Hoang Anh Gia Lai Agriculture Joint Stock Company (HAGL Agrico, stock code HNG) has just announced its consolidated financial statements for Q1 2025. Notably, this is the first quarter that HAGL Agrico has surprisingly stopped selling goods below cost after being questioned by shareholders.

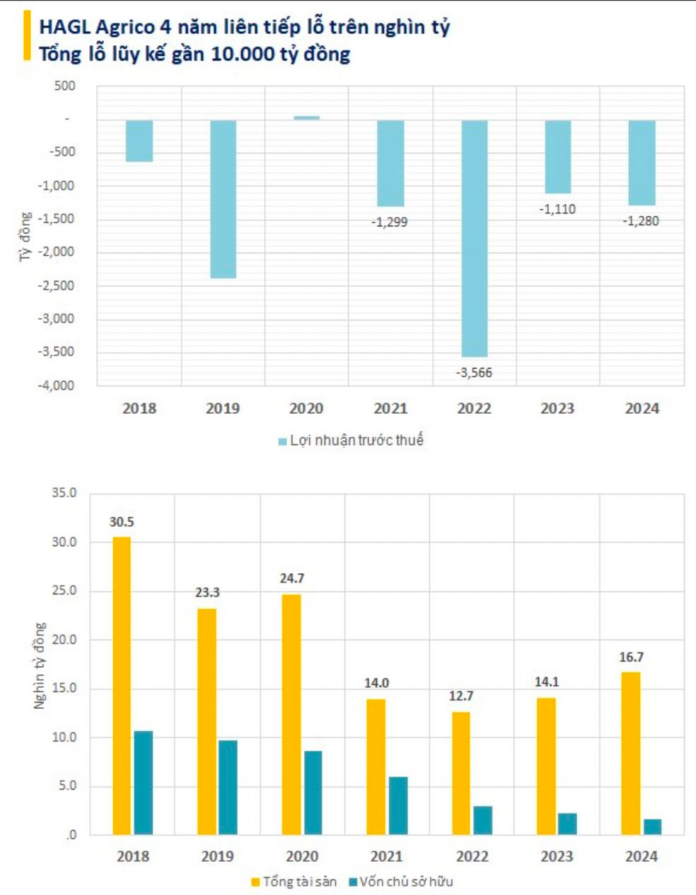

However, excluding expenses, the Company still lost an additional 84 billion VND, bringing its cumulative loss to nearly 9.5 trillion VND.

As far as we know, Thaco participated in the bailout of Hoang Anh Gia Lai (HAGL, stock code HAG) in 2018. By 2021, the two sides decided to part ways after considering various options, with Thaco officially taking back HAGL Agrico.

After four years, HAGL Agrico has been consistently loss-making.

In 2025, HAGL Agrico targets a further loss of 854 billion VND. The core business operations are expected to turn a profit of 55 billion VND (compared to a loss of 103 billion VND in the same period); the main loss comes from fruit tree cancellation costs (597 billion VND), orchard depreciation (229 billion VND), and factory/infrastructure depreciation (83 billion VND).

Alongside the concerns about the transparency of the Company’s transactions, a big question remains: When will HAGL Agrico stop making losses?

In response to shareholders’ inquiries, billionaire Tran Ba Duong also left the question open. He only provided a rough estimate, stating that HAGL Agrico will only stop making losses when the revenue from bananas offsets the investment cost per hectare of banana trees (currently over 200 million VND/ha).

To achieve this, Thaco is striving to minimize care costs and improve productivity through soil improvement (leveling the land, ensuring adequate irrigation…), while also expanding the banana-growing area.

“The loss in 2025 mostly came from orchard conversion and depreciation. This is a burden because it is not a real asset; this burden amounts to over 200 million VND per hectare. To stop making losses, the Company must strive to achieve perfection in each hectare of bananas, targeting a yield of 55 tons/ha and aiming for 70 tons/ha, while also reducing care costs. It is projected that when banana revenue exceeds 200 million VND/ha and the cultivated area expands, we can offset the losses,” Mr. Duong stated.

As of the end of 2024, HAGL Agrico owned 35,757 hectares of banana, mango, grapefruit, rubber plantations, and cattle farms in Laos and Cambodia.

In 2025, the Company plans to plant 2,026 hectares of new banana trees, with a harvest area of 1,117 hectares and a yield of 34,838 tons.

For 2026, HAGL Agrico aims for 3,000 hectares of bananas.

In summary, Thaco’s leadership has yet to determine when HAGL Agrico will turn a profit. Nonetheless, as stated on numerous occasions, Thaco will not give up on HAGL Agrico. Currently, HAGL Agrico owes Thaco 12 trillion VND, and as Mr. Duong pointed out, if HAGL Agrico fails, where would they get the money to repay the debt?

Apart from having already invested significant funds into HAGL Agrico, Thaco’s reason for “carrying this deadweight” also stems from the values it gains, specifically HAGL Agrico’s brand value in Cambodia and Laos.

Leveraging the brand to tap into the vast Chinese market and investing in a mega agricultural project with an expected revenue of 800 million USD/year

Photo: Thaco is investing in a mega agricultural project with an expected revenue of 800 million USD/year.

At the previous General Meeting, Mr. Duong mentioned that the HAGL Agrico brand helps sell goods at higher prices, and it is still used in trading activities. Currently, with the HAGL Agrico brand, Mr. Duong can sell a box of grade A bananas for up to 13.5 USD (quite high compared to the average market price of 12-13 USD/box of 13 kg).

“China is a huge market if we can ensure good quality. The company is still using the legal entity of Hoang Anh Attapeu, so exporting to China will not have a significant long-term impact; if there is any impact, it will only be temporary, such as a drop in banana prices during the harvest season,” Mr. Duong shared.

Moreover, HAGL Agrico also serves as a “springboard” for Thaco to invest in these two neighboring countries.

In the field of agriculture, at the beginning of 2024, the Lao government granted an investment license to the Nam Lao Agricultural Investment and Business Production Company to implement a large-scale fruit tree planting and cattle breeding project. This “mega agricultural project” has a total investment capital of 750 million USD.

This project is expected to bring in a revenue of 13.5 trillion VND/year (550 million USD/year) and a profit of 2.45 trillion VND/year (100 million USD/year), with an 18% profit rate.

Thaco Agri is also implementing two large-scale integrated circular agriculture projects: the Snuol Complex in Kratie province and the Koun Mom Complex in Ratanakiri province, covering a total area of 35,390 hectares, with a projected investment of nearly 1.3 billion USD.

Thaco Agri estimates that from 2028 onwards, these projects will generate an export revenue of 800 million USD/year.

Ambition in the field of logistics in neighboring countries

In the latest development, Thaco has expressed a clear intention to venture into the logistics sector in Laos and Cambodia.

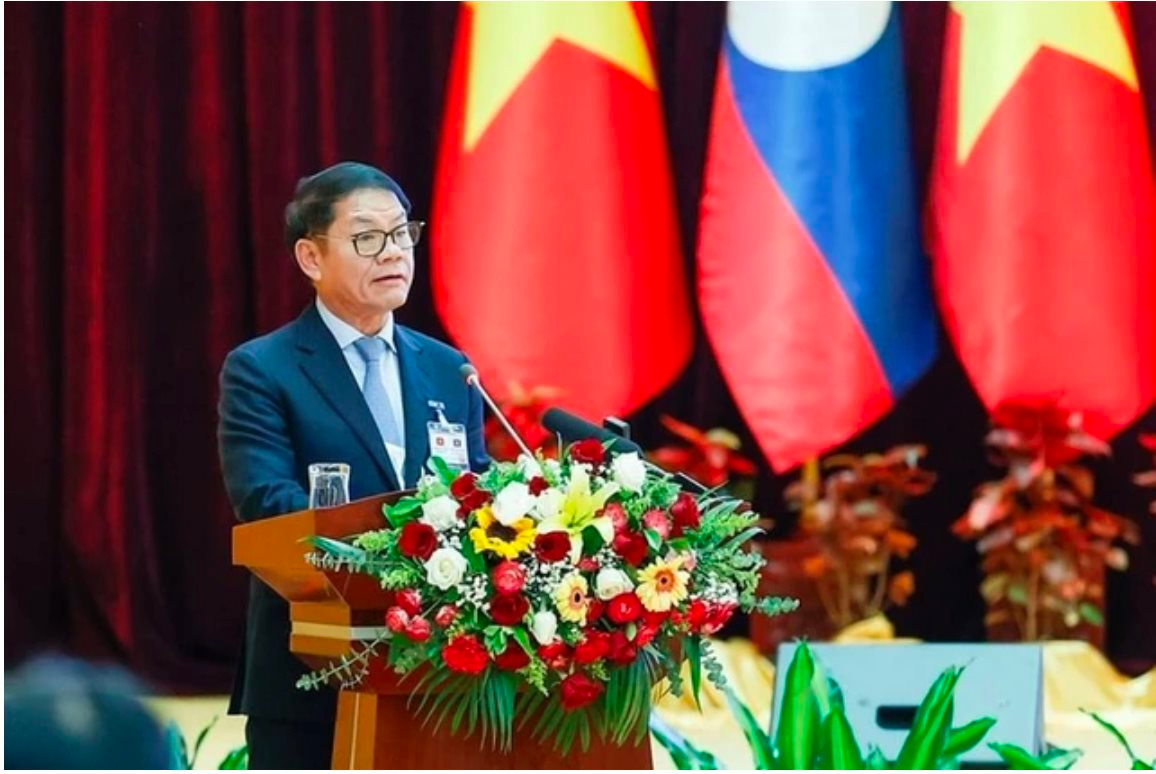

Photo: Mr. Tran Ba Duong at the Vietnam-Laos Investment Cooperation Conference in 2025.

On January 9, 2025, at the Vietnam-Laos Investment Cooperation Conference, Mr. Duong informed that the Group had repurchased 84,000 hectares of land from Hoang Anh Gia Lai, including many interspersed plots. The governments of Vietnam, Cambodia, and Laos have supported Thaco in implementing new projects, and the company has also expanded an additional 6,000 hectares for development.

Currently, Thaco has invested 31 trillion VND in Cambodia, 19 trillion VND in Laos, and 18 trillion VND in domestic provinces. In Laos and Cambodia, Thaco has implemented pilot models and is awaiting approval.

In February 2025, Thaco inaugurated the 50,000-ton Wharf at Chu Lai International Port. Earlier, in March 2024, the People’s Committee of Quang Nam province had approved the investment policy and selected Thaco as the investor for the expansion and upgrade of the Chu Lai Wharf in the Tam Hiep Wharf area, with a total investment of 1,590 billion VND.

Overall, with strong business operations in both Cambodia and Laos, Thaco will have at least two options for exporting goods – especially agricultural produce and foodstuffs – to China and other regional countries.

The Demise of the Pig-Eating-Banana Empire: A Tale of Missed Fortune.

In its heyday, Bapi Food boasted an impressive presence with almost 200 stores across major cities and provinces nationwide. It was a household name and a beloved fixture in the local food scene, offering a delightful array of culinary delights that captured the hearts and taste buds of many.

The Coffee Connoisseur: Brewing a Robot-Inspired Cafe Experience

The newly opened Besoverse Cosmic Cafe in Ho Chi Minh City is a stellar addition to the vibrant culinary scene, bringing a unique dining experience to locals and tourists alike. As a proud member of the Thiso family, a Thaco Group subsidiary, Besoverse Cosmic Cafe embodies a passion for culinary excellence and a commitment to creating memorable moments for its guests.

“Chairman Tran Ba Duong: Thaco Aspires to be the Auto Manufacturing Hub for International Brands”

On September 21, at a Conference of the Government’s Standing Committee with enterprises on solutions to contribute to the country’s socio-economic development, many private enterprises offered their insights and initiatives to collaboratively foster the nation’s economic and social growth. Mr. Tran Ba Duong, Chairman of Thaco, put forward proposals to promote the development of the auxiliary industry.