Vietnam Petroleum Technical Services Joint Stock Corporation (PVS: HNX) has just announced a report on the ownership of a group of related foreign investors holding 5% or more of the company’s shares.

Accordingly, during the trading session on May 9, 2025, the foreign fund Dragon Capital sold a total of 650,000 PVS shares through two member funds. Specifically, Amersham Industries Limited fund sold 500,000 shares, and Norges Bank fund sold 150,000 shares.

After this transaction, Dragon Capital reduced its ownership of PVS shares from nearly 24.03 million shares to nearly 23.38 million shares, equivalent to a decrease in ownership ratio from 5.0265% to 4.8906%.

Illustrative image

Based on the closing price of PVS shares on May 9, 2025, at VND 26,600 per share, it is estimated that Dragon Capital earned approximately VND 17.29 billion from this sale transaction.

In another development, PVS is expected to hold its 2025 Annual General Meeting of Shareholders (AGM) on May 29, 2025, in the form of an online meeting, with shareholders attending and voting electronically. The meeting venue will be at the company’s headquarters at 1-5 Le Duan, Ben Nghe Ward, District 1, Ho Chi Minh City.

At the AGM, PVS plans to present to shareholders reports on business results for 2024 and plans for 2025; profit distribution plan for 2024 and financial plan for 2025; capital increase plan through issuing shares to pay dividends for 2024, etc.

In terms of business results, according to the consolidated financial statements for the first quarter of 2025, PVS recorded net revenue of nearly VND 6,013.7 billion, up 62.1% over the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 299.6 billion, a slight decrease of nearly VND 5.1 billion.

As of March 31, 2025, PVS’s total assets increased slightly by 3.3% compared to the beginning of the year, reaching nearly VND 35,208.5 billion. Of this, cash and cash equivalents accounted for VND 12,331.1 billion, or 35% of total assets; long-term financial investments were nearly VND 4,733.9 billion, or 13.4% of total assets; and inventories were nearly VND 2,045 billion.

On the liability side of the balance sheet, total liabilities stood at over VND 20,174 billion, up 4.3% from the beginning of the year. Short-term payables accounted for VND 6,197.3 billion, or 30.7% of total liabilities, while loans and finance leases amounted to over VND 1,669.7 billion.

The Penultimate Word-Smith: Crafting Captivating Copy

“A Member of the Board of Directors of Dat Xanh Group Accumulated 5 Million Shares”

Mr. Ha Duc Hieu, a prominent member of the Board of Directors at Dat Xanh Group, has demonstrated his confidence in the company’s prospects by significantly increasing his stake. Between May 7 and May 15, Mr. Hieu acquired an impressive 5 million DXG shares, elevating his ownership to 0.66% of the group’s capital. This substantial purchase underscores Mr. Hieu’s faith in the company’s future trajectory and potential for growth.

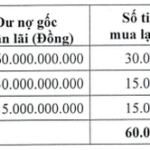

“Extending the Deadline: Hai Phat Postpones $60 Million Bond Maturity to Q2 2025”

With the approval of bondholders, Hai Phat extends the maturity date of its VND 60 billion bond, coded HPXH2123008, from April 28, 2025, to June 30, 2025.