Million-Dollar Villas Left Abandoned

In recent years, the real estate market has witnessed a significant surge in prices for townhouses and villas, even in less populated or abandoned urban areas. In many cases, property values have doubled compared to the previous period.

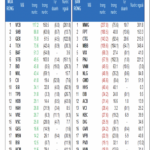

In the Duong Noi Urban Area (Ha Dong, Hanoi), numerous completed but unoccupied townhouses and villas are being offered for sale at high prices, ranging from VND 200-300 million/sqm. For example, a 300 sqm villa in a corner location, built over four floors, is on the market for a staggering VND 90 billion (equivalent to VND 300 million/sqm).

A similar situation can be observed in the Geleximco Le Trong Tan Urban Area (Ha Dong), where numerous rows of villas and townhouses stand vacant. Most of the townhouses are rented out as warehouses on the first floor or used as offices, but the residential population is sparse. However, prices here have also skyrocketed. A 90 sqm townhouse is currently listed for sale at VND 17.9 billion, equivalent to nearly VND 200 million/sqm. A year ago, the price of these townhouses was around VND 150 million/sqm. Another 80 sqm townhouse is priced at VND 19 billion, or VND 237 million/sqm, a significant increase from the previous year’s range of VND 160-170 million/sqm.

According to a survey by PropertyGuru Vietnam, townhouse and villa prices in this urban area have increased by 37.5% over the past year.

The same trend is evident in the Nam An Khanh Urban Area (Hoai Duc, Hanoi), where numerous completed villas and townhouses remain unoccupied. Current prices range from VND 150-200 million/sqm, with some prime locations commanding prices of up to VND 230 million/sqm.

In contrast, just three years ago, in 2022, prices in Nam An Khanh ranged from VND 60-100 million/sqm. This represents a doubling of prices in a short period.

Abandoned townhouses and villas are still being sold at exorbitant prices. (Photo: Binh Minh)

In a recent market report, real estate consulting firm CBRE stated that the first quarter recorded the largest supply of villas and townhouses in Hanoi’s history.

Many villas and townhouses that had been left unfinished for years are now being offered for sale at prices 30% higher than in the same period last year, and even double the price compared to 2022.

Abandoned Villas Continue to Appreciate in Value

Explaining this phenomenon, Mr. Nguyen The Diep, Vice President of the Hanoi Real Estate Club, attributed the sharp increase in villa and townhouse prices mainly to insufficient supply to meet demand. As land resources become scarcer and the number of new projects limited, even abandoned old projects have become “valuable.”

Ms. Pham Thi Mien, Vice Director of the Institute for Real Estate Market Research and Evaluation, Vietnam, offered a similar perspective. She stated that the prices of townhouses and villas have been pushed to extremely high levels due to limited supply in this segment. Additionally, new developments in this category are mostly positioned as luxury projects, further driving up prices. “The high prices of primary villas and townhouses have led to increased prices in the secondary market. This year, prices in this segment are unlikely to decrease and may remain stable,” she added.

Ms. Do Thi Thu Hang, Senior Director of Research and Consulting at Savills Hanoi, provided further insight: “These villas are also real estate products. Currently, all real estate is experiencing a price increase, and at this high level, abandoned villas, in a sense, are no exception.”

The appreciation of abandoned villas and townhouses can be attributed to a combination of factors, including limited supply, long-term investment mentality, expected urban planning improvements, and the dynamics of the secondary market. However, this trend also indicates an unhealthy and unsustainable development in the real estate market, as the actual value is detached from the potential for exploitation and utilization. If this situation persists, the formation of a price bubble is a serious concern. Market regulation, infrastructure development, and speculation control are necessary to steer the market in the right direction.

The Long Wait: Morning to Night Queues as Southern Land Remains in High Demand

In recent weeks, there has been a quiet buzz of real estate activity in areas such as Thu Duc City (formerly District 9) and Nha Be in Ho Chi Minh City, Nhon Trach in Dong Nai, and Da Nang. The local notary offices have been bustling, with people waiting patiently for their turn.

The Magic of Words: Transforming Titles with Artistry and Precision

“German Chemicals Giant Infuses $20 Million into its Real Estate Venture”

“With a substantial investment of 5000 billion VND, Duc Giang Chemicals plans to boost the charter capital of Duc Giang Real Estate to an impressive 1000 billion VND in the second quarter of 2025. This significant capital increase from 500 billion VND will undoubtedly propel the company’s growth and expansion in the real estate industry.”