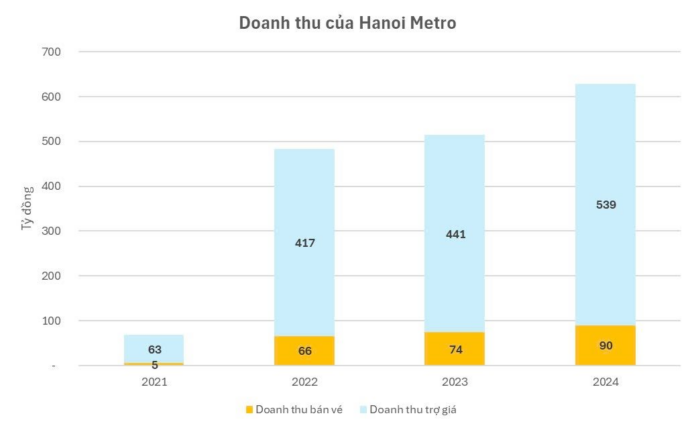

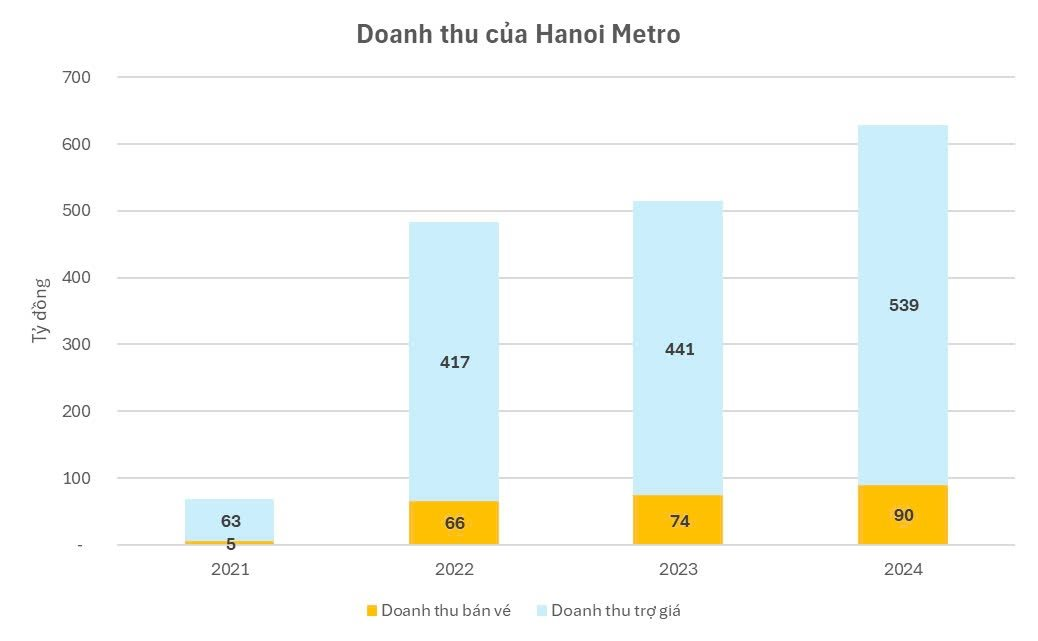

Hanoi Metro Company Limited (Hanoi Metro) – the operator of the Cat Linh-Ha Dong and Nhon-Hanoi metro lines, reported a 22% increase in revenue from sales and services in 2024, amounting to VND 629 billion.

Breakdown of this revenue stream reveals that VND 89.7 billion was generated from ticket sales, while the remaining VND 539.3 billion came from subsidies. These figures mark a respective 21.1% and 22.2% increase compared to the previous year, with the Nhon-Hanoi line officially commencing operations in August 2024.

This effectively means that for every VND 1 earned from ticket sales, Hanoi Metro received VND 6 in subsidies. As per the financial report, this subsidy arrangement is stipulated in the contract between the Hanoi Public Transport Operation and Management Center and the company.

Since the official launch of the Cat Linh-Ha Dong metro line in November 2021, Hanoi Metro’s revenue has consistently grown year over year.

With the Nhon-Hanoi metro line entering commercial operation on August 8, 2024, Hanoi Metro recorded a cost of sales and services of VND 138.5 billion for the remaining five months of the year. Meanwhile, the Cat Linh-Ha Dong line had a cost of sales and services of VND 472.4 billion, reflecting a 7% decrease from the previous year.

Combined, the total cost of sales and services for Hanoi Metro in 2024 stood at VND 611 billion, a 20% increase year-over-year.

Hanoi Metro’s financial report also revealed a pre-tax profit of VND 20 billion in 2024, representing a 22.7% increase from VND 16.4 billion in 2023. The company paid corporate income tax at a rate of 20% in 2024, amounting to VND 4.1 billion.

Additionally, the financial report disclosed that the compensation for key management personnel, including the Members’ Council (comprising 4 members: Khuat Viet Hung, Vu Hong Truong, Nguyen Van Ngoc, and Nguyen Trung Kien), the Supervisory Board (Dinh Thi Tu Anh), the Board of Directors and the Chief Accountant (Vu Hong Truong, Nguyen Van Ngoc, Le Ngoc Quang, and Le Thi Nhuan), totaled VND 1.9 billion.

Looking ahead, Hanoi Metro has set ambitious targets for 2025, aiming for a total revenue of VND 878.4 billion, reflecting a 40% increase from 2024. The company has also set goals for pre-tax and post-tax profits at VND 27 billion and VND 20.7 billion, respectively.

In terms of operational goals, Hanoi Metro aims to carry 19.3 million passengers with 159,732 train trips in 2025. Revenue from passenger transportation is expected to reach VND 111.5 billion, accounting for one-eighth of the total revenue.

The Cat Linh-Ha Dong metro line spans 13 km and comprises 12 elevated stations. Each train consists of 4 cars, accommodating 960 passengers, with a maximum speed of 80 km/h and an operating speed of 35 km/h. It takes 23 minutes to travel the entire line.

The Nhon-Hanoi metro line has a total length of 12.5 km, with an 8.5 km elevated section (Nhon-Cau Giay) and a 4 km underground section (Cau Giay-Hanoi Station). The trains have a maximum speed of 80 km/h and an average operating speed of 35 km/h, carrying approximately 950 passengers.

Unveiling the Ultimate Guide to Captivating Copy: “TOW Unveils Record-Breaking Dividends: A Historic Payout after Landmark Profits”

“In a move that will surely delight investors, the Tra Noc – O Mon Water Supply Joint Stock Company (TOW) has announced an extraordinarily generous cash dividend for 2024. Shareholders have every reason to rejoice as the company has declared a record-high dividend ratio. Mark your calendars, as May 29, 2025, is the crucial date for trading without entitlement to this dividend.”

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

“Sotrans CEO on the 54% Profit Growth Plan: What’s the Strategy?”

Despite aiming for over a 50% growth in after-tax profits in 2025, the leadership of Southern Logistics Joint Stock Company (Sotrans, HOSE: STG) believes that this is not an unrealistic expectation. This confidence is based on positive business signals since the beginning of the year and significant improvements in previously challenging operational areas.

The Industrial Real Estate Tycoons: A Profitable Start to the Year

In the first quarter of 2025, the industrial real estate giants continued to demonstrate robust growth. However, the April tax “shock” has prompted businesses to strategize meticulously for the year ahead.