|

Mr. Pham Van Trong has recently registered to sell 200,000 shares of Mobile World Investment Corporation (HOSE: MWG) from May 20 to June 18, 2025, to meet his personal financial needs. If the transaction is completed, Mr. Trong’s ownership will decrease from 0.218% to 0.205%, equivalent to 3.03 million MWG shares.

Based on MWG’s share price of VND 64,000 per share in the morning session of May 16, Mr. Trong could potentially receive approximately VND 12.8 billion if the transaction is successful. Mr. Trong is currently the CEO of Bach Hoa Xanh (Green Grocery) chain and has recently been elected to the Board of Directors of MWG for the term 2025-2028, along with Mr. Nguyen Duc Tai as Chairman, Mr. Vu Dang Linh as CEO, and Mr. Doan Van Hieu Em as CEO of Mobile World.

The registration for sale comes as MWG’s share price has increased by nearly 40% in just over a month, rising from VND 46,000 per share at the beginning of April to its current level. This is the highest price since November 2024, following a period of negative impact due to tax-related news.

| MWG Share Price Movement in the Past Year |

In parallel, the Board of Directors of MWG approved the plan to repurchase 324,161 treasury shares in May-June 2025 using its own capital sources to retrieve ESOP shares from employees who have left the company. This is a concrete step following the announcement made by Mr. Vu Dang Linh, CEO, at the 2025 Annual General Meeting, stating that the plan to buy back a maximum of 10 million treasury shares in 2024 could not be executed due to procedural issues. This year, the company has prepared thoroughly in terms of legal aspects and will implement the plan immediately after receiving approval from the Annual General Meeting.

Accelerating the Expansion of Bach Hoa Xanh

On May 13, 2025, the Board of Directors of MWG also approved the program for the conditional issuance of share purchase warrants at Bach Hoa Xanh Technology and Investment Joint Stock Company – a subsidiary 94.99% owned by MWG, which operates the supermarket chain of the same name.

At the 2025 Annual General Meeting, MWG’s leadership stated that Bach Hoa Xanh had opened 200 stores at the beginning of the year, in line with its plan. The company pursues a strategy of “expanding with solid execution,” prioritizing efficiency, and aims to complete the target of opening 400 stores this year. Additionally, they expect a revenue increase of over 10% for existing stores, with a minimum profit target of VND 500 billion for 2025.

In the first quarter of 2025, despite the Tet holiday in February, Bach Hoa Xanh recorded a profit, although not a significant one. The chain’s revenue reached more than VND 11,000 billion, a 20% increase compared to the same period last year. The average revenue of each store that has been in operation for at least six months was VND 2.1 billion per month. During this quarter, 232 new stores were opened, with more than 50% located in the Central region, and the average revenue of each new store ranged from VND 1.2 to 1.5 billion.

For the entire MWG Group, the first-quarter revenue reached VND 36,135 billion, an increase of nearly 15% compared to the same period in 2024. The net profit was VND 1,546 billion, a significant increase of 71%, making it the second-highest quarterly profit in MWG’s operating history, only surpassed by the fourth quarter of 2021.

In 2025, MWG sets a target of VND 150,000 billion in revenue and VND 4,850 billion in net profit, representing a 12% and 30% increase, respectively, compared to the previous year. As of the first quarter, the company has achieved 24% of its revenue target and 32% of its profit target for the year.

| MWG’s Net Profit by Quarter from 2021 to 2025 |

By: The Manh

– 11:15, May 16, 2025

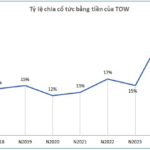

Unveiling the Ultimate Guide to Captivating Copy: “TOW Unveils Record-Breaking Dividends: A Historic Payout after Landmark Profits”

“In a move that will surely delight investors, the Tra Noc – O Mon Water Supply Joint Stock Company (TOW) has announced an extraordinarily generous cash dividend for 2024. Shareholders have every reason to rejoice as the company has declared a record-high dividend ratio. Mark your calendars, as May 29, 2025, is the crucial date for trading without entitlement to this dividend.”

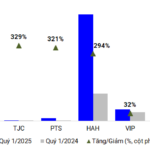

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.

The Coal Mining Company Stakes a Claim for Dividend Splits, Yielding a Whopping 400% Payout

Joint Stock Company 397 (UPCoM: BCB) is pleased to announce a cash dividend for the year 2024. The ex-dividend date is set for May 29th, marking an important milestone for shareholders.