Mr. Pham Van Trong, Member of the Board of Management of Mobile World Investment Corporation (MWG) and General Director of Bach Hoa Xanh chain, has registered to sell 200,000 MWG shares to address personal financial needs. The transaction is expected to be executed via order matching from May 20 to June 18.

Mr. Trong’s move comes as MWG shares have been on a strong upward trajectory since hitting a one-year low in early April. Over the past month, the share price has surged by nearly 40%, climbing to a six-month high. Consequently, the market capitalization has also risen to over VND 94,000 billion.

In a separate development, MWG has approved a program to issue conditional share purchase rights at its subsidiary, Bach Hoa Xanh Technology and Investment Joint Stock Company (owner of the Bach Hoa Xanh chain), to key management personnel of Bach Hoa Xanh Investment to boost motivation, recognize contributions, and foster alignment with the long-term growth objectives of Bach Hoa Xanh.

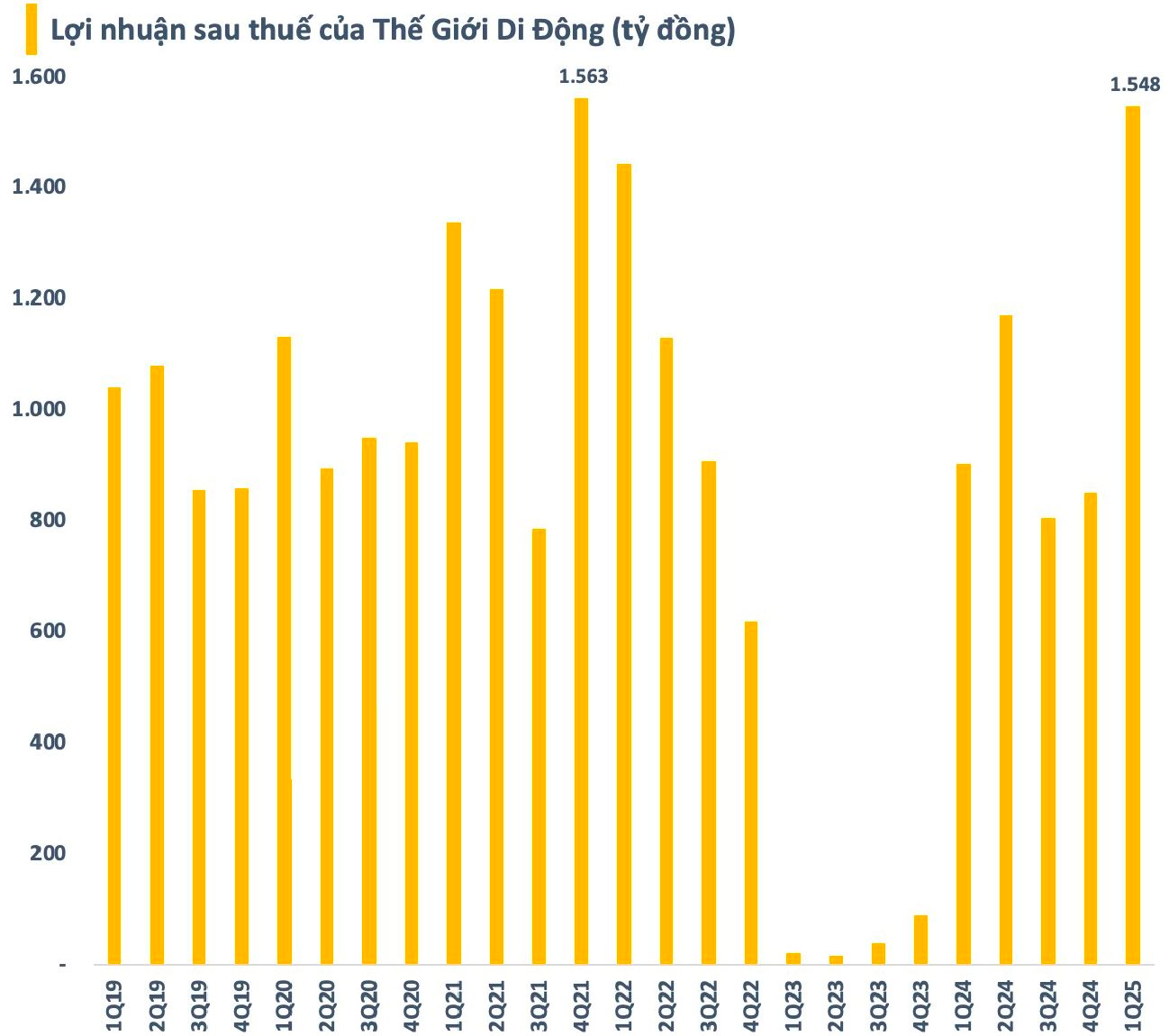

Regarding the first-quarter business results, MWG recorded net revenue of VND 36,135 billion, a nearly 15% increase compared to the same period in 2024. After-tax profit reached VND 1,548 billion, a surge of over 71% from the previous year. This quarterly profit is the second-highest in the history of this retail enterprise, slightly lower than the peak achieved in Q4/2021.

For 2025, The Gioi Di Dong sets targets of VND 150,000 billion in net revenue and VND 4,850 billion in after-tax profit, representing increases of 12% and 30%, respectively, compared to 2024. With the results achieved in the first quarter, the retail enterprise has accomplished 24% of the revenue plan and 32% of the profit target for the full year.

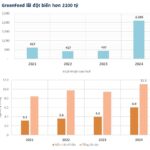

The Booming Agri-Business Mogul of Long An: A Sudden Surge in Profits, Surpassing Industry Giants

GreenFeed witnessed a remarkable surge in its financial performance, recording an impressive after-tax profit of over 2,106 billion VND in 2024, marking a substantial 382% increase compared to the previous year. This unprecedented achievement sets a new record for the company, highlighting its exceptional growth and success.