Source: VietstockFinance

|

Industrial Import-Export Investment JSC (HNX: DDG) reported a net loss of over VND 63 billion in its 2024 audited consolidated financial statements, contrasting the profit of over VND 15 billion in the self-prepared statements.

According to DDG’s explanation letter, the discrepancy mainly arose from the parent company’s provision for investment in its subsidiary of over VND 5.5 billion and doubtful debt of more than VND 41.4 billion as per the auditor’s requirement. Additionally, financial income was significantly adjusted downward due to the absence of profit recognition from the divestment in CL Joint Stock Company, a subsidiary of DDG.

|

In June 2024, DDG announced its intention to divest 63.93% of its capital in CL, equivalent to nearly VND 48 billion, reducing its ownership to 21%. Notably, CL is currently guaranteeing a VND 300 billion bond issuance of DDG, with the collateral being the right to use land and construction works at Tra Noc II Industrial Park, Can Tho city. |

Specifically, financial income after the audit stood at only VND 1.1 billion, a decrease of 98% compared to the nearly VND 53 billion in the self-prepared report. Meanwhile, selling expenses increased more than 4.5 times, from VND 13.6 billion before the audit to VND 61.8 billion, due to the provision for bad debts.

On a positive note, the cost of goods sold after the audit was adjusted downward by 6%, improving the gross profit margin to nearly 22%, despite the net revenue remaining unchanged at nearly VND 358 billion.

Compared to 2023, audited revenue in 2024 decreased by 45%, but the loss improved compared to the record loss of over VND 206 billion in the previous year. However, the accumulated loss by the end of 2024 stood at nearly VND 103 billion. The company attributed the revenue decline mainly to the sharp decrease in biomass trading activities.

| DDG’s Financial Results for the Past 5 Years |

|

|

DDG’s financial situation remains tense, with cash holdings of less than VND 4.5 billion at the end of 2024, while non-performing loans soared to over VND 144 billion, more than 20 times higher than at the beginning of the year. Some significant non-performing loans were recorded with Service Company Tan Viet at over VND 64 billion and Ocean Energy Development Investment Company at nearly VND 25 billion.

In terms of capital sources, DDG’s financial lease debt exceeded VND 680 billion, of which overdue debt not yet paid reached VND 539 billion, double that of the beginning of the year. The largest overdue debt was with BIDV, amounting to nearly VND 117 billion. The company attributed the difficulty in liquidity to the negative impact of the economy and the tightening of credit by banks.

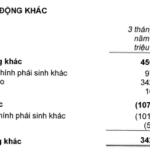

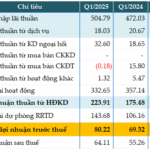

In the first quarter of 2025, DDG recorded a net loss of nearly VND 26 billion, while in the same period last year, it made a profit of nearly VND 5 billion. Net revenue decreased by 31%, and the gross profit margin narrowed to 3.2% (compared to 20.8% in the same period last year). The decline in trading activities, the suspension of steam supply systems after the Tet holiday, interest expense pressure, and the continued provision for doubtful accounts were the main reasons for the deteriorating performance.

Stock Price Surges but Remains Lower than the Price of a Glass of Iced Tea

On the stock exchange, DDG stock shocked investors by falling for 19 consecutive sessions in July 2023, causing the market price to plunge from the VND 42,000/share range to just above VND 6,000/share, resulting in a loss of over 85% in value. Although it rebounded with five consecutive ceiling prices, the stock continued to hit new lows. As of May 16, despite surging to the ceiling price of VND 2,800/share with a matching volume of more than 1.7 million shares, the stock still dropped by 26% in the past quarter, and the price is now “cheaper than a glass of iced tea.” Currently, DDG stock is in the warning and control list on HNX.

| DDG Stock Price Plunge from July 2023 to Present |

|

|

DDG is expected to hold its 2025 Annual General Meeting of Shareholders in June, with the ex-dividend date being May 28. The meeting agenda includes reports on business results in 2024, plans for 2025, and other matters within the competence of the shareholders.

– 14:58 16/05/2025

“VIB Bank Reports a Slight 3% Dip in Q1 Pre-Tax Profits, CASA Up by 17%”

The consolidated financial statements for Q1 2025 revealed that Vietnam International Commercial Joint Stock Bank (HOSE: VIB) posted a pre-tax profit of nearly VND 2,421 billion, a slight decrease of 3% compared to the same period last year.

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

Sacombank: The Power of Business Savvy

Despite facing significant challenges from the restructuring plan, including constraints on capital increases, Sacombank has achieved notable successes in financial indicators, credit ratings, and risk management. These accomplishments have significantly enhanced the appeal of Sacombank’s stock, attracting the attention of domestic and foreign investors alike.

“Boosting Risk Reserves, BVBank Posts 16% Rise in Q1 Pre-Tax Profit”

The consolidated financial statements for the first quarter of 2025 show that BVBank (UPCoM: BVB) recorded a pre-tax profit of over VND 80 billion, a 16% increase compared to the same period last year, despite a 35% rise in risk provisions by the Bank.