In its April 2025 market newsletter, Dragon Capital assesses that in the first 30 days following the US retaliatory tariff announcement, Vietnam’s macroeconomic indicators did not show significant fluctuations, and the underlying growth momentum remained stable.

April 2025 data showed that the Industrial Production Index (IPI) increased by 8.9% year-on-year and reached 8.4% in the first four months, led by a robust 10.1% growth in the manufacturing industry. Retail goods and services revenue increased by 11.1% year-on-year and 9.9% in the first four months, significantly surpassing the 8.6% growth in the same period last year, indicating that domestic demand remains positive despite external fluctuations.

However, some pressure signals have started to emerge. The Purchasing Managers’ Index (PMI) for April fell sharply to 45.6 from 50.5 in March, indicating a contraction in manufacturing activity due to decreases in new orders and output.

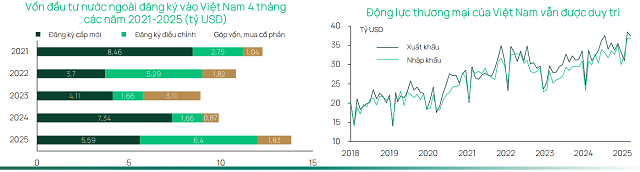

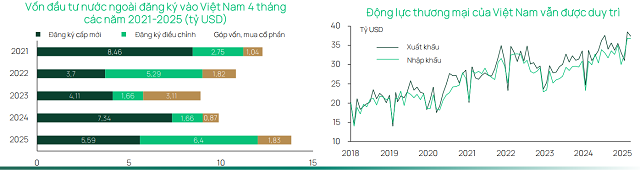

Export businesses expedited shipments to avoid potential disruptions, temporarily boosting trade activities. Total trade turnover in April increased by 18.6% year-on-year, with exports and imports rising by 19.1% and 18.1%, respectively. In the first four months, exports grew by 12.8%, recording a trade surplus of $5 billion. This export growth reflects the openness of the Vietnamese economy and the increase in purchases by US businesses from markets other than China when the 145% tariff was imposed. The US was Vietnam’s largest export market in the first four months, reaching $43.3 billion, accounting for 30% of total exports. Vietnam is in trade dialogue with the US, and the first round of negotiations has concluded. Subsequent rounds are expected in May and June, focusing on issues such as transshipment through a third country and commitments to increase imports from the US.

Stock market data for Q1 2025 from a group of 80 large-cap stocks showed a stable growth picture but with some differentiation. Float-adjusted post-tax profit increased by 10.2% year-on-year. The banking sector continued to be the main contributor to profits, with credit growth recorded alongside a narrowing of net interest margins and variations in profits among banks. Residential real estate and retail performed remarkably well, reflecting positive domestic demand and an early recovery signal in the housing market. Meanwhile, the production and essential consumer goods sectors continued to slow down due to export impacts and profit margin pressures. Overall, the data suggests that industries linked to domestic demand are regaining momentum, while export-dependent and cost-sensitive sectors remain under pressure.

Source: Dragon Capital

|

Resolution 68 Enhances the Role of the Private Sector

Amid global trade uncertainties, Vietnam is striving to boost domestic growth, particularly through the private sector. Resolution 68 was issued to elevate the role of this sector, which currently comprises over 940,000 registered businesses and about 5 million individual business households. The private sector contributes approximately 50% of GDP, more than 30% of state revenue, and employs around 82% of the workforce. By 2030, the government aims to have at least 2 million operating enterprises. The expected average annual growth rate is 10-12%, increasing the contribution to GDP to 55-58%, state revenue to 35-40%, and employment to 84-85%.

Dragon Capital evaluates that Resolution 68 presents a comprehensive policy framework to realize these goals. Notably, the resolution includes a commitment to decriminalize civil and economic violations and strengthen property rights, which are crucial for bolstering business confidence and promoting investment.

Policies encouraging innovation are also emphasized, with provisions allowing enterprises to deduct 200% of actual expenses incurred for scientific, technological, and R&D activities from taxable income. Additional support includes tax and fee reductions, land rent cuts, and improved access to credit for private enterprises. These reforms are designed to enhance Vietnam’s economic resilience and minimize the impact of external shocks, positioning the private sector as a more stable, long-term growth driver amid rising global uncertainty. The resolution’s effectiveness will depend on the administrative apparatus’s implementation process and the private sector’s policy absorption.

– 11:42 15/05/2025

“The Rise of Bac Giang: Sustaining High Economic Growth”

As of April, Bac Giang province continued its high economic growth trajectory, with industry remaining the key driver. This was affirmed by the Provincial People’s Committee of Bac Giang.

The New York Buzz: Unveiling the City’s Surging Consumer Spending and Vibrant Economic Revival in April

Ho Chi Minh City witnessed a positive trajectory in April 2025, with impressive economic indicators. The highlight was the estimated VND 128,886 billion in revenue from retail goods and consumer services, marking a 17.9% increase from the previous month and a significant 37.6% surge year-over-year.