In March of this year, Thailand’s SCG Group submitted a proposal to the Prime Minister and relevant ministries regarding the Long Son Petrochemical Complex project, with an investment of over $5 billion. SCG proposed to increase the preferential import tax rate (MFN) for polypropylene (PP) and polyethylene (PE) plastics to 10%.

These products are fundamental raw materials for various industries, including packaging, agriculture, electrical equipment, automotive parts, and more.

According to SCG, this measure aims to protect Vietnam’s nascent petrochemical industry and ensure long-term sustainability by reducing reliance on foreign suppliers.

In a document seeking appraisal of the draft amendment to Decree 26/2023/ND-CP on import and export taxes, the Ministry of Finance stated that the tax rate for PP and PE pellets ranges from 0-3%, and the WTO-bound rate is 6-6.5%.

The import turnover of PP plastics in 2024 was $1.5 billion. The portion subject to MFN taxes was $451 million, accounting for 30% of total imports. Vietnam mainly imports these products from South Korea, China, and Saudi Arabia.

As for PE plastics, the import turnover in 2024 was $2 billion. The portion subject to MFN taxes was $1.7 billion, accounting for 86% of total imports. Vietnam’s main import sources for these products are South Korea, the US, Thailand, and Saudi Arabia.

Regarding SCG’s proposal, the Ministry of Finance proposed to the Government to increase the preferential import tax rate for PP and PE pellets from 0% to 2%. This option could potentially increase state budget revenue by VND 924.6 billion.

However, the Ministry also noted that this proposal was previously discussed in 2023 and did not receive consensus from the Ministry of Industry and Trade (the sector management agency), the Plastic Association, and other agencies due to the insufficient domestic production capacity of PP and PE pellets to meet market demand.

How has SCG been performing in the Vietnamese market?

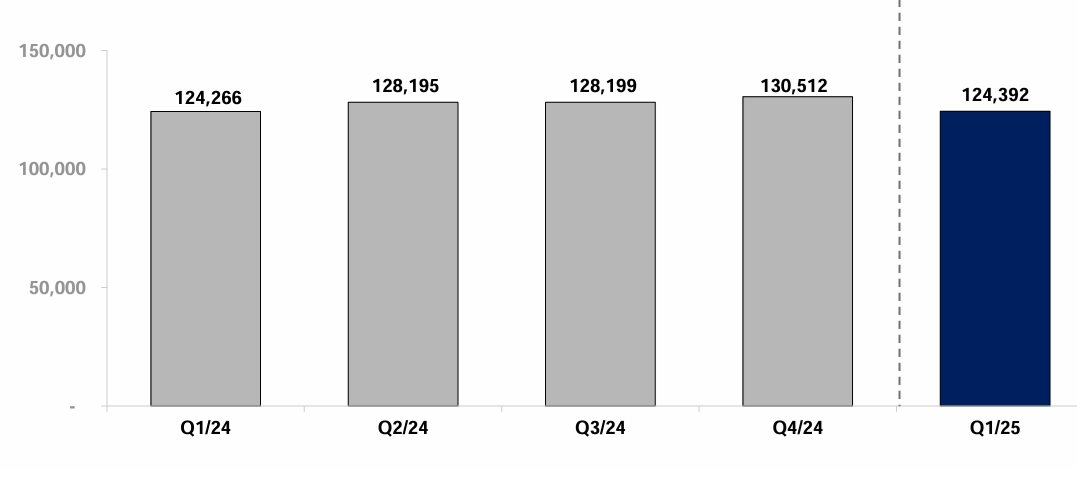

In its Q1 report this year, SCG reported revenue of 124.4 billion baht, a slight increase of 0.1% from the same period last year but a 5% decrease from Q4/2025.

SCG’s global revenue (in million baht)

SCG’s largest revenue source is its home market, Thailand, which contributed 70.1 billion baht, or 56% of the total. Vietnam is the second-largest market, accounting for 8% or approximately 9.95 billion baht (over 6.8 trillion VND). Other significant markets include Indonesia (7%), China (4%), and Cambodia (2%).

SCG’s global after-tax profit was 1.1 billion baht, but the company noted that excluding the results from the Long Son Petrochemical Complex (LSP), this figure would have been 4 billion baht. Thus, LSP resulted in a loss of approximately 2 trillion VND.

The Long Son Petrochemical Complex has a total design capacity of 1.4 million tons of plastic pellets per year, along with various other plastic products. At maximum capacity, the complex is expected to generate $1.5 billion in revenue annually and contribute approximately $150 million to the state budget.

However, the Long Son Petrochemical Complex, which commenced operations on September 30, 2024, had to suspend its activities after only 15 days due to market challenges. LSP stated that it would resume operations once profit margins improve.

Facing difficulties and determined to turn things around at the LSP plant, SCG announced in February 2025 that it would invest an additional $500 million to retrofit the facility, using ethane as a new feedstock, either alone or in combination with naphtha and propane.

The project is expected to be completed in 2.5 years, with a targeted completion date of late 2027.

Vietnam was the second-largest market, generating 49.5 billion baht in revenue, equivalent to 37,630 billion VND, an increase of 11.1% from the previous year. This result was only surpassed by Thailand.

The $500 Million Telecom Giant Viettel Records 2nd Consecutive Month of Profit Growth

As of the first four months of the year, the company has recorded impressive figures with a revenue of VND 3,824.5 billion and a gross profit of VND 209.8 billion, reflecting a remarkable 7% growth compared to the same period last year.

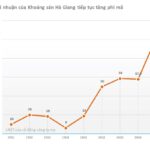

The Ultimate Windfall: Unveiling the Secrets Behind a Vietnamese Company’s Stellar Performance with a 444% Surge in Q1 Profits, Positioning Itself as a Global Leader in the Highly Coveted Mineral Industry.

“With this latest announcement, the total cash dividend for 2024 amounts to an impressive 138% (VND 13,800 per share), marking a historic high for the company. This unprecedented payout underscores our commitment to sharing our success with our valued shareholders and reinforces our position as a leader in the industry.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)