The Tax Department – Ministry of Finance has just announced an urgent plan to temporarily suspend tax industry applications to facilitate the relocation of its data center.

The transition to the new data center location will take place from May 23rd to June 15th. During this period, several tax industry applications will be temporarily unavailable to ensure a smooth system transition. The suspension will allow for the migration of applications from the primary data center environment to the backup data center and vice versa.

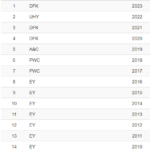

Specifically, the electronic invoicing application will be suspended from midnight to 4 am on May 24th and from midnight to 4 am on June 14th.

The electronic tax services and message switching applications will be unavailable from 6 pm on May 23rd to 4 pm on May 25th and from 6 pm on June 13th to 4 pm on June 15th.

From May 23rd to June 15th, several tax industry applications will be temporarily suspended during the system transition.

The Tax Department’s application system will operate at the backup data center (DRC) with a performance of 70% compared to the primary data center as follows: the electronic invoicing application will be suspended from 4 am on May 24th to midnight on June 14th; the electronic tax services and message switching applications will be unavailable from 4 pm on May 25th to 6 pm on June 13th.

The Tax Department’s application system will resume operations at the primary data center, with the electronic invoicing application resuming at 4 am on June 14th and the electronic tax services and message switching applications resuming at 4 pm on June 15th.

During the system suspension, taxpayers are requested to refrain from using the electronic invoicing and electronic tax services applications.

The electronic tax services application includes: eTax for businesses, iCanhan for individuals, eTax Mobile for mobile devices, and the e-commerce information portal, among others.

The Final Countdown: Gas Stations in HCMC Urged to Embrace Digital Transformation for Automated Invoicing

The current manual data entry practices and incomplete invoicing prevalent in the retail fuel industry are non-compliant and leave retailers vulnerable to penalties.