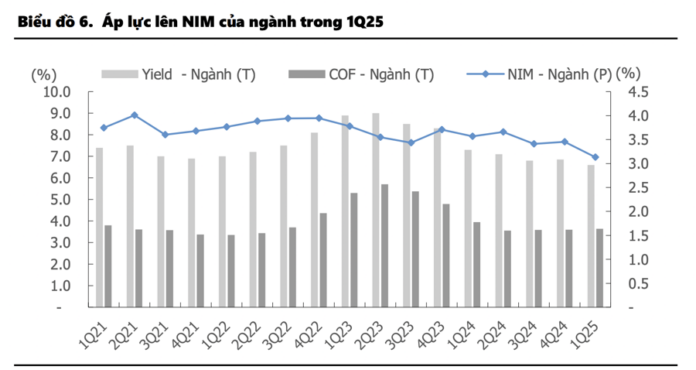

Net interest margin (NIM) for the 27 banks decreased by 45 basis points year-on-year to 3.1% in Q1 2025, mainly due to a decline in asset yields. Most banks reported a decrease in NIM during this quarter.

Non-performing loans (NPLs) increased again in Q1 2025. NPLs in the sub-categories of Group 3–5 and Group 2–5 for all 27 banks rose from 9% and 3.5% in Q4 2024 to 2.1% and 3.8%, respectively, in Q1 2025.

Some banks with low NPL ratios (Group 3–5) saw changes from Q4 2024 to Q1 2025: VAB decreased from 1.3% to 0.6%, VCB maintained its position at 1%, TCB increased from 1.1% to 1.2%, BAB rose from 1.2% to 1.3%, and ACB remained at 1%.

The loan loss coverage ratio (LLCR) decreased from 91% in Q4 2024 to 80% in Q1 2025. Banks with high LLCRs included: VCB (223% in Q4 2024, down to 216% in Q1 2025), CTG (175% in Q4 2024, down to 137% in Q1 2025), and TCB (114% in Q4 2024, down to 112% in Q1 2025).

KIS Securities anticipates that credit growth in Q2 2025 will likely continue to increase year-on-year. The State Bank of Vietnam has set an ambitious target of 16% credit growth for the entire banking system in 2025 – the highest in seven years.

However, declining asset profitability is preventing an NIM recovery in Q2 2025. NIM for 2025 is expected to remain stable in the base case scenario and decrease slightly in the adverse scenario. Provisioning costs may increase due to additional loan loss provisions, and the NPL ratio remains high.

In terms of valuation, the banking sector is currently attractively valued for long-term investment, with a current price-to-book (P/B) ratio of 1.37x, below the five-year average of 1.73x.

Tran Hoang Son, a securities expert, also believes that, in the medium and long term, bank stocks remain attractively valued. If the State Bank of Vietnam continues its accommodative monetary policy to support the market this year, credit growth will remain high. Bank stocks, especially those of leading banks, will have strong momentum for credit growth, thereby driving revenue and profit expansion.

In the past period, the NIM of some banks has started to narrow, especially in the Q1 2025 earnings reports. This trend is reasonable, as banks need to share profits and responsibilities with the economy and the market by providing reasonable interest rate loan packages to support growth. When the economy recovers, bank stocks are usually prioritized, experiencing good growth.

“I still maintain my expectation that if trade negotiations go smoothly and the Vietnamese economy weathers the storm, bank stocks will continue to be a destination for cash flow this year,” emphasized Son.

Market Beat: Foreigners Resume Net Selling, VN-Index Halts Rally

The market closed with the VN-Index down 11.81 points (-0.9%), settling at 1,301.39. The HNX-Index also witnessed a decline of 0.59 points (-0.27%), ending the day at 218.69. The market breadth tilted towards decliners, with 444 stocks falling against 332 advancing stocks. Within the VN30 basket, bears dominated as 24 stocks dropped, while only 4 rose, and 2 remained unchanged.

The End of Easy Profits: What’s Next for Banks to Sustain Profitability?

In the first quarter, banks navigated a challenging environment marked by a continuing compression in net interest margins (NIM). Lending rates were lowered to support the economy, while funding costs remained relatively high to attract deposits. This squeeze on interest rate margins impacted the core income stream from credit activities, directly affecting the bottom line of banking institutions.

Market Pulse, May 15: Real Estate Pressures Mount, But Banking Sectors Come to the Rescue

The VN-Index demonstrated its resilience in the face of morning pressures, with the critical 1,300 level providing excellent support as buying interest emerged. The index rebounded to close at 1,313.2 points, a gain of 3.47 points. The contrasting performances of the two large-cap sectors, banking, and real estate, were the highlight of the session.

“Agribank Aims for a 3-5% Rise in Pre-Tax Profits in 2025”

According to the 2024 Annual Report, the Vietnam Bank for Agriculture and Rural Development (Agribank) has set an ambitious target for its 2025 pre-tax profit. The bank aims to achieve a 3-5% increase compared to its 2024 performance and strives to meet or exceed the profit plan approved by the State Bank of Vietnam.