Vietnam-based GELEX Group Joint Stock Company (HOSE: GEX) announced that May 15, 2025, is the record date for a 5% stock dividend for the year 2024.

Accordingly, the number of shares to be issued is 42.9 million, bringing the total number of outstanding shares to approximately 902.4 million.

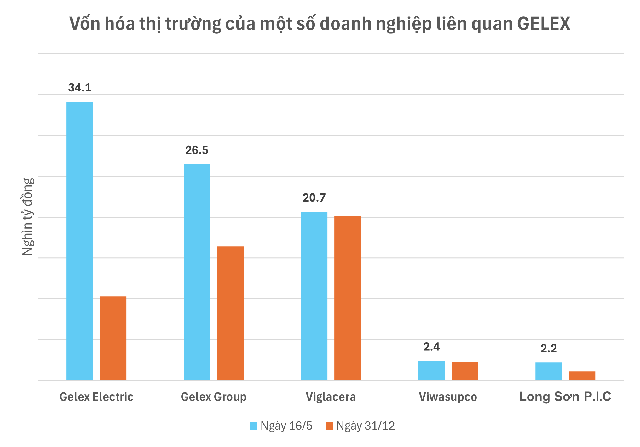

GEX shares of GELEX Joint Stock Company closed at VND 29,350 per share on May 16, up over 60% from the beginning of the year and the highest level in the past 3 years.

With this price, the market capitalization reached nearly VND 26,500 billion, equivalent to over $1 billion.

Not long ago, Gelex Electric (GEE), a subsidiary of Gelex, also surpassed the $1 billion market capitalization threshold and is one of the few representatives in the manufacturing industry to achieve this milestone, alongside Hoa Phat. Gelex Electric’s current market capitalization is over VND 34,000 billion.

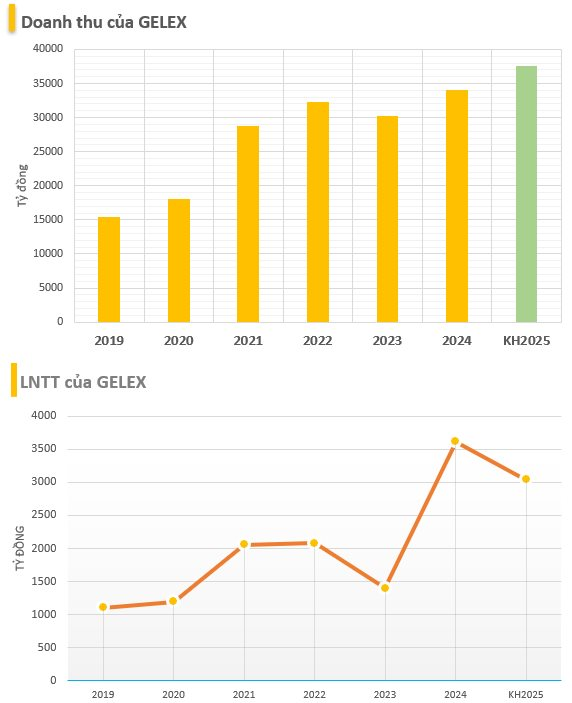

GELEX Group Joint Stock Company, formerly known as Vietnam Electrical Equipment Corporation, was established on July 10, 1990. GELEX currently operates as a Holdings company, one of the leading investment corporations in Vietnam.

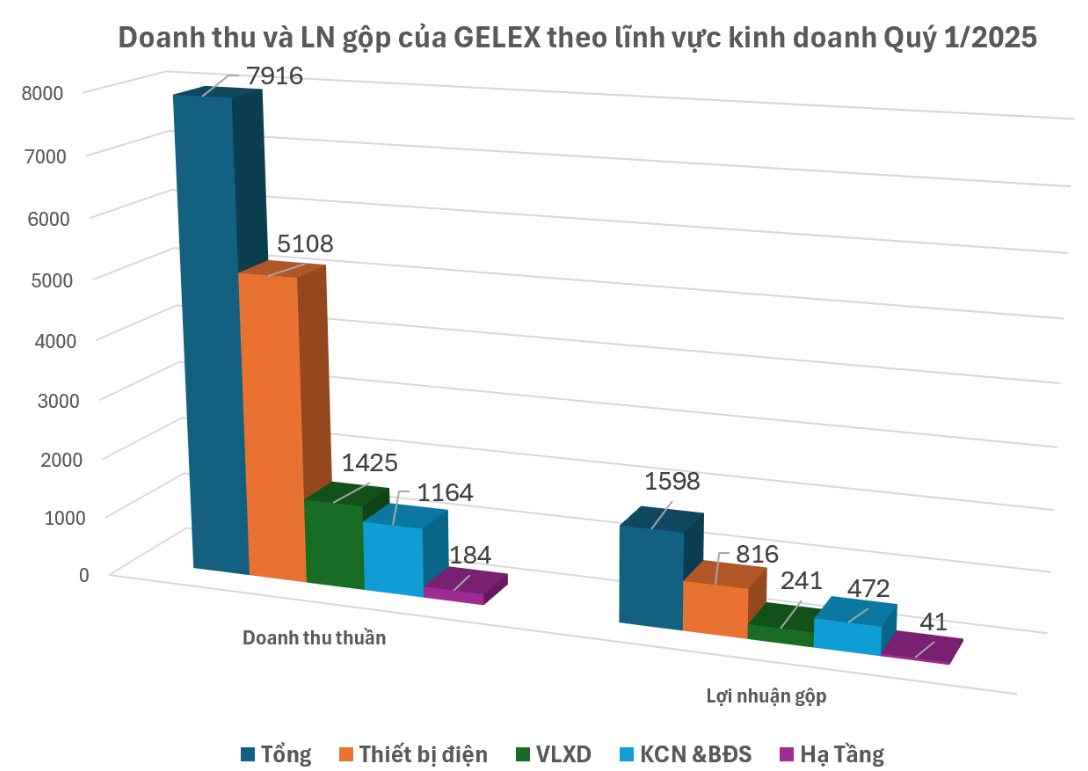

For the first quarter of 2025, GELEX’s consolidated net revenue reached VND 7,916 billion, up 18.9% year-on-year. The electrical equipment segment contributed VND 5,108 billion, a growth of 41.7%, while the building materials segment generated VND 1,425 billion, a slight increase of 0.6% compared to the same period last year. The industrial park, real estate, and infrastructure and utilities segments recorded sales of VND 1,164 billion and VND 184 billion, respectively, a decrease from the previous year.

Consolidated pre-tax profit reached VND 646 billion, up 67.8% year-on-year.

GELEX has completed 21.1% of its revenue plan and 21.2% of its profit plan for the full year 2025.

Mr. Le Tuan Anh, Deputy General Director of the Group, shared that GELEX will focus on the domestic market and promote high-tech products to maintain its position in the local market, increase the company’s value, and contribute to the government’s initiative to boost domestic production.

“For the industrial park real estate and building materials segments, GELEX will adapt by restructuring, streamlining, and focusing on efficient and impactful investments,” said the Deputy General Director of GELEX. He also added that in 2025, the Group will tighten investment discipline and aim for long-term, strategic investments.

“Rookie” Vinpearl (VPL) Surges with Three Consecutive Upper Limit Gains, Market Capitalization Increases by Over VND 45,000 Billion

Introducing Vinpearl Joint Stock Company’s (VPL) impressive performance on the Ho Chi Minh Stock Exchange (HoSE) on May 13th, 2025. With a third consecutive daily limit-up, VPL’s market capitalization surged by an astonishing VND 45,000 billion. This remarkable achievement underscores the strong investor confidence in Vinpearl and sets a new milestone for the company’s future growth prospects.

The Dragon Capital Securities: Stock Issuance Roadmap for Dividend Payout and Private Placement

The Board of Directors of Rong Viet Securities JSC (VDSC, HOSE: VDS) approved a resolution on May 13 to increase the company’s charter capital in 2025 by offering a maximum of 77 million new shares, starting with a dividend payout of 24.3 million shares.

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.