Saigon Co.op Development Investment Joint Stock Company (SCID, stock code SID) held its 2025 Annual General Meeting of Shareholders, approving a plan for nearly VND 168 billion in total revenue, up 34%, and over VND 73 billion in pre-tax profit, up 28% compared to 2024.

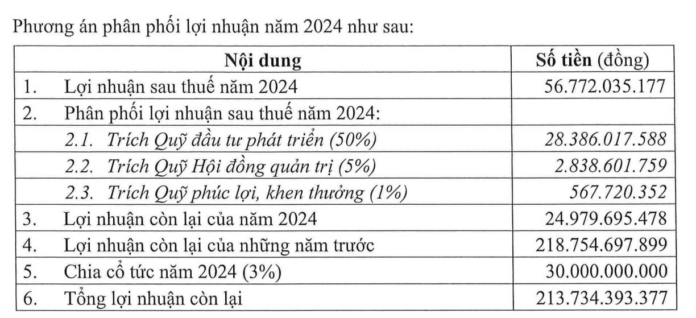

In 2024, the Company recorded revenue of over VND 99 billion and net profit of nearly VND 67 billion. With these results, the Company expects to pay dividends again after 7 years, with a ratio of 3%.

Image: Report at the Annual General Meeting.

First dividend payment in 7 years

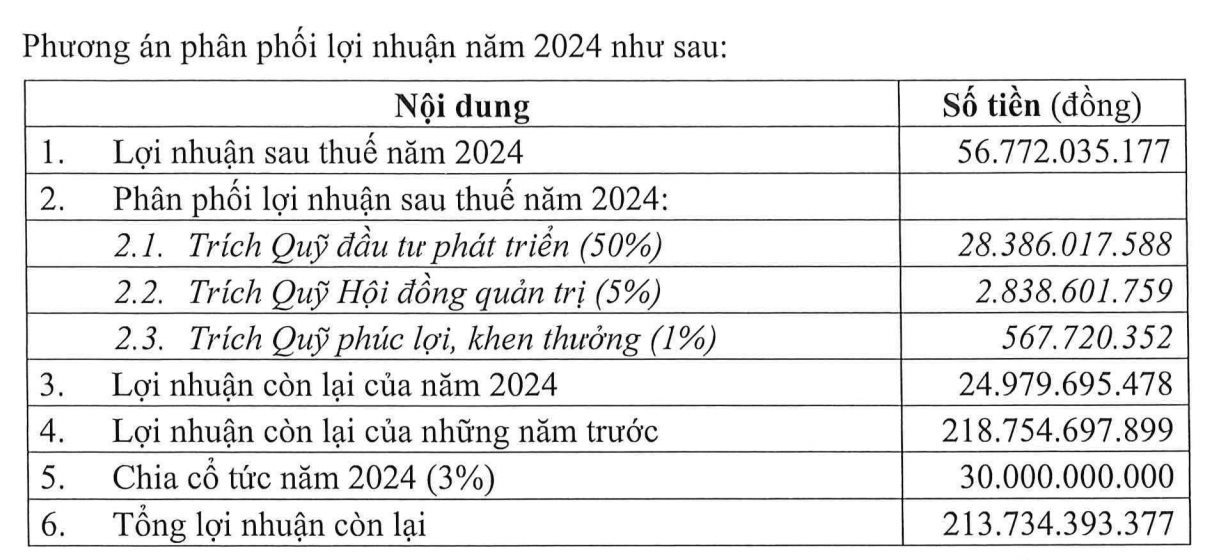

This year, the Company’s revenue and profit will come from basic sources such as direct leasing of the 253 Dien Bien Phu project (District 3, Ho Chi Minh City), the Saigon Co.op system, and mainly financial activity income through dividends from units in which SCID invests capital, especially dividends from Sense Ben Tre.

In parallel, SCID also plans to boost investment in developing key commercial real estate projects with new models, including new shopping mall models such as Sense Plaza and Sense Festi, office leasing business models, and coordinating the management and operation of SC Vivo City shopping mall…

This year, the Company plans to start construction of Sense Plaza Cam Pha and Sense Festi Vinh Long shopping malls, as well as inaugurate the 102 Nam Ky Khoi Nghia office building; continue to implement legal procedures for the An Phu project.

In addition, SCID also plans to complete the construction and handover of the Co.opmart Thong Nhat supermarket project to Saigon Co.op in 2025.

General Director Pham Trung Kien said that SCID’s overall strategy is to specialize in developing commercial infrastructure to serve Saigon Co.op’s retail activities. Currently, global economic and political fluctuations are affecting commercial real estate, and SCID will also be significantly impacted.

Image: SCID’s invested projects.

Lawsuit with Novaland: SCID has filed a request to overturn VIAC’s ruling

Regarding the An Phu project, the General Director affirmed that there is no risk of the project being revoked as SCID was responsible for site clearance compensation. Currently, the project is delayed due to objective obstacles common to many projects in Ho Chi Minh City related to procedural and state regulatory issues.

Specifically, the project is hindered by the requirement to fulfill technical infrastructure contribution obligations, according to SCID, due to Thu Thiem Real Estate Joint Stock Company not completing site clearance, so the Company cannot determine the amount to be paid.

The second obstacle is that the project has a 1/500 plan, but Ho Chi Minh City’s 1/2000 plan has not been approved, so there is a lack of consistency.

Regarding the cooperation with Novaland Group Joint Stock Company (Novaland, stock code NVL), Mr. Kien said that SCID has proposed to terminate the cooperation contract between the two sides to renegotiate a new contract according to current regulations, as the previous contract, signed in 2020 according to old regulations, is no longer suitable.

However, Novaland decided to sue SCID. Novaland requested the continuation of the previously signed contract.

On March 11, 2025, the Vietnam International Arbitration Center (VIAC) announced its acceptance of Novaland and Nova An Phu’s request to sue, forcing SCID to fully perform its obligations under the project development cooperation contract signed in December 2016 between Novaland, Nova An Phu, and SCID.

Subsequently, SCID filed a request with the Economic Court of the Ho Chi Minh City People’s Court to overturn VIAC’s ruling. The Economic Court has accepted SCID’s request on May 14.

SCID’s General Director affirmed that, as the investor of the An Phu project, whether cooperating with Novaland or any other unit, the Company will only execute the project if it complies with current regulations. As the project involves legal issues, it may take time, but SCID will persistently pursue it.

Saigon Co.op An Phu is a key project

Image: Saigon Co.op An Phu illustration.

Saigon Co.op An Phu, formerly known as An Phu Complex, is a complex project comprising a shopping mall, office building, and luxury apartment building. The project is located in the new urban area of An Phu – An Khanh, Thu Duc City, right next to Estella Heights and Phap Vien Minh Dang Quang.

The project covers an area of 6.9 hectares with a total floor area of nearly 350,000 square meters. It is expected to have about 4,000 apartments built, along with a range of amenities such as a high-end shopping mall, entertainment services, shopping, amusement parks, etc. According to the initial roadmap, the project was to commence in April 2012 and be completed by 2015. However, the project was dormant for a long period.

At the previous General Meeting, SCID’s Chairman of the Board, Vu Anh Khoa, stated that Saigon Co.op An Phu is a key project for both Saigon Co.op and SCID in forming a complex project cluster, and it is expected to become Saigon Co.op’s headquarter in the future.

The Big Payout: Unveiling the Banks’ Dividend Strategies

In the latter half of May, no less than three banks will finalize their shareholder registers to facilitate dividend payments.

“Shareholder Meeting of SCID: Application Filed to Annul VIAC Ruling on An Phu and NVL Projects”

“At the annual general meeting held on May 16, 2025, the management of Saigon Co.op Investment and Development Joint Stock Company (SCID) provided insights into their strategic direction amidst the ongoing global trade tensions. This meeting also addressed the company’s response to the legal proceedings initiated by Novaland regarding the An Phu project.”

The Chairman of Hoa Phat Group is Planning to Transfer HPG Shares Worth $9.5 Million to Family Members

Hòa Phát has recently unveiled its plans for a 20% stock dividend, as per the latest Board of Management resolution. This development marks a strategic move by the company, offering a detailed roadmap for executing the 2024 dividend policy. Shareholders can anticipate the distribution of these dividends in the upcoming month of May.