Several factors contributed to the rise in NPLs in Q1 2025

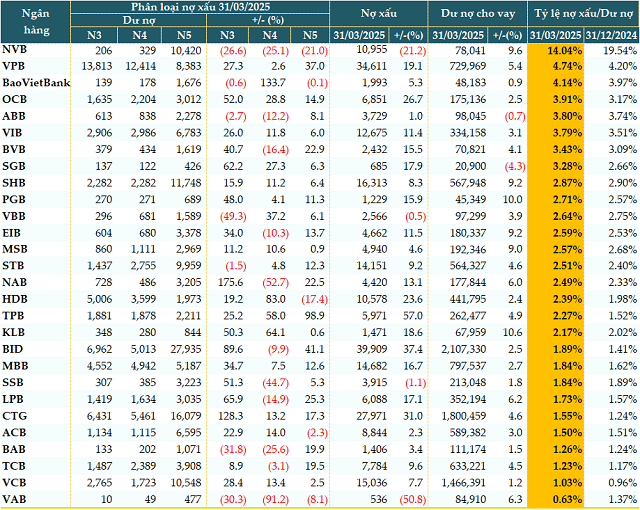

Data from VietstockFinance reveals that as of March 31, 2025, the total outstanding loans of 28 banks that have published financial statements exceeded VND 12.3 quadrillion, a nearly 4% increase from the beginning of the year.

Except for two declining banks (ABBank and Saigonbank), the remaining banks experienced credit growth. KienlongBank (KLB) witnessed the highest increase (+11%), followed by PGBank (PGB, +10%), NCB (NVB, +9.6%), and SHB and Eximbank (EIB), which both grew by 9.2%.

Non-performing loans (NPLs) also increased in line with credit growth. As of the end of Q1, the total NPLs of the 28 banks stood at VND 266,403 billion, a nearly 16% rise compared to the beginning of the year. However, four banks improved their NPL situation compared to the previous year: VietABank (VAB, -51%), NVB (-21%), SeABank (SSB, -1%), and Vietbank (VBB, -0.5%).

The structure of NPLs became more diversified, with a spread across different loan groups. Substandard loans (Group 3) increased by over 37%, while doubtful loans (Group 4) and loss loans (Group 5) rose by more than 5% and nearly 13%, respectively.

Some banks observed a significant improvement in loan quality, successfully reducing all categories of NPLs, including VAB and NVB.

|

Loan quality of banks as of March 31, 2025 (in VND trillion)

Source: VietstockFinance

|

Mr.

Even though the pandemic has subsided, many businesses and households have not fully recovered. Loans that were restructured during 2020-2022 have now reached the end of their grace periods, but operating cash flow remains weak, and consumer demand has not rebounded as expected. Small and medium-sized enterprises, lacking financial buffers, easily fall into debt repayment difficulties, especially in an environment of high-interest rates compared to the supportive phase.

Additionally, in 2023-2024, Circular No. 02/2023/TT-NHNN allowed banks to restructure loan repayment periods and maintain loan groups for customers affected by economic difficulties. However, with the expiration of this circular at the beginning of 2025, numerous loans had to be reclassified according to standard criteria, resulting in a shift from Groups 1-2 to Groups 3-5.

The surge in the NPL ratio in Q1 2025 reflects a policy technicality rather than solely new debt. It is a consequence of “unwrapping” and accurately assessing the risk of old loans.

The first quarter also witnessed a decline in the export market due to the US’s trade countermeasures. In 2024-2025, the US imposed countervailing duties and heightened trade barriers on goods from several countries, including Vietnam. Labor-intensive and highly leveraged sectors, such as wood, textiles, seafood, and electronics assembly, were significantly impacted. The resulting drop in orders severely constrained businesses’ cash flow and affected their debt repayment ability.

Challenges in handling secured assets and the distressed debt market also contributed to the rise in NPLs. Collateralized assets, particularly illiquid real estate or unlisted corporate equity, were difficult to sell. Complex and prolonged legal procedures hindered banks from swift action to recover debts. The distressed debt market fell short of expectations, lacking a clear legal framework, professional investors, and transparent pricing tools.

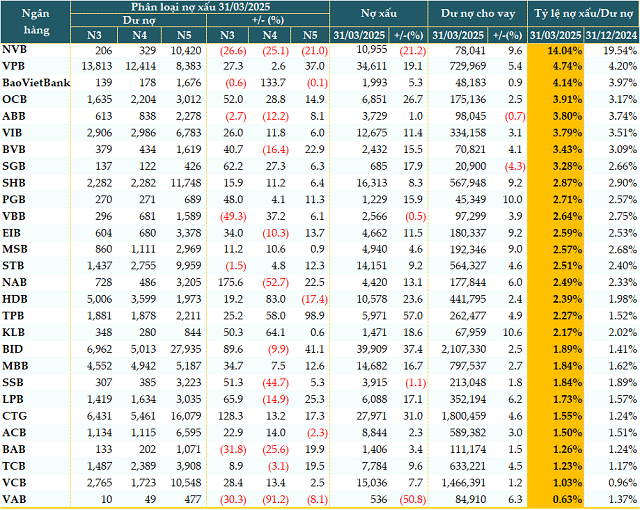

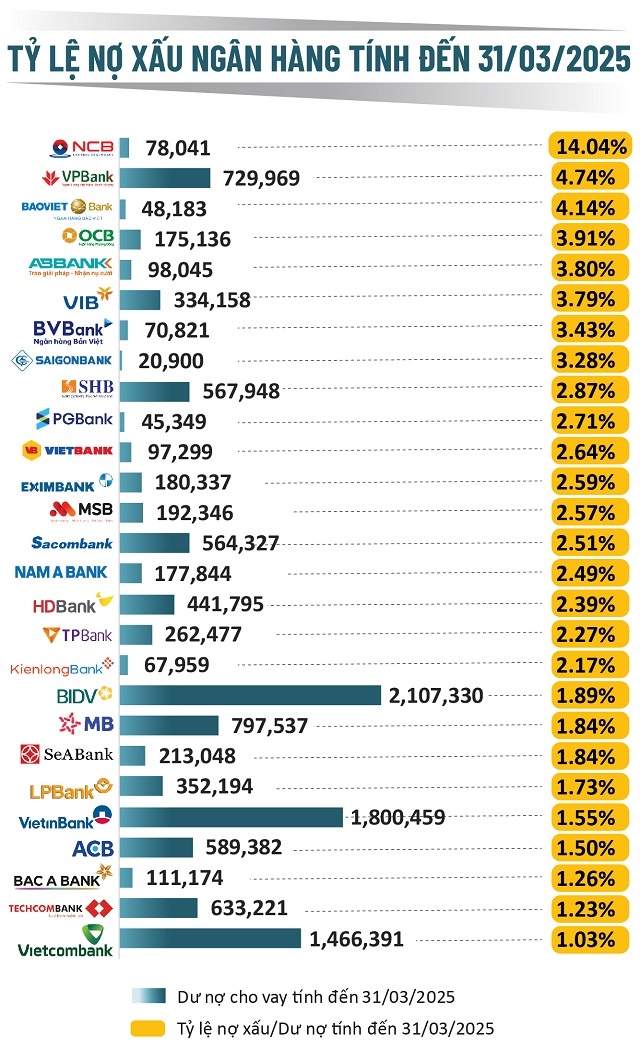

The NPL ratio continues to climb

As of March 31, 2025, 22 out of 28 banks witnessed an increase in their NPL ratio compared to the beginning of the year. The number of banks with an NPL ratio exceeding 3% rose to eight, up from seven at the start of the year.

Source: VietstockFinance

(The NPL ratio of SGB according to Circular 31/2024/TT-NHNN as of March 31, 2025, was 2.46%)

|

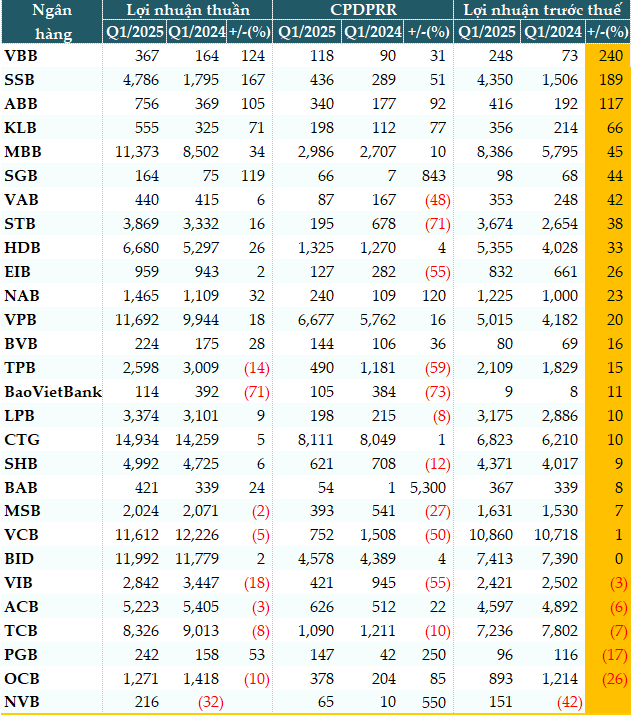

Despite the rise in NPLs, it is worth noting that some banks bolstered their credit risk provisions in the first quarter, depending on their resilience and reserves. As a result, while 17 out of 28 banks increased their provisions, only five banks experienced a decline in pre-tax profits.

|

Pre-tax profits of banks in Q1 2025 (in VND billion)

Source: VietstockFinance

|

NPL growth may slow down in Q2 2025 but is unlikely to reverse

While the second quarter of 2025 may not mark a turning point, it could be a period of stabilization and risk containment. The economy continues to face challenges, with weak domestic consumption and a lackluster global market. Loans restructured in the previous year will continue to mature, and the real estate market remains imbalanced, impacting consumption, investment, and credit.

However, there are positive signs as the government accelerates public investment disbursement, creating a ripple effect on related sectors such as construction, materials, and logistics. The SBV has room to maneuver monetary policy flexibly (reducing operating interest rates, supporting liquidity, and adjusting credit growth limits cautiously while supporting growth).

Some localities have implemented support policies for businesses affected by natural disasters, alleviating financial pressure on agricultural borrowers. To improve NPLs in the future, Mr. Nguyen Quang Huy recommends that the SBV consider issuing a new circular that inherits the supportive spirit of Circular No. 02 but with stricter conditions to prevent abuse of debt restructuring. He also suggests expediting the establishment of a legal framework for the distressed debt market, encouraging socialization, and allowing foreign investor participation.

Commercial banks should proactively identify customer risks through internal credit assessment systems and early warning models. They should also diversify debt handling measures, including negotiating debt rescheduling, asset swaps, collaborating on third-party debt recovery, and enhancing post-disbursement monitoring. Borrowers, including businesses and households, should maintain financial transparency and actively collaborate with banks when facing difficulties to avail of lawful debt restructuring support. They should also proactively restructure their production and business operations toward agility and flexibility, capitalizing on opportunities arising from supply chain shifts and domestic stimulus policies.

– 11:07 16/05/2025

Is There an End in Sight to the Declining Interest Rates?

According to analysts, deposit interest rates have continued their downward trend, albeit at a slower pace. It is predicted that input interest rates will gradually increase towards the end of the year, with expectations of positive economic growth and credit growth reaching or even surpassing the set target of 16%.

The Top 5 Shareholders Related to Chairman Bui Thanh Nhon Have Registered to Sell Nearly 18.8 Million Novaland Shares

Novagroup is set to offer a substantial number of shares, with a planned sale of over 3.9 million NVL stocks. Diamond Properties is also looking to offload a significant amount, totaling 3.2 million shares. In a separate move, the wife and children of Bui Thanh Nhon, Chairman of the Board of Directors, are seeking to sell a combined total of nearly 11.6 million shares.

Will Deposit Rates Rise Again?

The slight upward trend in deposit interest rates since the beginning of May 2025 is not merely a temporary fluctuation, but a reflection of the intricate interplay between systemic liquidity, credit growth targets, policy expectations, and global macroeconomic shifts.