Domestic and foreign investors alike offloaded their holdings en masse during Friday’s trading session, resulting in a starkly negative breadth with a vast majority of stocks ending in the red. Foreign investors, who had been net buyers for the previous three consecutive sessions, turned net sellers today, offloading nearly VND 957 billion worth of shares, with a particular focus on the VN30 basket, where they sold a substantial VND 1,127 billion. Among the large-cap stocks, only a handful of heavyweights managed to keep the VN-Index from falling further, as banking stocks witnessed a steep decline across the board.

The VN-Index closed the day down 0.9%, or 11.81 points, settling at 1,301.39. This marks the sharpest daily decline in 16 sessions and represents a notable correction within the broader uptrend that has been in place since the abrupt shakeout on April 22nd, which formed a significant trough.

The primary culprit behind the VN-Index’s retracement was the weakness exhibited by blue-chip stocks, particularly the banking sector, which failed to sustain its upward momentum. Following a strong showing on the previous day’s futures expiry, all banking stocks within the VN30 basket ended in negative territory during today’s session.

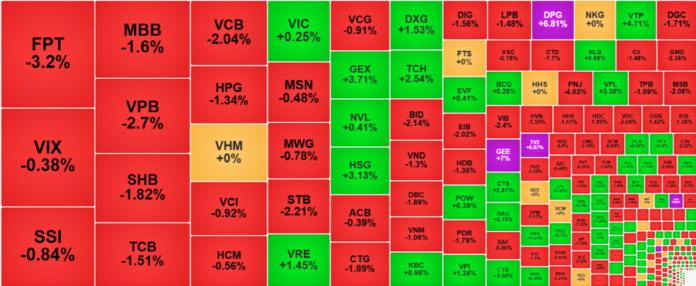

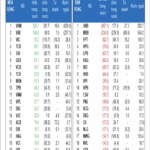

Of the top 10 stocks that dragged the VN-Index lower, eight were from the banking sector. VCB led the decline, falling 2.04% and shaving off 2.3 points from the index. However, VCB was not the weakest banking stock, as VPB tumbled 2.7%, VIB fell 2.4%, STB declined by 2.21%, BID lost 2.14%, and SSB decreased by 2.06%. Among the remaining large-cap banks, CTG fell by 1.89%, TCB dropped by 1.51%, and MBB slipped by 1.6%.

The VN30-Index closed 1.22% lower, signaling a failed attempt to breach its previous high, despite closing at a 36-month high just a day earlier. The breadth within the basket was heavily skewed towards decliners, with only four gainers versus 24 losers, out of which 19 fell by more than 1%. Unsurprisingly, banking stocks bore the brunt of the selling, but FPT’s 3.2% decline and BVH’s 2.72% drop also contributed significantly. Notably, FPT is the eighth-largest stock by market capitalization within the VN-Index.

The index found some support in VIC and VPL, with the former managing to eke out a 0.25% gain after being down as much as 1.38% intraday. VPL, which had rallied for three consecutive sessions, hitting the daily limit-up in each session, continued its ascent during the first hour of trading today before encountering profit-taking. However, it still managed to close 3.38% higher on relatively robust volume of approximately VND 117 billion. With VPL’s market capitalization now surpassing that of FPT, its performance in the coming sessions will be a key factor to monitor. VRE also displayed resilience, climbing 1.45%, while PLX and SAB posted modest gains.

The weakness among blue-chip stocks had a profound impact on market sentiment. The large-cap stocks, particularly those in the banking sector, carry significant weight in the market, and with the prolonged uptrend, profit-taking pressures had been building. The breadth on the HoSE reflected this dynamic, with only 123 gainers versus 186 losers, including 117 stocks that fell by more than 1%. This lopsided selling pressure was evident across the board.

Naturally, the blue-chip stocks accounted for a significant portion of the heaviest decliners, leading the market in terms of both price performance and trading volume. However, mid-cap and small-cap stocks also witnessed notable sell-offs: VND fell 1.3% on volume of VND 207.9 billion, DBC dropped 1.89% with volume of VND 184.5 billion, DIG declined 1.56% on volume of VND 170.2 billion, DGC fell 1.71% with volume of VND 155.3 billion, and VSC tumbled 3.15%, recording volume of VND 134.8 billion. Overall, stocks that fell by more than 1% today accounted for approximately 47.9% of the total trading value on the HoSE, underscoring the pervasive selling pressure.

Foreign investors joined the fray, turning net sellers to the tune of nearly VND 957 billion on the HoSE. Their selling was particularly pronounced in the VN30 basket, where they offloaded a substantial VND 1,127 billion. VCB bore the brunt of their selling, as foreign outflows accounted for nearly 90% of the total trading volume in the stock, resulting in a net selling figure of VND 420.1 billion. Other blue-chip stocks that witnessed notable foreign outflows included FPT (VND 228.4 billion), VHM (VND 188.8 billion), MSN (VND 102.6 billion), VPB (VND 70.2 billion), STB (VND 56.6 billion), SSI (VND 56 billion), and VIC (VND 55.8 billion). On the buying side, their activity was more subdued, with notable purchases in MWG (VND 125.6 billion), HSG (VND 95.9 billion), TCH (VND 92.8 billion), MBB (VND 79.5 billion), NLG (VND 53.3 billion), CTR (VND 44.8 billion), and VCI (VND 38.6 billion).

Despite the broad-based weakness, a select few stocks managed to attract robust buying interest from domestic investors, enabling them to buck the negative trend. GEX, for instance, climbed 3.71% on volume of VND 277.3 billion, while HSG rose 3.13% with volume of VND 275 billion. DXG advanced 1.53% on volume of VND 254.3 billion, TCH gained 2.54% with volume of VND 249.9 billion, DPG surged 6.81% on volume of VND 162.9 billion, VTP increased 4.71% with volume of VND 155.9 billion, VPI rose 1.24% on volume of VND 135.4 billion, GEE climbed 7% with volume of VND 110.5 billion, and CTS added 2.81%, recording volume of VND 100.9 billion. The ability of these stocks to attract substantial buying interest and swim against the tide, despite the pronounced weakness in the VN-Index and the broad decline among blue-chip stocks, is noteworthy.

Additionally, a number of mid-cap and small-cap stocks with lower liquidity also displayed resilience, such as VNE, TV2, and TCD, which all hit their daily limit-up, while TDH, DXS, TLD, ANV, DLG, KHG, NT2, YEG, and CTR posted gains ranging from 2% to 6%. This indicates that pockets of strength remain within the market, and the flow of funds is still concentrated in select stocks. The ability of the market to maintain this level of differentiation is a positive sign, especially at a juncture where the index faces the risk of a trend reversal.

The Flow of Foreign Capital Continues: VN30-Index Peaks at a 3-Year High During Derivatives Expiry

The foreign bloc ramped up selling in the afternoon session, with notable dumps in VHM and VRE. Despite this, buyers remained robust, resulting in a net position of nearly VND 236 billion. This pushed the overall net buying for the day to VND 919 billion, with approximately VND 656 billion worth of stocks in the VN30 basket being snapped up.

The Foreign Block: A Surprising Sell-Off of Nearly VND 1,000 Billion, With Personal Investors Holding Steady

The foreign bloc reversed course and locked in profits after a record-breaking buying spree. Today, they offloaded 970.7 billion VND, with a net sell-off of 771.4 billion VND in matched orders alone.

“The Power of Pillars: Market Shifts and Foreign Capital Inflows”

The pressure to secure profits this morning was widespread, coupled with weakness in some large-cap stocks, which caused significant market volatility. On the bright side, cash flow remains positive, particularly from foreign investors. As the VN-Index approaches its previous peak, a divergence of opinions is only natural.

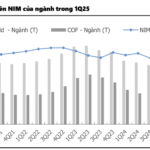

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.