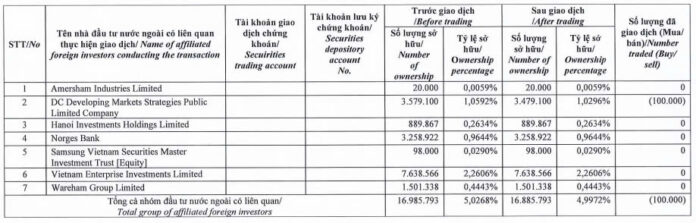

Phú Nhuận Jewelry Joint Stock Company (PNJ: HoSE) has just released a report on the ownership of its largest foreign investor group, holding 5% or more of the company’s shares.

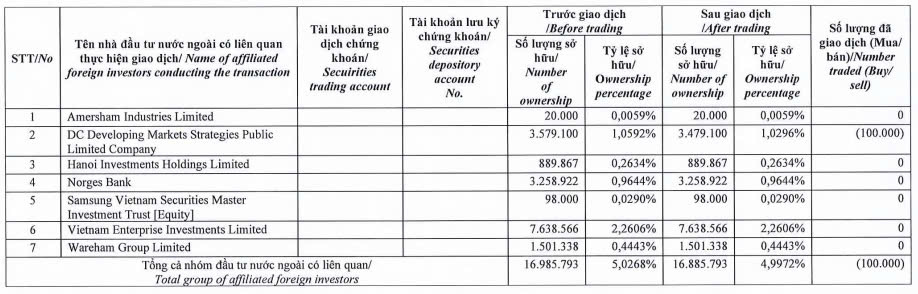

According to the report, on May 8, 2025, the foreign fund Dragon Capital, represented by Ms. Truong Ngoc Phuong, sold 100,000 PNJ shares through its fund member, DC Developing Markets Strategies Public Limited Company.

Following this transaction, the fund’s ownership decreased from nearly 16.99 million shares to approximately 16.89 million shares, equivalent to a decrease in holding ratio from 5.0268% to 4.9972%. With this sale, Dragon Capital officially stepped down as a major shareholder of PNJ.

Source: PNJ

Based on the closing price of PNJ shares on May 8, 2025, at VND 74,000 per share, Dragon Capital is estimated to have earned approximately VND 7.4 billion from this sale.

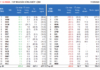

In terms of business performance, according to the company’s consolidated financial statements for Q1 2025, PNJ recorded a revenue of nearly VND 9,635.1 billion, a decrease of 23.5% compared to the same period last year. After deducting the cost of goods sold, gross profit amounted to over VND 2,048.3 billion, a 4.7% decrease.

During this period, the company also recorded a significant increase of 165% in financial income compared to the previous year, amounting to nearly VND 37.7 billion. However, financial expenses also increased by 54.7% to VND 37 billion, and selling expenses rose by 3.1% to nearly VND 1,005.7 billion. Conversely, administrative expenses decreased by 14.7% to over VND 193.7 billion.

After deducting taxes and other expenses, PNJ reported a net profit of over VND 677.7 billion, an 8.1% decline compared to the same period in 2024.

At the 2025 Annual General Meeting of Shareholders held on April 26, 2025, PNJ shareholders approved a business plan with an estimated after-tax profit of nearly VND 1,959.7 billion, a 7.3% decrease compared to the results achieved in 2024.

As of the end of Q1 2025, PNJ has achieved 34.6% of its annual profit target.

As of March 31, 2025, PNJ’s total assets increased slightly by nearly VND 211.6 billion compared to the beginning of the year, reaching over VND 17,419.3 billion. Inventories accounted for VND 13,647.3 billion, or 78.3% of total assets.

On the liability side of the balance sheet, total liabilities amounted to over VND 5,689 billion, a 4.4% decrease from the beginning of the year. Short-term financial borrowings and lease liabilities accounted for VND 3,488 billion, or 61.3% of total liabilities.

The Booming Agri-Business Mogul of Long An: A Sudden Surge in Profits, Surpassing Industry Giants

GreenFeed witnessed a remarkable surge in its financial performance, recording an impressive after-tax profit of over 2,106 billion VND in 2024, marking a substantial 382% increase compared to the previous year. This unprecedented achievement sets a new record for the company, highlighting its exceptional growth and success.

The Coal Mining Company Stakes a Claim for Dividend Splits, Yielding a Whopping 400% Payout

Joint Stock Company 397 (UPCoM: BCB) is pleased to announce a cash dividend for the year 2024. The ex-dividend date is set for May 29th, marking an important milestone for shareholders.

“Harec Building Owner Locks in 30.5% Dividend Yield.”

The Harec Investment and Trading JSC (UPCoM: HRB), owner and operator of the prestigious Harec Building in Hanoi, has announced the record date for shareholders to receive cash dividends for the year 2024. Shareholders on record as of May 21st, 2025, will be eligible to receive this dividend payment.