SMC Trading Investment JSC (SMC stock code) has just announced the supplement to the documents of the 2025 Annual General Meeting of Shareholders, with a plan to privately offer 73 million shares, priced at VND 10,000/share to a maximum of 20 investors, raising VND 730 billion, to be implemented in 2025-2026 and the shares will be restricted from transfer for 1 year.

The purpose of the capital raise is to repay loans, settle accounts payable, and supplement working capital.

As a result, after the issuance, the charter capital will increase from VND 736.8 billion to VND 1,466 billion.

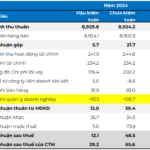

According to the Consolidated Financial Statements for the first quarter of 2025, SMC recorded revenue of approximately VND 1,846 billion, down 17.2% over the same period. Profit after tax was VND 127 million, down 99.9% over the same period. Gross profit margin decreased from 3% to 2.3%.

As of March 31, 2025, SMC Trading Investment still had accumulated losses of VND 137.7 billion, equivalent to 18.7% of charter capital and was still using VND 854.5 billion of short-term capital to finance long-term assets.

In terms of 2025 plan, SMC Trading Investment expects revenue of VND 9,500 billion, up 6.4% compared to 2024, and expected profit after tax of VND 30 billion, up 148% compared to the performance in 2024. Accordingly, the total consumption volume is expected to reach 620,000 tons, up slightly by 3.8% compared to the previous year.

SMC Trading Investment was once one of the leading steel trading enterprises in Vietnam with net revenue in 2021 reaching over VND 21,000 billion and after-tax profit reaching VND 901 billion.

Since 2022, in addition to business difficulties due to the sharp decline in steel prices, SMC Company has also faced challenges in recovering receivables, especially those related to bad debts of construction companies and real estate investors facing liquidity difficulties.

Recently, the company unexpectedly adjusted down the value of Expected credit loss provision from VND 663 billion to VND 328 billion, equivalent to a decrease of 51%. With this change, SMC’s 2024 after-tax profit turned from a loss of VND 287 billion to a profit of over VND 48 billion.

This marks SMC’s return to profitability after two consecutive years of heavy losses. Note that according to the current regulations of HOSE, if a company reports losses for three consecutive years, its shares will be forcibly delisted.

The list of bad debts of this steel company includes familiar enterprises in the ecosystem of Novaland (NVL) such as Delta – Valley Binh Thuan One Member Limited Company (principal debt of VND 441 billion, provision of VND 125 billion), Da Lat Valley Real Estate One Member Limited Company (principal debt of 169 billion, provision of 1.5 billion), The Forest City Limited Company (principal debt of VND 132 billion, provision of VND 182 million). SMC also recorded bad debts at Hung Thinh INCONS Joint Stock Company (principal debt of VND 63 billion, provision of VND 17 billion); bad debts of other subjects are nearly VND 485 billion and currently have to make provision of VND 184 billion.

The Steel Baron: SMC’s Spiraling Losses in a Troubled Industry

As per the disclosure on November 11th, SMC acknowledged the disappointing Q3/2024 profit results, despite their implemented strategies to enhance performance.