Source: VietstockFinance

|

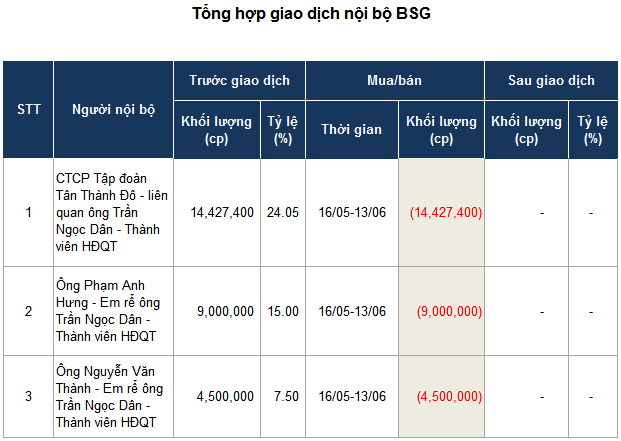

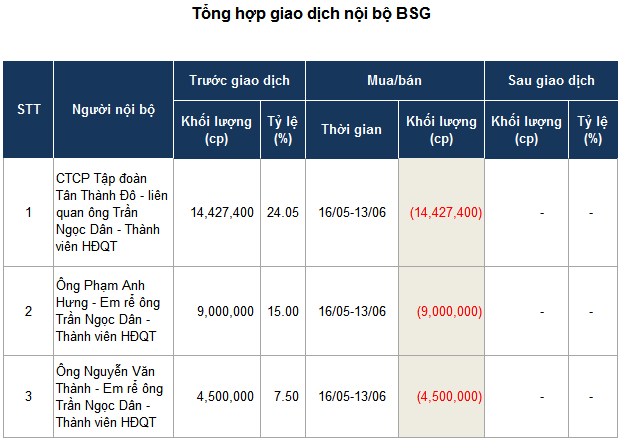

On May 14, three major shareholders, including Tan Thanh Do Corporation (TDCC), Mr. Pham Anh Hung, and Mr. Nguyen Van Thanh, announced their plan to sell their entire stake of over 27.9 million BSG shares, equivalent to approximately 47% of the company’s charter capital. Tan Thanh Do Corporation intends to sell more than 14.4 million shares, Mr. Hung 9 million shares, and Mr. Thanh 4.5 million shares. The transaction is expected to take place from May 16 to June 13.

Tan Thanh Do Corporation cited the need to raise funds for business expansion as the reason for their divestment, while Mr. Hung and Mr. Thanh mentioned personal financial needs.

All three shareholders are related to Mr. Tran Ngoc Dan, who is currently the Chairman of the Board of Tan Thanh Do Corporation and City Auto Joint Stock Company (HOSE: CTF), as well as a member of the Board of Directors of BSG. Mr. Hung and Mr. Thanh are Mr. Dan’s brothers-in-law.

Source: VietstockFinance

|

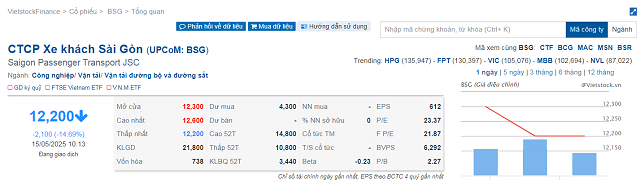

The news of the major shareholder group’s intention to fully divest has negatively impacted the share price, causing BSG shares to plunge to the floor price. Based on the price of VND 12,200 per share, the total value of the above 47% divestment deal is expected to exceed VND 340 billion.

| BSG Share Price Movement from the beginning of 2024 to May 15, 2025 |

If the transaction is successfully completed, the structure of major shareholders at BSG will change significantly. Currently, in addition to the divesting shareholder group, the Saigon Transportation Engineering Corporation (SAMCO) holds 49% of the capital and is the largest shareholder of the company.

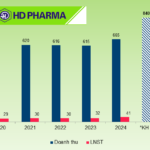

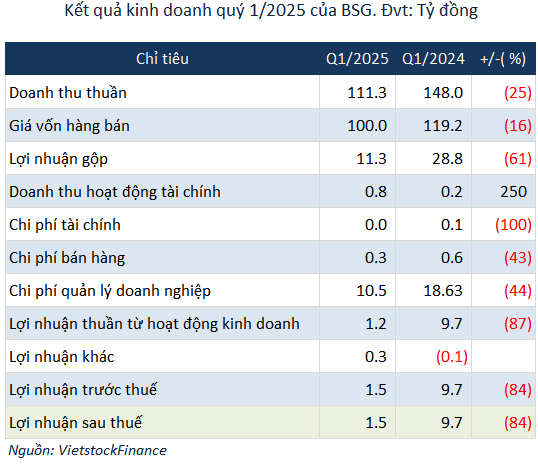

In 2025, BSG has set a backward-looking business plan with expected revenue of nearly VND 563 billion and pre-tax profit of over VND 16 billion, down 11% and 64%, respectively, compared to 2024. The company attributed this to various factors such as changes in transport laws, administrative procedures following the merger of government agencies, and increasing competition from financially strong enterprises.

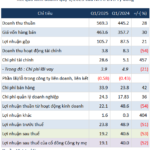

In the first quarter of 2025, BSG recorded a 25% year-on-year decrease in revenue to over VND 111 billion. While the cost of goods sold decreased by only 16%, gross profit plummeted by 61% to over VND 11 billion. Despite a significant reduction in selling and management expenses by 43% and 44%, respectively, net profit still declined by 84% to nearly VND 2 billion, fulfilling only about 9% of the year’s profit plan.

– 10:54 15/05/2025

Revolutionizing Travel Experiences: Vietravel’s Strategic Fundraising Endeavor to Settle Outstanding Debts

On May 7, Vietravel, a leading travel and transportation marketing company in Vietnam, announced its plans to offer nearly 28.7 million shares to the public. The company, traded on the UPCoM exchange under the ticker symbol VTR, aims to raise approximately VND 344 billion to repay its bank loans.