Oil prices fell as U.S. crude inventories rose more than expected, sparking oversupply concerns.

Oil Prices Slip on Unexpected Build in U.S. Inventories, Concerns of Oversupply

Oil prices declined after data from the U.S. Energy Information Administration (EIA) revealed a surprise build in crude stocks, sparking concerns about oversupply in the market. Specifically, Brent crude fell by 0.54 USD (or 0.81%) to 66.09 USD per barrel, while WTI crude dropped by 0.52 USD (or 0.82%) to 63.15 USD per barrel.

According to the EIA, U.S. crude oil inventories rose by 3.5 million barrels to 441.8 million barrels, contrary to analysts’ expectations of a 1.1 million barrel draw. Data from the American Petroleum Institute (API) also showed a build of 4.3 million barrels. During this period, net U.S. crude imports rose by 422,000 barrels per day.

Additionally, OPEC downwardly revised its forecast for supply growth from non-OPEC+ countries in 2025, even as the organization and its allies continue to boost output. This has raised concerns that supply could outpace demand in the coming months.

The U.S. dollar also rebounded during the session, putting additional pressure on oil prices by making the commodity more expensive for investors holding other currencies.

Gold Prices Hit Over One-Month Low as Risk Appetite Improves

Gold prices dropped by over 2%, falling to their lowest level since April 11, as improving risk sentiment amid U.S.-China trade optimism dampened demand for safe-haven assets like gold.

Spot gold fell by 2% to 3,181.62 USD per ounce, after earlier touching an intraday low of 3,174.62 USD. Gold futures in the U.S. settled down by 1.8% at 3,188.30 USD per ounce.

Analysts attributed the decline to a technical correction in the market following the U.S.-China trade truce, which included a rollback of tariffs and a pause in escalatory measures for 90 days. President Trump also hinted at potential trade deals with India, Japan, and South Korea.

Gold had hit a record high of 3,500.05 USD per ounce last month and is still up by 21.3% year-to-date. However, the downward trend could continue in the near term, with support levels expected at 3,136, 3,073, and 3,000 USD per ounce, according to technical analysts.

The market now awaits U.S. producer price index (PPI) data due on Thursday, after weaker-than-expected CPI data raised expectations of a Fed rate cut.

Other precious metals also fell, with silver down by 1.9% to 32.25 USD per ounce, platinum falling by 0.6% to 982.05, and palladium slipping by 0.3% to 954.36 USD per ounce.

Iron Ore Prices Hit Over Five-Week High on U.S.-China Trade Optimism

Iron ore futures rose to their highest level in over five weeks, buoyed by news of tariff cuts between the U.S. and China as part of a trade deal, raising hopes for a sustainable resolution to the trade dispute between the world’s two largest economies.

The September 2025 iron ore contract on the Dalian Commodity Exchange (DCE) climbed by 1.81% to 732.5 yuan (101.51 USD) per ton, after earlier touching its highest since April 7 at 736.5 yuan.

On the Singapore Exchange, the June 2025 contract rose by 1.6% to 101.10 USD per ton, its highest since April 4.

China announced it would cut tariffs on U.S. goods to 10% for 90 days starting May 15, while the U.S. reduced tariffs to a minimum of 30% for low-value goods from China. President Trump also stated he was willing to directly negotiate final terms with Chinese President Xi Jinping.

Additionally, Shougang Hierro Peru, a significant iron ore supplier to China, halted operations due to infrastructure damage at its port. Repairs could take 4-5 months, forcing the Chinese parent company to increase purchases on the spot market to ensure production, according to analysts.

Other steelmaking inputs on the DCE also rose, with coking coal up by 0.97% and coke climbing by 0.86%. On the Shanghai Futures Exchange, hot-rolled coil rose by 0.65%, hot-rolled sheet gained 0.74%, wire rod climbed 0.93%, and stainless steel rose by 0.93%.

Soybean Futures Touch Near Ten-Month High, Corn and Wheat Also Gain

Soybean futures on the Chicago Board of Trade (CBOT) climbed to their highest level in nearly ten months, boosted by the U.S.-China trade ceasefire and a proposed extension of U.S. biofuel tax credits, both of which fueled expectations of increased demand.

Soybean prices rose for the fifth straight session, supported by the 90-day truce between Washington and Beijing, which includes a pause in tariff hikes. Traders are closely watching to see if China, the world’s top soybean importer, will resume purchases of U.S. agricultural products as part of the negotiations. However, there is caution about the outlook once the tariff reprieve ends, just ahead of the U.S. soybean and corn harvests.

At the close, the most active soybean contract on the CBOT rose by 5.25 cents to 10.77-3/4 USD per bushel, after earlier touching 10.82 USD, its highest since July 2024.

Earlier in the week, the U.S. Department of Agriculture (USDA) surprised investors with a forecast for lower-than-expected soybean stocks by September 1, 2026. Additionally, a proposal in the U.S. House of Representatives to extend the 45Z biofuel tax credit to the end of 2031 supported market sentiment, as it would maintain demand for soybean oil in the renewable diesel sector.

Meanwhile, CBOT wheat futures gained 7.5 cents to 5.24-3/4 USD per bushel, and corn rose by 3 cents to 4.45-1/2 USD per bushel.

The market now awaits the weekly U.S. export sales report on May 15 and data from the National Oilseed Processors Association (NOPA), which is expected to show record soybean crushings in April.

Japanese Rubber Futures Extend Gains on U.S.-China Trade Optimism

Japanese rubber futures continued their upward climb for the tenth straight session, supported by the trade truce between the U.S. and China. The October 2025 rubber contract on the Osaka Exchange (OSE) rose by 1.43% to 319.6 yen per kg. On the Shanghai Futures Exchange (SHFE), the September 2025 contract climbed by 1.6% to 15,235 yuan per ton. Improved outlook for rubber consumption from downstream industries, particularly the automotive sector, boosted prices, despite improving supply conditions. While the rubber harvesting season has begun, and output is gradually increasing, Thailand announced a one-month delay in its harvest, which could support prices in the near term.

Cocoa Prices Hold Near Two-and-a-Half Month High, Sugar Falls, Coffee Drops Sharply

Cocoa prices held near a two-and-a-half-month high, supported by concerns about production in the world’s top grower, Ivory Coast. In London, the July cocoa contract was almost unchanged at 7,077 GBP per ton, after touching 7,207 GBP, its highest since late February, in the previous session. In New York, cocoa fell by 32 USD, or 0.3%, to 9,919 USD per ton, after reaching a peak of 10,045 USD on Tuesday.

According to traders, concerns about lower output from Ivory Coast’s mid-crop are supporting prices. Additionally, initial assessments of the number of cocoa pods on trees for the 2025/26 main crop indicate that production is unlikely to recover significantly next year.

Cocoa stocks on exchanges remain low, at 55,680 tons as of May 13, down sharply from 80,480 tons in the same period last year.

Raw sugar futures for delivery in July fell by 0.16 cent, or 0.9%, to 18.06 cents per lb, after touching a one-month high of 18.29 cents in the previous session. However, traders noted that data from Brazil’s industry association UNICA showed lower-than-expected sugar production in the country’s key Center-South region, which had supported prices earlier.

Nonetheless, consultancy Datagro predicted that Brazil’s sugar crop would generally improve in the coming months. White sugar fell by 1.2% to 503.90 USD per ton. Notably, Cuba’s annual sugar output is expected to drop below 200,000 tons in 2025, its lowest since the 19th century.

Arabica coffee futures dropped by 11.55 cents, or 3.1%, to 3.648 USD per lb, as favorable weather in Brazil improved output expectations from the world’s top exporter. Robusta coffee also fell by 2.3% to 5,010 USD per ton.

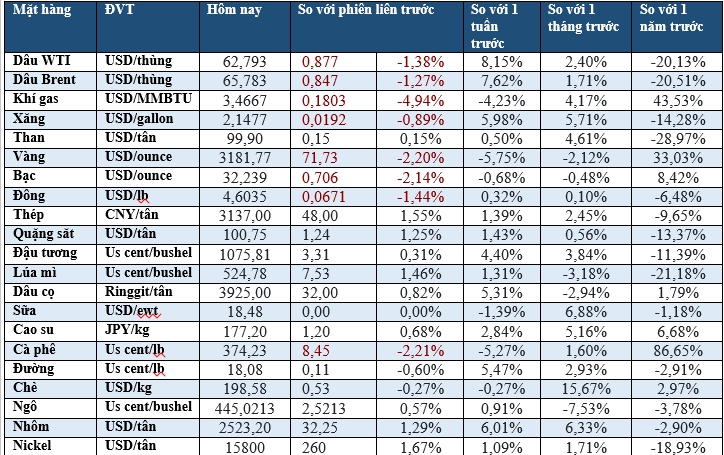

Prices of Key Commodities in the Morning Session Today

Commodity prices as of May 14, 2025, 10:11 am GMT+7.

The Pain of Q1: Oil & Gas Sector’s Struggles

The sharp decline in global oil prices in Q1 has taken a toll on businesses in the petroleum sector, with most companies experiencing a significant downturn compared to the previous year. This development aligns with the predictions made by several securities firms.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)