Foreign investment power remains intact as this bloc continues to strongly net buy nearly VND 1,000 billion in today’s trading session. This is mainly due to the fact that the Vietnamese stock market has become more attractive compared to other stock markets globally, and investors are optimistic about positive outcomes from trade negotiations with the US.

The VN-Index fluctuated during the session due to profit-taking pressure from individual investors but still managed to gain 3.47 points, advancing towards the 1,313 price level with a breadth of 167 gainers and 152 losers. Banks and securities stocks remained the main driving forces.

Although the large-cap stocks showed a significant slowdown, with VCB stabilizing and BID even declining, several smaller-scale banks witnessed strong breakthroughs today, including SHB, SSB, VIB, LPB, and MBB, which surged by 2.24%. Along with VPL from Vinpearl, these stocks contributed 6.57 points to the overall market.

Securities stocks also witnessed notable gains in various stocks such as SHS, HCM, VIX, VCI, MBS, and VND. Similarly, electricity and investment stocks showcased excellent performances today, with BCG surging to its upper limit, while CTD, SJG, CC1, HHV, FCN, C4G, and VCG continued their upward trajectory. On the contrary, banks witnessed deep corrections in stocks like VHM, VRE, BCM, NVL, KBC, and VPI. Notably, VHM erased 2.32 points despite the persistent efforts of the banking group.

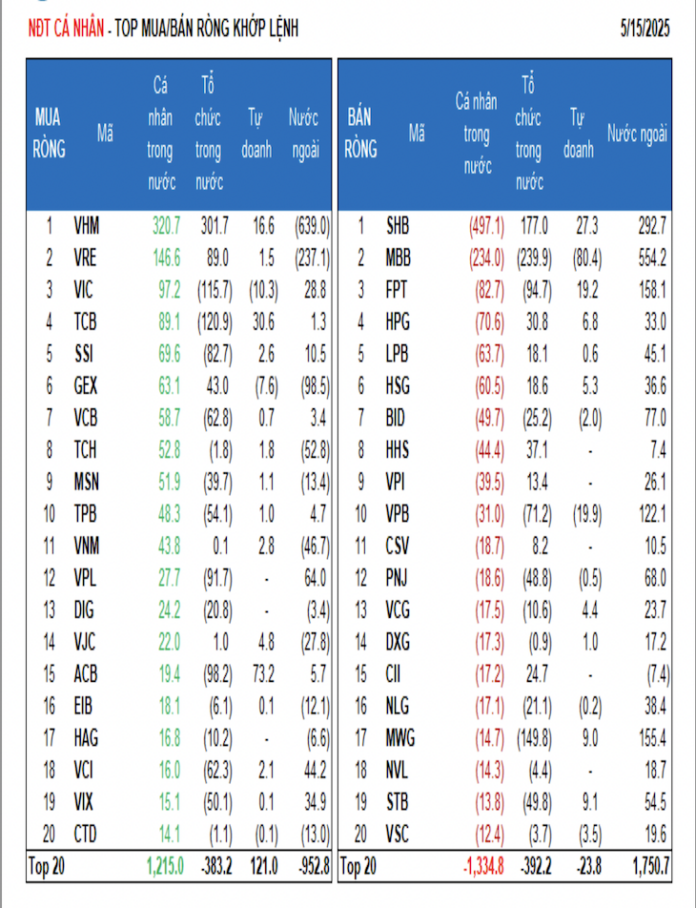

The liquidity of the three exchanges remained high at VND 27,800 billion, indicating positive market demand. Foreign investors net bought VND 889.5 billion, and their net buying in the matched order trading segment reached VND 896.9 billion. Their main net buying in this segment focused on the Banking and Retail sectors. The top net bought stocks by foreign investors in the matched order trading segment included MBB, SHB, FPT, MWG, VPB, BID, PNJ, VPL, STB, and LPB.

On the other hand, the Real Estate sector witnessed net selling by foreign investors in the matched order trading segment. The top net sold stocks in this segment by foreign investors included VHM, VRE, GEX, TCH, VNM, HDB, VHC, PDR, and POW.

Individual investors net bought VND 58.1 billion, although they net sold VND 65.5 billion in the matched order trading segment. In this segment, they net bought 8 out of 18 sectors, mainly focusing on the Real Estate sector. Their top net bought stocks included VHM, VRE, VIC, TCB, SSI, GEX, VCB, TCH, MSN, and TPB.

In terms of net selling, they net sold 10 out of 18 sectors, primarily in the Banking and Basic Materials sectors. The top net sold stocks by individual investors included SHB, MBB, FPT, HPG, LPB, HSG, HHS, VPI, and VPB.

Proprietary trading accounts net bought VND 58.5 billion, and their net buying value in the matched order trading segment reached VND 173.0 billion. In this segment, proprietary trading accounts net bought 13 out of 18 sectors, with the strongest net buying observed in the Banking and Financial Services sectors. The top net bought stocks by proprietary trading accounts today included ACB, TCB, SHB, E1VFVN30, FPT, VHC, VHM, VIB, STB, and MWG.

The top net sold sector was Industrial Goods & Services. The top net sold stocks included MBB, VPB, VIC, GEX, VSC, REE, HAX, HAH, BID, and SIP.

Domestic institutional investors net sold VND 1,034.2 billion, and their net selling value in the matched order trading segment stood at VND 1,004.4 billion. In this segment, domestic institutions net sold 12 out of 18 sectors, with the highest net selling value observed in the Banking sector. The top net sold stocks by domestic institutions included MBB, MWG, TCB, VIC, ACB, FPT, VPL, SSI, VPB, and VCB. The highest net buying value was witnessed in the Real Estate sector. The top net bought stocks included VHM, SHB, VRE, GEX, HHS, HPG, HDB, CHI, HDC, and HSG.

Today’s matched order trading value reached VND 1,747.0 billion, decreasing by 63.9% compared to the previous session and contributing 6.2% of the total trading value. Notable matched order trading activities were observed among domestic institutions, focusing on OCB, FPT, SBT, VCG, and VND.

The money flow allocation ratio increased in the Real Estate, Banking, and Construction sectors while decreasing in Securities, Steel, Chemicals, Food & Beverage, Retail, Software, Warehousing & Logistics, Rubber & Plastics, and Electricity Production & Distribution sectors.

In the matched order trading segment, the money flow allocation ratio increased in the large-cap VN30 stocks while decreasing in the mid-cap VNMID and small-cap VNSML stocks.

“The Power of Pillars: Market Shifts and Foreign Capital Inflows”

The pressure to secure profits this morning was widespread, coupled with weakness in some large-cap stocks, which caused significant market volatility. On the bright side, cash flow remains positive, particularly from foreign investors. As the VN-Index approaches its previous peak, a divergence of opinions is only natural.

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

Market Beat: Foreigners Resume Net Selling, VN-Index Halts Rally

The market closed with the VN-Index down 11.81 points (-0.9%), settling at 1,301.39. The HNX-Index also witnessed a decline of 0.59 points (-0.27%), ending the day at 218.69. The market breadth tilted towards decliners, with 444 stocks falling against 332 advancing stocks. Within the VN30 basket, bears dominated as 24 stocks dropped, while only 4 rose, and 2 remained unchanged.