MB Bank’s May 2025 Savings Interest Rates for Individual Customers

As of May 17, Military Commercial Joint Stock Bank (MB) offers interest rates on deposits from individual customers ranging from 0.5% to 5.8% per annum.

For short-term deposits with a tenure of 1, 2, or 3 weeks, a flat interest rate of 0.5% per annum is applicable regardless of the deposit amount.

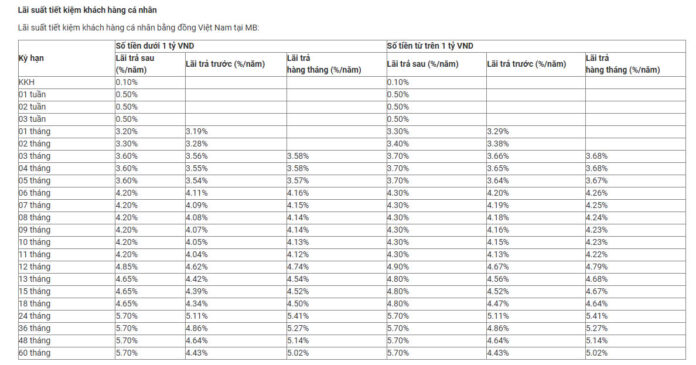

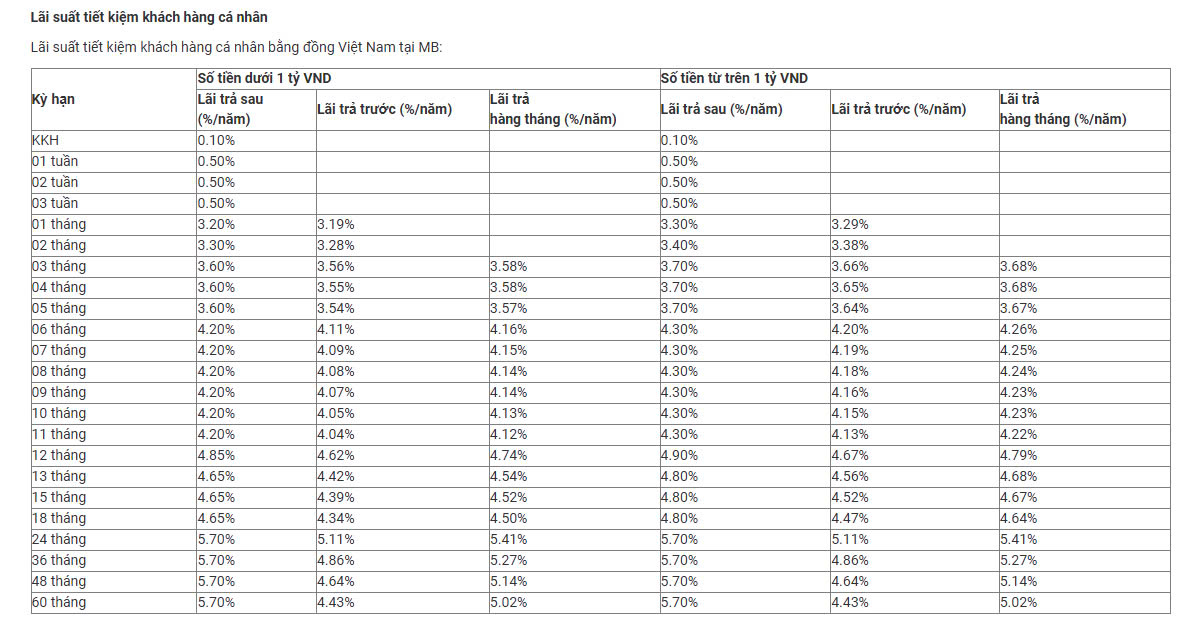

For longer tenures, MB offers different interest rates based on two deposit tiers: below VND 1 billion and VND 1 billion or above.

For deposits below VND 1 billion, the interest rates are as follows: 1-month tenure at 3.2% per annum; 2-month tenure at 3.3%; 3-5 months at 3.6%; 6–11 months at 4.2%; 12 months at 4.85%; 13-18 months at 4.65%; and the highest rate of 5.7% for 24-36 months.

For deposits of VND 1 billion or more, the interest rates are: 1-month tenure at 3.3% per annum; 2-month tenure at 3.4%; 3-5 months at 3.7%; 6–11 months at 4.3%; 12 months and above at 4.9%; 13-18 months at 4.8%; and the highest rate of 5.7% for 24-36 months.

MB’s Deposit Interest Rates for Individual Customers for May 2025

Additionally, individual customers who deposit at branches in the Central and Southern regions will enjoy slightly higher interest rates compared to other regions, with a difference of approximately 0.1% per annum (excluding tenures shorter than 1 month). The interest rate range for this region is 0.5% to 5.8% per annum for end-of-term interest payment options. The highest rate of 5.8% per annum is offered for deposits with a tenure of 24 to 60 months.

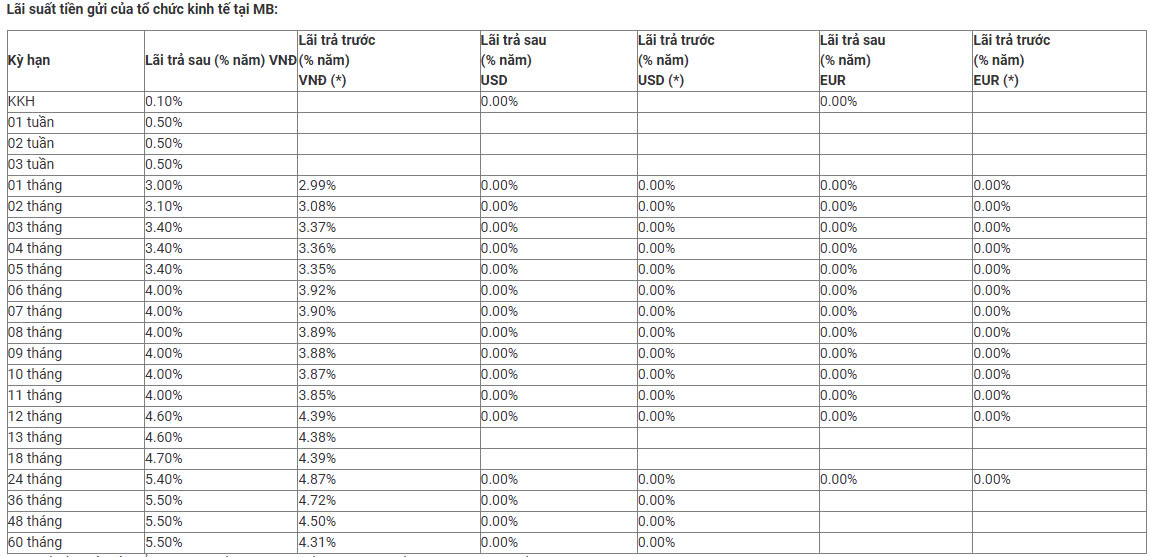

MB Bank’s May 2025 Savings Interest Rates for Business Customers

As of May 17, MB offers interest rates on term deposits for business customers ranging from 0.5% to 5.5% per annum for end-of-term interest payment options.

For short-term deposits with a tenure of 1, 2, or 3 weeks, the interest rate is set at 0.5% per annum.

The interest rates for longer tenures are as follows: 1-month tenure at 3.0% per annum; 2-month tenure at 3.1%; 3-5 months at 3.4%; 6–11 months at 4.0%; 12-13 months at 4.6%; 18 months at 4.7%; 24 months at 5.4%; and the highest rate of 5.5% per annum for tenures ranging from 36 to 60 months.

MB’s Deposit Interest Rates for Business Customers for May 2025

MB also offers a separate interest rate framework for business customers in the Central and Southern regions (excluding Ho Chi Minh City). This framework provides higher interest rates, approximately 0.1% per annum higher for tenures of 6 months and above compared to regular customers. The highest interest rate of 5.6% per annum is offered for business customers with deposits of 36 to 60 months.

A Bank Raises Savings Interest Rates Starting Today, November 20th.

South Asia Bank has announced an update to its savings account interest rates, effective immediately from November 20th onwards.

The Power of Compounding: Maximizing Your BIDV Savings Account Interest in November 2024

In November, BIDV offered an impressive 4.9% annual interest rate on online deposits for personal customers with a tenure of 24 to 36 months. This highly competitive rate showcases BIDV’s commitment to rewarding its customers with attractive returns on their savings. With this offer, customers can rest assured that their money is not only secure but also growing at a remarkable rate during this period.

What’s the Highest Interest Rate TPBank Offers After the Recent Increase in Savings Rates in Early August?

With an impressive average increase of 0.2% per annum, TPBank has officially adjusted its savings interest rates at the beginning of August.