The Great Gym Shutdown

In mid-2024, a well-established gym with a network of three branches in Ho Chi Minh City abruptly closed its doors due to “unforeseeable and uncontrollable circumstances.” After a few months of restructuring, two out of the three branches reopened, but the founder remained apprehensive about the challenging market conditions.

This phenomenon is not isolated to this particular chain. Many fledgling gym franchises have also quietly shut down after grand openings.

According to Q&Me’s 2025 Retail Market Trends report, the number of gyms across the country decreased from 105 to 88 within a year. This reduction of 17 facilities indicates a quiet upheaval in the fitness industry, as brands unable to sustain operations gradually disappear from the fitness landscape.

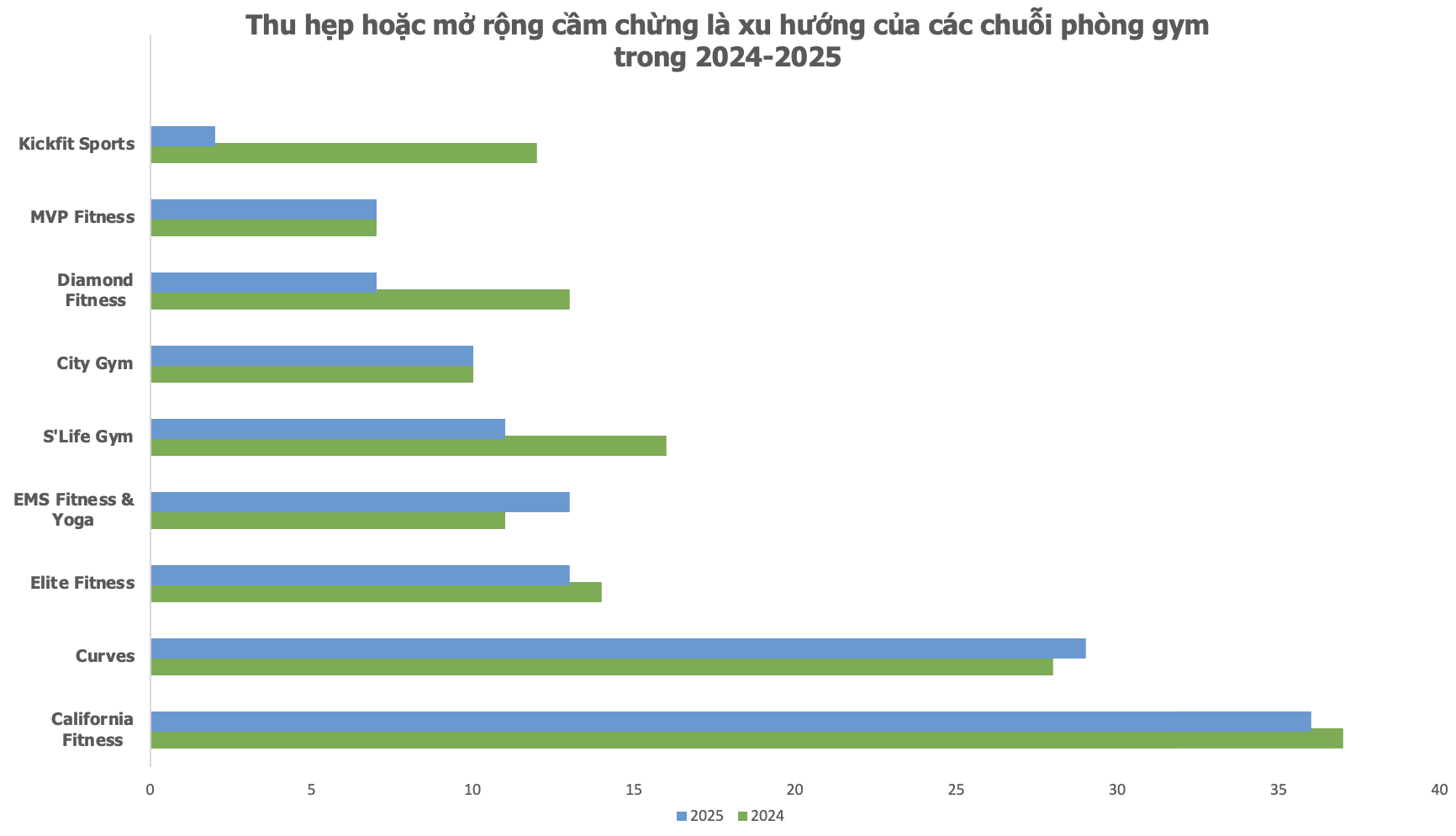

A survey of gym chains revealed that smaller or newer entrants to the market were the most affected. Kickfit Sport shrank from 12 to 2 locations, S’Life GYM lost 5 facilities, and Diamond Fitness Center nearly halved in size compared to the previous year.

Meanwhile, industry giants like California Fitness, Curves, and EMS Fitness & Yoga maintained their stronghold. California Fitness reduced its presence by one facility but retained its leading position with 36 branches. Curves, catering to female clientele, experienced a slight increase to 29 locations. EMS Fitness & Yoga expanded with two new locations, focusing on Hanoi.

The cautious expansion or closure of fitness chains reflects the challenges faced in developing the gym industry in Vietnam.

A Complex Equation

Research by Ken Research (India) indicates that membership fees at some gyms have increased by an average of 4%, while economic hardships have prompted consumers to tighten their belts.

A separate study on Vietnam’s fitness market by Cốc Cốc revealed that monthly workout budgets can vary significantly, ranging from 300,000 VND to 3,000,000 VND. Consequently, upscale gym chains offering limited additional services struggle to persuade members to loosen their purse strings.

Illustrative image

Additionally, fierce competition has fueled a race for market share in the industry. A 2023 survey by Vietdata showed that the Vietnamese gym market has been growing at an average annual rate of 20%.

The market is also segmented, catering to different income levels. There are upscale gyms for high-income individuals, as well as more affordable options for students and low-income earners. However, the lion’s share of the market is dominated by premium brands, leaving less room for expansion among budget-friendly chains.

Aside from competing with established giants, some all-inclusive gym chains also face rivalry from “Private Gym” studios. This trend involves private training sessions with a personal trainer during specific time slots, targeting middle to high-income individuals seeking a more focused workout experience.

“There is a shift from traditional gym services to activities like Zumba, pilates, yoga, and more private models,” Ken Research noted in its report.

Moreover, outdoor sports like running and pickleball have gained significant traction. In 2024, “pickleball” emerged as a prominent keyword, generating 189,000 discussions and signifying a staggering 400% growth in the first eight months. Notably, during August, the number of conversations related to this sport surged sevenfold, reaching 49,100.

For gym investors, soaring rental costs also pose a significant challenge. Nguyen Trung Kien, director of a fitness center with two branches in Hanoi, shared that rent is one of the most substantial expenses for businesses in the industry, especially for those leasing spaces in upscale residential complexes.

Savills’ commercial rental survey corroborates this, showing that ground-floor rental rates in Ho Chi Minh City and Hanoi commercial centers have increased compared to the previous year.

The Vietnamese gym industry faces multiple challenges due to consumers’ shrinking spending, rising operational costs—particularly rentals—and intense competition from various fitness alternatives. The market segmentation and lack of additional services further hinder the expansion of budget-friendly chains, while premium brands struggle to retain members amid rapidly changing consumer behavior.