On June 2nd, Dinh Vu Port Investment and Development JSC (code: DVP) will finalize its shareholder list to distribute the second round of cash dividends for 2024, with a ratio of 40% (1 share receives VND 4,000). The ex-dividend date is May 30th, and the expected payment date is June 27th, 2025.

With 40 million shares outstanding, Dinh Vu Port will allocate VND 160 billion in dividends. Earlier, in February, the company paid the first dividend with a ratio of 30%. As per the plan approved by the 2025 AGM, DVP aims to distribute a record-high total dividend ratio of 80% for 2024. Thus, after these two installments, the company will make the final dividend payment of 10% in September.

Regarding shareholder structure, the parent company, Hai Phong Port JSC (holding 51% of capital), is expected to receive nearly VND 82 billion. The second largest shareholder, Agricultural Products Supplies JSC (owning 18.7%), will correspondingly receive about VND 30 billion.

According to our sources, Dinh Vu Port Investment and Development JSC was established as a joint-stock company by Decision No. 990/QD-TGD dated November 11, 2002, of the General Director of Vietnam Maritime Corporation.

The initial chartered capital was VND 100 billion, contributed by founding shareholders, including Hai Phong Port with VND 51 billion, accounting for 51% of the charter capital, along with other legal entities and officials of Hai Phong Port.

Notably, Dinh Vu Port has a tradition of maintaining attractive cash dividends for many years, with ratios reaching tens of percent. Most recently, DVP distributed a 70% dividend for the year 2023.

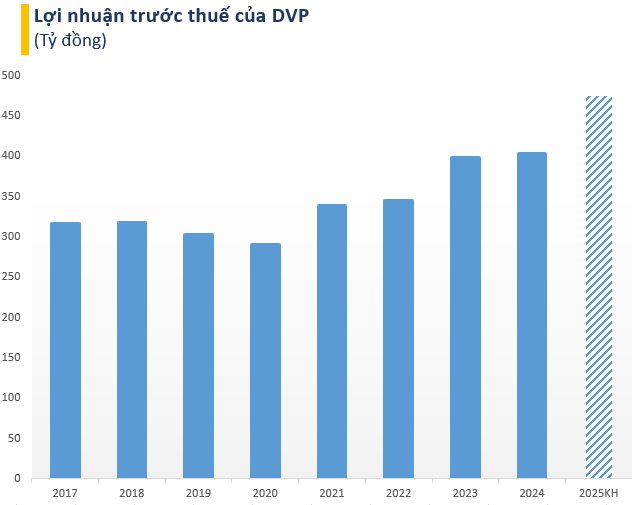

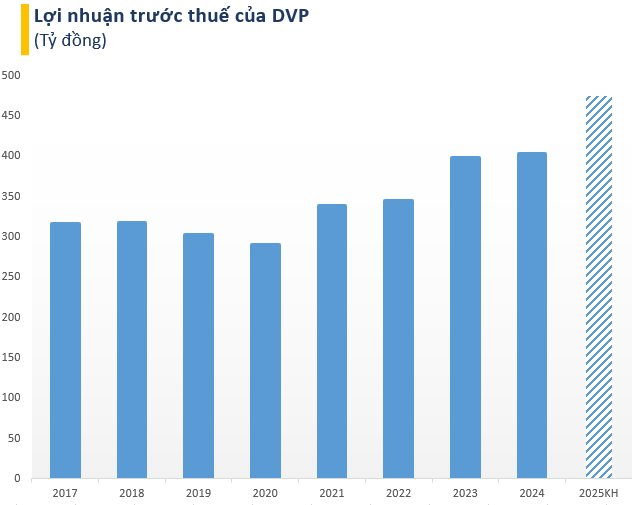

This consistent dividend policy is supported by stable business performance. In 2024, the company recorded net revenue of VND 694 billion and after-tax profit of over VND 336 billion, up 26% and 2%, respectively, from the previous year, marking historical highs.

In the first quarter of 2025, DVP achieved net revenue of nearly VND 159 billion and pre-tax profit of over VND 80 billion, increasing by 5% and 4% compared to the same period last year.

DVP’s Impressive Performance: Historical Revenue and Profit Trends

Entering 2025, DVP sets ambitious growth targets, aiming for revenue of VND 950 billion and pre-tax profit of VND 475 billion, corresponding to increases of 37% and 18%, respectively, compared to the previous year. If achieved, these will be the highest revenue and profit milestones in the company’s operating history. The company also plans to maintain high dividend ratios in 2025, with a minimum target of 60%.

On the stock exchange, DVP shares have been on a positive recovery path since the sharp drop in early April. As of the market close on May 16th, DVP’s share price stood at VND , reflecting a gain of approximately 13% after more than a month.

DVP Share Price Performance: Steady Recovery Since Early April

“Sotrans CEO on the 54% Profit Growth Plan: What’s the Strategy?”

Despite aiming for over a 50% growth in after-tax profits in 2025, the leadership of Southern Logistics Joint Stock Company (Sotrans, HOSE: STG) believes that this is not an unrealistic expectation. This confidence is based on positive business signals since the beginning of the year and significant improvements in previously challenging operational areas.

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.

“An Exciting Dividend Announcement: A 100% Cash Payout and a 50% Stock Surge”

“The company is expected to dish out a substantial sum of 184 billion VND to shareholders come June. This upcoming payout is certainly a notable event for investors to keep an eye on.”

I hope that captures the essence of your request, showcasing a fluent and engaging writing style.