Gold prices tumbled on Friday, May 16, marking the biggest weekly decline in six months, as risk appetite waned following the US-China trade war truce. The world’s largest gold ETF, SPDR Gold Trust, sold nearly 20 tons of gold this week, continuing the previous three weeks’ outflow trend.

At the close of the New York trading session, spot gold fell by $37.8/oz, or nearly 1.2%, to settle at $3,203.7/oz, according to Kitco exchange data. When converted using Vietcombank’s selling rate, this price is equivalent to approximately 100.8 million VND per tael.

Gold futures on the COMEX exchange fell by 1.2% to close at $3,187.2/oz.

This week, spot gold prices dropped by $122/oz, or nearly 3.7%, marking the biggest weekly decline since November last year. In VND terms, gold prices fell by almost 4 million VND per tael.

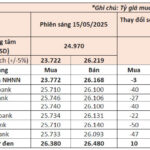

Vietcombank’s USD buying and selling rates for the week stood at VND 25,720 and VND 26,110, respectively, according to its website. These rates were VND 30 lower than the previous week’s closing levels.

“The US-China trade war de-escalation has boosted risk appetite across markets. This shift has prompted gold traders to lock in profits. Gold liquidation has been ongoing throughout the week,” said senior analyst Jim Wyckoff of Kitco Metals in a report.

Last week, the US and China agreed to a trade truce, with the US reducing tariffs on Chinese goods to 30% and China reducing tariffs on American goods to 10%, effective for 90 days. US and global stock markets rallied this week, contrasting with the decline in safe-haven assets like gold, the Japanese yen, and the Swiss franc.

This week also witnessed a wide range of gold price fluctuations, with hundreds of dollars in variation during New York trading sessions. For instance, on Friday, spot gold hit an intra-day low of $3,152.4/oz and a high of $3,253.4/oz, a difference of over $100/oz.

About a month ago, gold prices peaked at over $3,500/oz. Currently, prices have dropped by about $300/oz from this record high, equivalent to a decline of approximately 8.6%.

Analysts suggest that the wide range of fluctuations indicates a potential short-term peak in gold’s bullish momentum. Some experts predict a short-term correction to the $3,000/oz level, despite the long-term upward trend remaining intact.

The US dollar gained slightly on Friday, with the Dollar Index settling near 101, up from the previous session’s close of 100.9. For the week, the index rose over 0.6%, extending its one-month gain to 1.6%. The greenback’s recent recovery has added downward pressure on gold, as the metal is priced in USD.

The world’s largest gold ETF, SPDR Gold Trust, offloaded approximately 9 tons of gold on Friday, reducing its holdings to around 918.7 tons, according to data from the US website. This follows a similar sale of about 9 tons on Thursday. For the week, the ETF sold nearly 20 tons, marking the fourth consecutive week of outflows.

After the market closed on Friday, Moody’s Ratings downgraded the US sovereign credit rating to Aa1 from the top rating of Aaa. The rating agency cited the growing fiscal burden due to the federal government’s budget deficit and the rising cost of debt servicing in a high-interest-rate environment as reasons for the downgrade.

Some analysts suggest that this development could encourage risk-averse sentiment among investors next week, benefiting gold prices.

“Next week’s market reaction will be interesting to watch,” said Fred Hickey, editor of The High-Tech Strategist. He predicts a sharp decline in US Treasury bond prices and the dollar’s exchange rate, coupled with a rise in gold prices.

The Dollar and Gold Prices Plummet: May 15th’s Market Shockwave

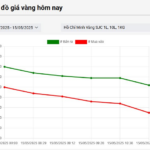

The morning witnessed a unanimous drop in USD exchange rates across banks, with fluctuations more pronounced than previous sessions. Domestic gold prices also took a hit, plunging by 2 to 2.5 million VND per tael.

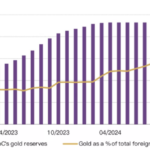

The Golden Opportunity: Exploring China’s Shifting Gold Investment Landscape

The Chinese gold market witnessed unprecedented growth in April, with a surge in prices and demand for both physical and paper gold investments.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)