Boosting Land Auctions, Non-Agricultural Taxation…

According to a report from the Hanoi Statistics Office, in the first four months of this year, budget revenue is estimated at over VND 310,000 billion; Hanoi leads the country in budget revenue. Land use fee collection alone accounts for more than VND 54,000 billion.

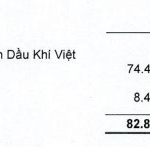

In 2024, revenue from land and housing increased by more than 29% compared to the previous year, reaching over VND 48,590 billion. This figure exceeded the estimate by 14%. Land use fee revenue alone contributed nearly 75% with VND 36,100 billion, an increase of 40.5% over the previous year.

The total revenue from auctions by localities in the city amounted to over VND 11,000 billion. Meanwhile, in 2023, this revenue stood at VND 9,200 billion. In the first three months of 2025 alone, Hanoi raised about VND 6,860 billion from land-use right auctions.

This achievement is due to Hanoi being one of the first localities to establish a task force to address difficulties and obstacles in real estate projects. To date, the city has inspected and listed 829 slow-moving projects for inspection and urged implementation.

Speaking to Tien Phong Newspaper, Assoc. Prof. Dr. Nguyen Dinh Tho, Deputy Director of the Institute of Strategy and Policy on Agriculture and Rural Development, Ministry of Agriculture and Rural Development, said that to increase budget revenue, it is necessary to promote land-use right auctions.

Hanoi promotes land auctions to implement projects and increase budget revenue.

According to Mr. Tho, localities must closely monitor the land fund planned for urban development, industrial parks, industrial clusters, land for production facilities, and non-agricultural business to use the land fund economically and efficiently, and overcome land wastage and slow land allocation.

The planning of sectors and fields involving land use must be consistent with the land use planning and plans. Land management and use must comply with approved planning and plans, especially in areas where the land use purpose will be changed to focus on economic development and structural adjustment towards service and urban development to increase budget revenue.

In addition, Mr. Tho said that localities must increase the value of land according to new planning to increase budget revenue from land. For example, when building a new infrastructure area, it is necessary to follow market mechanisms and adjust land prices, which will create opportunities for land prices to increase. Accordingly, revenue from land will continue to increase.

Prof. Dr. Dang Hung Vo, former Deputy Minister of Natural Resources and Environment, said that the proportion of budget revenue from land in recent years has been increasing rapidly, but compared to many countries, the proportion of budget revenue from land in Vietnam is still very low.

Mr. Vo cited the example of the UK, where up to 90% of local budget revenue comes from land-related taxes. The main source of revenue is property taxes on land and real estate. In Vietnam, local revenue from land in the past has mainly come from the allocation of residential land through auctions of land-use rights.

Imposing Tax on Real Estate Transfer?

In a report submitted to the National Assembly for the questioning session, the Ministry of Finance proposed two methods for calculating personal income tax on real estate transfer to better suit market realities and optimize budget revenue.

The first method is to calculate the tax on the actual income from the transfer of real estate, which is the difference between the selling price and the total cost (including the purchase price and other legitimate expenses). The proposed tax rate is 20%, similar to the corporate income tax rate applied to organizations involved in real estate transfer.

The second method is simpler, continuing to apply a 2% tax rate on the total transfer value as is currently the case.

Lawyer Pham Thanh Tuan, from the Hanoi Bar Association, shared that we used to apply the method of calculating tax on actual income from the transfer of real estate, which is the difference between the selling price and the total cost (difference between selling and buying prices).

Specifically, the Law on Personal Income Tax 2007 stipulates a tax rate of 25% on income from real estate transfer (selling price minus capital and related expenses). However, tax evasion still occurs if the two parties agree on a low surplus amount or even an amount equal to or lower than the input price.

“The method of calculating tax on profit is only feasible when the State has a method of calculating accurate and transparent input and output costs. To do this, information technology infrastructure and land data (purchase and sale prices of each land lot…) must be fully reflected. The national land database (land price tables of localities, land prices by digitized land lots…) must be accurate.”

Unveiling Hanoi’s Transformational Vision: Redefining the Office Space Landscape with the My Dinh Pearl Residential Complex

The Hanoi People’s Committee has approved a decision to re-purpose 1,790 square meters of land at the My Dinh Pearl Complex in Phu Do Ward, Nam Tu Liem District.

The Capital Ha Noi: Shining Bright as the Country’s Top Revenue Generator, Poised to Become a ‘Superstar’ Post-Merger

In the nationwide ranking of budget revenues for the first four months of this year, Hanoi took the top spot with over VND 310 trillion. Ho Chi Minh City followed with more than VND 200 trillion, and Haiphong came in third with nearly VND 58 trillion. According to the list of 34 provinces and cities after the merger, some localities will see significant changes.

The Captivating Capital’s Watery Wonders: Hanoi Unveils a Directory of 3,501 Pristine Ponds, Lakes, and Wetlands Off-Limits to Reclamation.

The Hanoi People’s Committee has added 339 lakes, ponds, and marshes to the city’s non-reclamation list. With this update, Hanoi now boasts 3,501 bodies of water that are protected from land reclamation.