VN-Index Surges on Blue-Chip Rally: Foreign Investors Fuel Market with Net Inflows

The VN-Index witnessed another enthusiastic trading session, especially among large-cap stocks. The strong upward momentum of large-cap stocks served as the main driver, while mid- and small-cap stocks exhibited some divergence.

At the close of the May 14 session, the VN-Index climbed 16.3 points to reach 1,309.73. Trading liquidity improved, with the matched order value on HoSE surpassing VND 22,786 billion.

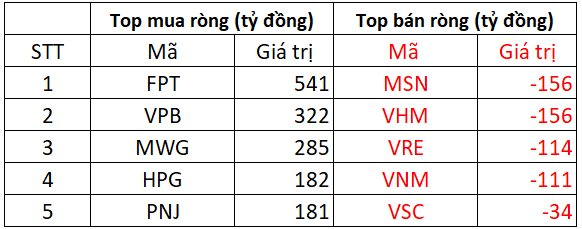

Notably, foreign investors continued their robust net buying on Vietnam’s stock market, with a remarkable net buy value of VND 2,266 billion in today’s session. Here are the details:

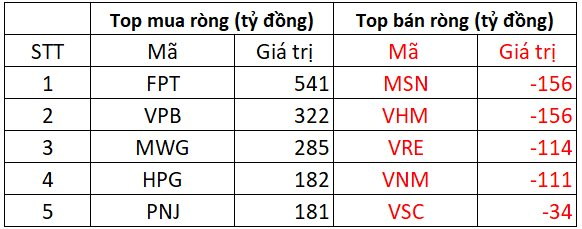

HoSE: Foreign investors net bought approximately VND 2,265 billion

In the buying side, FPT witnessed the strongest net buying in the entire market, with an astonishing net buy value of VND 541 billion. Following closely, VPB and MWG also attracted net buying of VND 322 billion and VND 285 billion, respectively. Additionally, HPG and PNJ witnessed net buying of over VND 180 billion each.

On the opposite side, MSN and VHM faced substantial net selling by foreign investors, amounting to VND 156 billion. VRE and VNM also experienced net selling between VND 111 billion and VND 114 billion. Subsequently, VSC witnessed net selling of VND 34 billion.

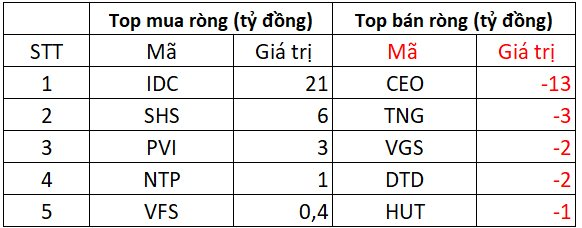

On the HNX, foreign investors net bought approximately VND 6 billion

On the buying side, IDC and PVS witnessed net buying of VND 21 billion and VND 6 billion, respectively. Following them, PVI and NTP also experienced net buying in today’s session, amounting to a few billion VND each.

Conversely, CEO faced the strongest net selling of VND 13 billion. TNG, VGS, DTD, and HUT witnessed net selling of around VND 1-3 billion each.

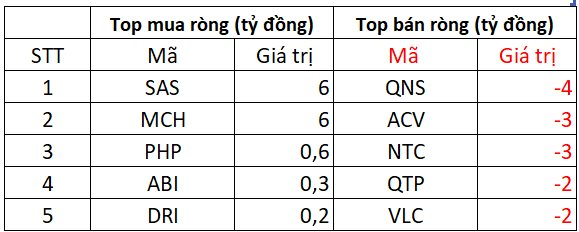

On UPCOM, foreign investors net sold over VND 5 billion

In terms of net buying, SAS and MCH attracted net buying of approximately VND 6 billion each. Additionally, PHP, ABI, and DRI witnessed modest net buying of a few hundred million VND.

On the selling side, QNS faced net selling of VND 4 billion. ACV, NTC, QTP, and VLC also experienced net selling of a few billion VND each.

The Billion-Dollar Question: Unraveling the Foreign Block’s Strategy in Banking Stocks

Foreign transactions continue to be a bright spot, extending the net buying streak. Foreign capital inflows into the banking group, with MBB leading the way with net purchases of over 554 billion VND, followed by SHB with over 292 billion VND, and VPB, BID, STB, and LPB also among the top performers.

“Foreign Investors Turn Bearish: Net-Sell Nearly VND 1 Trillion, Dumping a Bank Stock”

The MWG stock was the most actively bought on the entire exchange, with a net purchase value of VND 126 billion, going against the bearish trend.

Pursuing a Liberal Naturalization Policy, Revising Citizenship Laws

“This morning, the National Assembly heard a presentation from the Minister of Justice, Nguyen Hai Ninh, on the proposed amendments to the Law on Vietnamese Citizenship. The Minister’s address focused on the need to revise and enhance specific provisions within the existing legislation to ensure it remains relevant and effective in the modern context.”