VN-Index rebounds after trading session on April 23

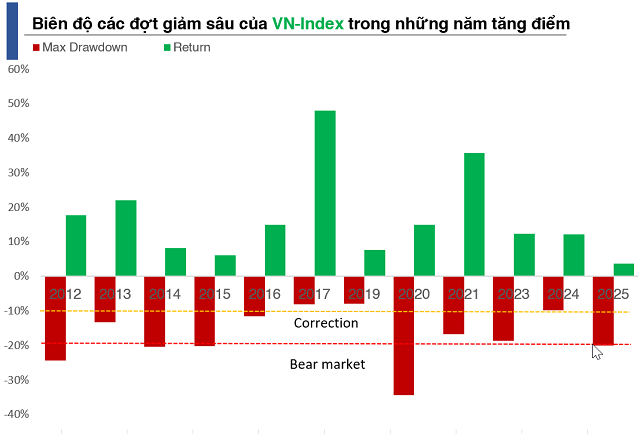

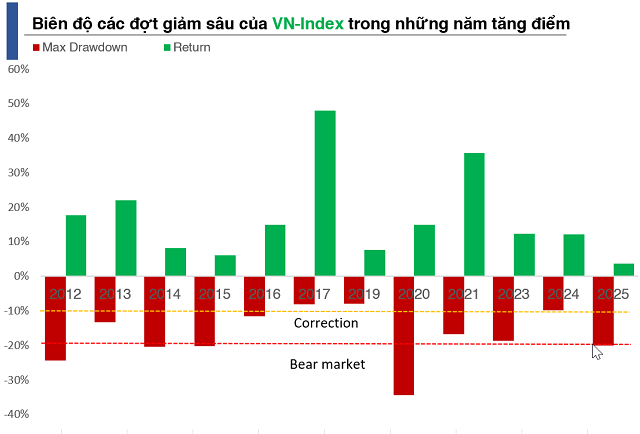

The 2025 tariff shock caused a significant dip for the VN-Index in April 2025. At its lowest point, the index entered a “bear market” territory, with a maximum drawdown of over 20% on April 9.

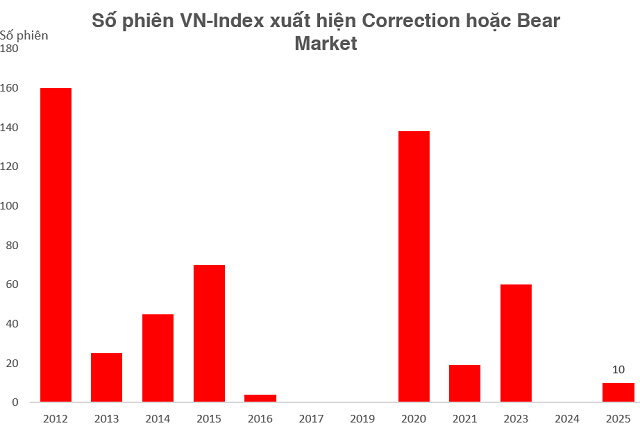

However, this downward trend lasted only 10 trading sessions in April. After April 23, the VN-Index narrowed its drawdown to below 10%, signaling a swift recovery.

The VN-Index rebounded after briefly entering a “bear market.”

|

As of May 15, the VN-Index surpassed the 1,300-point mark, recording a 3.66% increase since the beginning of 2025.

This was the sharpest correction since 2022 – the second-worst performing year for Vietnamese stocks.

However, compared to the COVID-19 period in 2020, when the maximum drawdown reached 35% over 138 sessions, the first half of 2025’s correction was milder in both magnitude and duration.

The VN-Index corrected in just 10 sessions this year.

|

Statistically, this was the shortest correction among the bull market years since 2016, indicating the market’s remarkable resilience.

Which stocks survived the 2025 tariff shock?

The 2025 tariff shock sent most stocks plunging to their lows on April 9. However, by May 15, over 1,000 stocks across all exchanges rebounded from their lows, accounting for 66% of all securities.

Many stocks achieved growth rates above 25% – the average threshold to return to their 2025 peaks.

|

Real estate stocks became the focal point, with numerous securities staging a robust recovery. The giant VIC surged by 40% since April 9, nearing 80,000 VND per share, and acted as a crucial catalyst for both the VN30 and VN-Index.

The listing of nearly 1.8 billion VPL (Vinpearl) shares on the HOSE on May 13 provided substantial support. Other stocks like VRE (+34%), NVL (+49%), HHS (+45%), DXG (+32%), and GEX (+48%) showcased the sector’s strong appeal.

Meanwhile, port and logistics stocks, despite bearing the brunt of the tariff shock, surprised with their impressive rebound. VSC soared by 59% from its low, while PHP climbed by 47%. HAH gained 45%, also hitting a new high.

In contrast, the financial sector didn’t outperform, even with the KRX system launching on May 5.

In the banking industry, only 6 out of 27 stocks rose over 25% from their lows: VAB (+31%), EIB (+27%), TCB (+27%), KLB (+27%), TPB (+26%), and SHB (+25%). Notably, TCB reached a new peak on May 14.

For securities firms, while 12 out of 34 stocks recovered by more than 25%, they were mostly small-cap securities. Only SHS (+32.43%) and VIX (+25.36%) stood out.

Despite the 2025 tariff shock, Vietnam’s stock market still presents opportunities. Mr. Nguyen The Minh, Director of Customer Research and Development at Yuanta Securities Vietnam, commented: “In the context of the government promoting the private sector, the market shows that there is ‘opportunity in crisis’ for dynamic investors.”

For cautious investors, Mr. Minh advises against rushing in and suggests allocating funds to safe assets like savings or bonds until there’s clarity from US-Vietnam tariff negotiations. “At that point,” he adds, “the sectors most affected by the 2025 tariffs, such as Industrial Parks and Exports, may offer the biggest opportunities.”

– 08:33 16/05/2025

The Bamboo Capital Group’s Shares Take an Unexpected Turn.

The Bamboo Capital group of stocks witnessed a lively trading session, with a substantial buy surplus at the ceiling price, indicating strong demand in the market.