The Ho Chi Minh Stock Exchange (HoSE) witnessed a positive trading session on May 15, 2025, with the VN-Index gaining 4.46 points to close at 1,314.19. The banking sector was a key driver of this growth, with notable increases from prominent banks such as MBB, SHB, ACB, and VCB.

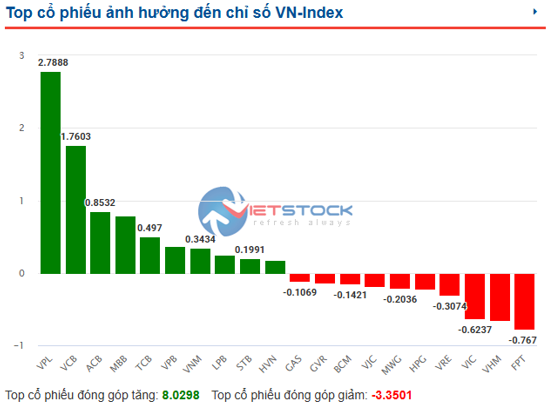

On the contrary, the real estate sector faced headwinds, with several large-cap stocks experiencing declines. VHM, VRE, and VIC, all part of the Vingroup ecosystem, witnessed notable drops, dragging down the market. However, VPL, another Vingroup member, achieved its third consecutive trading session gain since its relisting on HoSE, contributing positively to the index.

|

Source: VietstockFinance

|

The trading value slightly surpassed VND 28,000 billion, a slight increase compared to the previous session and significantly higher than the recent average. The market breadth remained balanced, with 410 advancing stocks, including 28 stocks hitting the ceiling price, while 358 stocks declined, including 5 at the floor price. The remaining 844 stocks stayed flat.

The market witnessed a strong polarization, with the banking sector providing the main upward momentum. In addition to the aforementioned banks, other prominent gainers included VIX, MSB, and LPB. Foreign investors played a significant role in driving the banking sector’s performance, with notable net purchases in MBB, SHB, STB, LPB, and VPB.

The securities sector also witnessed positive momentum, led by VIX, SHS, and HCM. In contrast, the real estate sector faced headwinds, with declines in large-cap stocks such as VHM, VRE, and TCH. On the flip side, CII, CEO, and HDC posted gains, along with several stocks hitting the ceiling price, including BCR, API, and NRC.

The real estate sector was the second-worst performer in the market, just behind specialized services and commerce. Given the large market capitalization of the sector, it exerted considerable pressure on the overall market performance.

Foreign investors’ actions contributed to the polarization in the real estate sector, with notable net selling in VHM and VRE. Despite this, foreign investors recorded a third consecutive net buying session, a rare occurrence in recent times, with a net purchase value of nearly VND 193 billion.

| Foreign investors net buy for the third consecutive session |

As a result of these dynamics, banking and real estate stocks were on opposite ends of the spectrum in terms of their impact on the VN-Index. Among the top 10 positive contributors to the index, eight were from the banking sector, along with VNM and the newly listed VPL from Vingroup. On the other hand, several real estate stocks, led by VHM, were among the top negative contributors.

| Banks and real estate stocks in contrast in their contribution to VN-Index |

Morning session: Recovery at the 1,300 support level

The VN-Index spent most of the morning session in correction mode, dipping below the 1,300 mark at one point. However, timely buying interest at this crucial support level helped the index recover slightly, closing the morning session at 1,306.72, down over 3 points.

Similarly, the HNX-Index ended the morning in negative territory, losing 0.89 points to 217.99, while the UPCoM-Index gained 0.47 points to 95.36. The total trading value across the market reached VND 14,206 billion, higher than the previous sessions.

Source: VietstockFinance

|

The market polarization was evident during the morning session, with the banking sector attracting strong buying interest. MBB, SHB, ACB, LPB, and STB posted notable gains, with MBB and SHB also being the top net bought stocks by foreign investors, contributing significantly to the sector’s performance.

The securities sector also remained in positive territory, although with more modest gains, led by HCM, VCI, VND, and SSI. In contrast, the real estate sector witnessed a broad decline, with VHM, VRE, and VIC leading the losses. This was in stark contrast to VPL, another Vingroup member, which continued its upward momentum, hitting the ceiling price for the third consecutive session.

Other sectors that faced headwinds included metals and mining, retail, electrical equipment, and software.

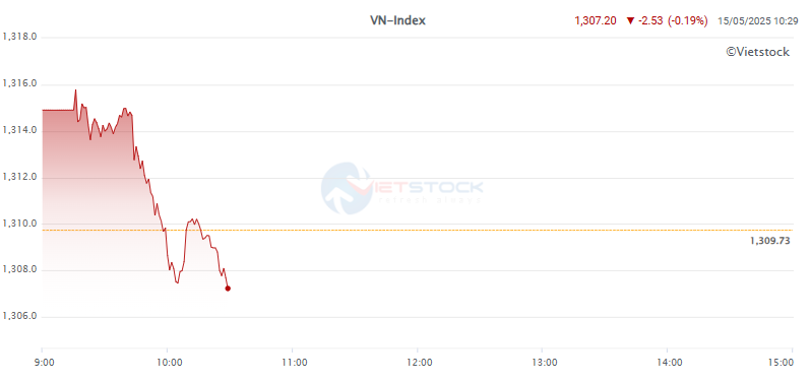

10:30 am: Quick rise followed by a sharp fall, VN-Index turns red

After an initial positive start, the VN-Index quickly faced corrective pressure, dipping into negative territory. As of 10:30 am, the index fell 2.28 points to 1,307.45, while the HNX-Index lost 0.91 points to 217.97. The UPCoM, however, remained in positive territory, gaining 0.53 points to 95.42.

Source: VietstockFinance

|

While most banking and securities stocks managed to hold on to their gains, several other sectors faced selling pressure. The real estate sector stood out, with VHM, VRE, and VIC posting notable declines, alongside other stocks such as TCH, VPI, and DXG.

Other sectors in the red included steel, with HPG leading the losses, followed by food & beverage (DBC), software (FPT), retail (MWG and PNJ), and electrical equipment (GEX).

Market liquidity remained robust, with over 403 million shares changing hands, translating to a trading value of nearly VND 9,026 billion, higher than the previous session and the recent average.

Foreign investors were net buyers in the morning session, purchasing nearly VND 1,367 billion and selling VND 876 billion, resulting in a net buy value of nearly VND 491 billion. Their buying interest was concentrated in the banking sector, with notable net purchases in MBB, SHB, VPB, STB, and LPB, providing support to the sector and preventing a more substantial correction.

On the other hand, the real estate sector faced net selling pressure, with VHM, VRE, and VIC being the top three net sold stocks.

Opening session: Green across the board, VPL achieves a “hat-trick” of ceiling prices

As of 9:30 am, the market was painted green, with the VN-Index climbing 4.46 points to 1,314.19. Banking, real estate, securities, and construction sectors dominated the trading volume.

Out of 473 stocks, 303 posted gains, including 18 hitting the ceiling price. VPL, a newcomer to HoSE, stood out with its third consecutive ceiling price since its relisting, contributing the most to the VN-Index’s gains. Other notable gainers included a group of banking stocks: VCB, ACB, MBB, TCB, VPB, LPB, and STB. Together, the top 10 positive contributors to the VN-Index added over 8 points to the index.

On the flip side, only 160 stocks declined, with VHM, VRE, and VIC, all part of the Vingroup ecosystem, being the top negative contributors, deducting nearly 1.6 points from the index.

Source: VietstockFinance

|

Looking at Asian markets, performances were mixed, with Hang Seng and Singapore Straits Times posting slight gains, while All Ordinaries, Nikkei 225, and Shanghai Composite dipped into negative territory.

In the US, the S&P 500 and Nasdaq Composite closed higher on May 14, while the Dow Jones slipped. Notably, the S&P 500 recovered all its year-to-date losses.

|

Changes to the KRX System

|

The Stock Market’s “Royal” Attractions

The stock market witnessed a surge in numerous stocks that demonstrated robust momentum and witnessed a boom in trading volume. This rally was further fueled by substantial net buying from foreign investors, indicating their confidence in the potential of these stocks.

Stock Market Update for Week of May 12-16, 2025: Pausing the Uptrend

The VN-Index ended the week on a negative note, halting its four-day winning streak. In the coming weeks, the index is likely to face challenges as volatility persists around the 1,300-point mark. If the index can hold firm above this threshold and foreign investors maintain their net buying trend, the short-term uptrend is expected to continue.

Has the Vietnamese Stock Market Ended its Three-Week Correction?

The VN-Index has staged a remarkable comeback, with losses from the 2025 peak narrowing to under 10% since the April 23 trading session. This marks the third consecutive year of growth for the index. In the aftermath of the 2025 tariff shock, over 1,000 stocks have rebounded from their lows, although the recovery has been uneven across sectors.