Vietnamese Stock Market Faces Strong Downward Pressure on Friday’s Session

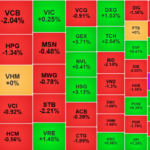

The Vietnamese stock market experienced significant downward pressure on Friday’s trading session. Large-cap stocks struggled, causing the VN-Index to lack support and perform poorly in the afternoon session. At the close of May 16, the benchmark VN-Index fell 11.81 points to 1,301.39. Trading liquidity decreased compared to the previous session, with the matching value on HoSE exceeding VND 19,200 billion.

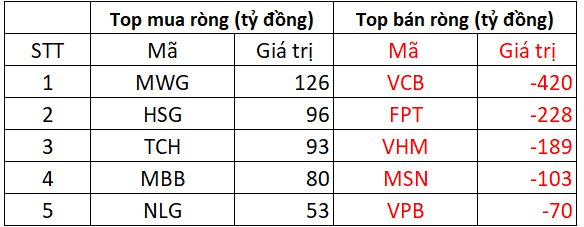

In terms of foreign investors’ activities, non-resident investors reversed to net sell VND 973 billion on the entire market, breaking the previous consecutive net buying streak.

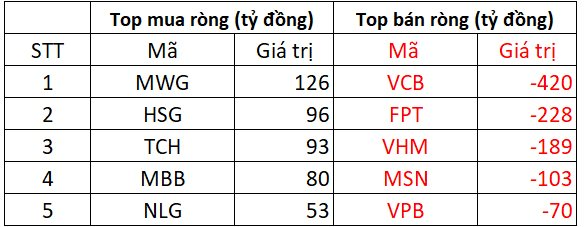

Foreign investors net sold nearly VND 957 billion on HoSE

In the selling side, VCB shares were heavily net sold with a value of up to VND 420 billion, and FPT shares were net sold VND 228 billion. Two other tickers, VHM and MSN, were also net sold by foreign investors for VND 189 billion and VND 103 billion, respectively. Following them, bank stock VPB witnessed net selling pressure of about VND 70 billion.

Conversely, MWG shares were the most net bought in the market with a value of VND 126 billion. HSG, TCH, MBB, and NLG stocks were also among the most net bought, with values ranging from VND 53 billion to VND 96 billion each.

HoSE witnessed net selling pressure from foreign investors

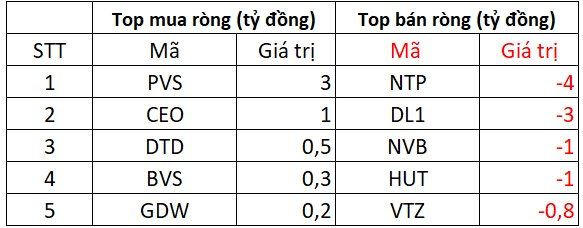

On the HNX, foreign investors net sold VND 9 billion

At the buying side, PVS and CEO stocks were net bought around VND 1-3 billion each. DTD, BVS, and GDW stocks were also net bought, but the values were in the range of a few hundred million VND.

On the opposite side, NTP and DL1 shares witnessed net selling pressure of VND 4 billion and VND 3 billion, respectively. NVB and HUT shares were also net sold for VND 1 billion each. Additionally, VTZ was among the top net sold stocks by foreign investors in today’s session.

HNX also experienced net selling from foreign investors

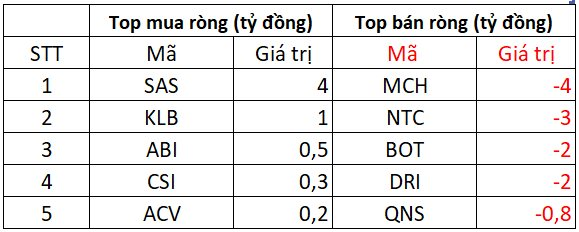

On UPCOM, foreign investors net sold nearly VND 8 billion

In terms of net bought stocks, SAS led the market with a net buying value of about VND 4 billion. KLB, ABI, CSI, and ACV stocks were also among the net bought stocks, but the values were not significant.

Conversely, MCH, NTC, BOT, and DRI stocks witnessed the strongest net selling pressure, with values ranging from VND 2 billion to VND 4 billion each.

UPCOM witnessed net selling pressure on stocks MCH, NTC, BOT, and DRI

The Great Bank Code “Flush”

The proprietary trading arms of securities companies offloaded a net sell value of VND1.92 trillion on the Ho Chi Minh Stock Exchange (HoSE).

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

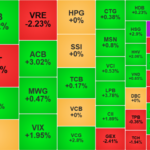

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

The Flow of Foreign Capital Continues: VN30-Index Peaks at a 3-Year High During Derivatives Expiry

The foreign bloc ramped up selling in the afternoon session, with notable dumps in VHM and VRE. Despite this, buyers remained robust, resulting in a net position of nearly VND 236 billion. This pushed the overall net buying for the day to VND 919 billion, with approximately VND 656 billion worth of stocks in the VN30 basket being snapped up.