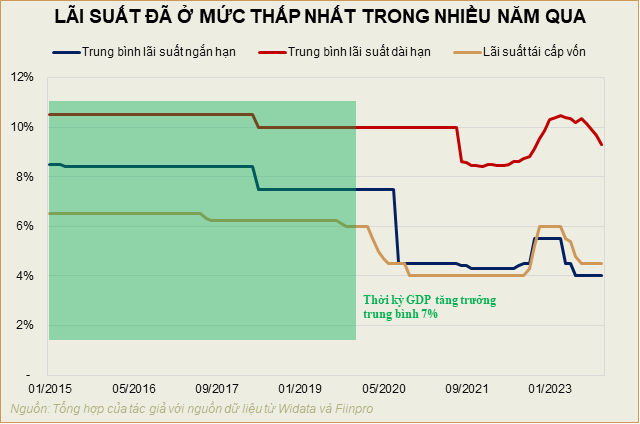

Analysts predict that while deposit interest rates have continued their downward trend recently, the pace has slowed, and input rates are expected to gradually increase towards the end of the year. This forecast is based on the expectation of positive economic growth and credit growth meeting or even surpassing the set target of 16%.

After a series of interest rate cuts by banks in the past two months, deposit interest rates (for economic organizations and individuals) continued their downward trend but at a slower pace. As of May 2025, deposit interest rates in Vietnam are at their lowest in the past two years. This comes as the State Bank maintains its focus on stabilizing interest rates and supporting credit growth, as affirmed in recent policy statements and governance actions. According to BSC Research and KBSV Research, average deposit interest rates at banks have decreased by 6-7% from their 2023 peak.

On the other hand, the market has seen a few small and medium-sized private banks increase input rates as credit demand shows positive recovery signs. According to the State Bank’s data, as of Q1 2025, the credit growth of the entire system reached 3.93% – nearly three times higher than the same period last year.

However, the number of banks reducing interest rates still predominates. By the end of April, the average interest rate for a 12-month term of commercial banks had decreased by 12 basis points to 4.93%, while the interest rate of state-owned commercial banks remained at 4.7%.

In the interbank market (market 2), interbank interest rates hit a 13-month low, indicating ample liquidity. As currency pressure increased, the State Bank resumed net liquidity absorption in April, estimated at nearly VND 22.2 trillion.

Specifically, the State Bank injected about VND 220.3 trillion through the OMO channel at an interest rate of 4% per annum and terms ranging from 7 to 91 days. However, the total maturing volume in the month amounted to more than VND 242.4 trillion. Despite the net absorption by the regulator, the overnight interbank interest rate fell to a 13-month low of 2.2% per annum on April 25 after hovering around 4.0-4.4% per annum in the first half of April, indicating a surplus in the system’s liquidity. This significantly impacted the VND-USD interest rate differential and currency pressure.

While the overnight USD interest rate was 0.2-1.2% higher than VND from the beginning of the year to mid-April, the differential widened to 2.1% by the end of the month – the highest level since the beginning of the year. At the end of the month, the overnight rate stood at 3.8%, while rates for terms of one week to one month fluctuated around 3.9-4.1%.

MBS Research experts suggest that while deposit interest rates have been on a downward trend recently, input rates are expected to gradually increase towards the end of the year, anticipating positive economic growth and credit growth meeting or surpassing the 16% target.

As of the end of March, the total credit outstanding of the system increased by 3.93% compared to the end of 2024 – 2.5 times higher than the 1.42% increase in March 2024, indicating a recovery in capital demand.

“Credit growth this year will reach 17-18%, driven by the recovery in production and domestic consumption and the acceleration of public investment disbursement. Based on these factors, we forecast that the 12-month deposit interest rate of large commercial banks will fluctuate around 5.5-6% in 2025,” MBS Research predicted.

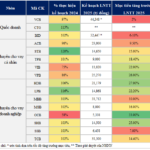

The Evolution of Banking Strategies: Insights from the 2025 Annual General Meetings

The past month has seen a series of annual general meetings (AGMs) held by banks, capturing the attention of investors and the market. With the need to boost credit growth this year to support the economy, the banking sector is expected to have multiple growth drivers. However, businesses still face numerous challenges, both internally and externally. Thus, each bank’s strategy will be a key differentiator.

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.