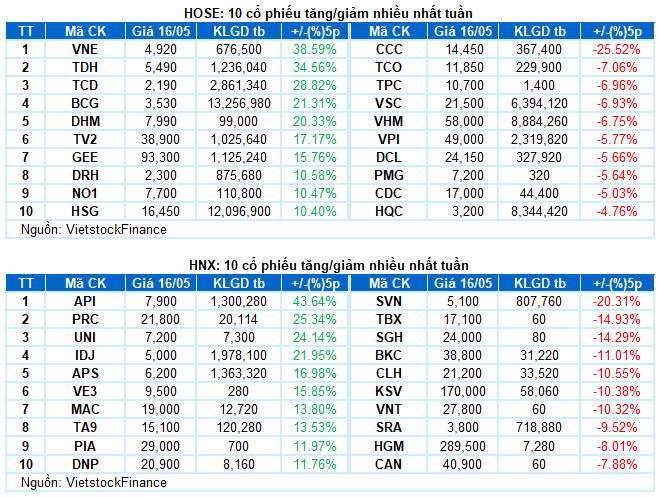

I. VIETNAMESE STOCK MARKET WEEK 12-16/05/2025

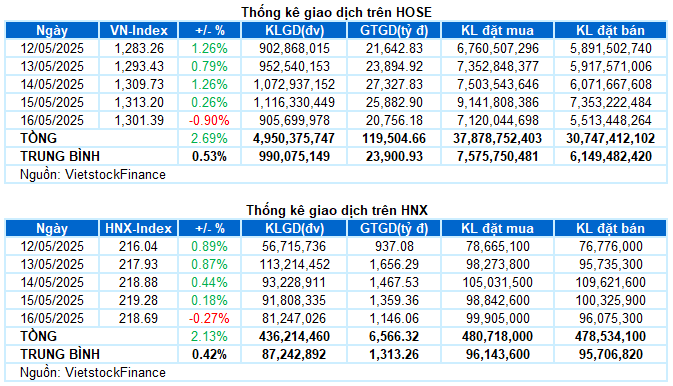

Trading: The main indices adjusted during the last trading session of the week. The VN-Index decreased by 0.9% from the previous session, ending the week at 1,301.39 points; HNX-Index retreated to 218.69 points, a 0.27% drop. However, for the whole week, the VN-Index still gained a total of 34.09 points (+2.69%), while the HNX-Index increased by 4.56 points (+2.13%).

The Vietnamese stock market closed the trading week with 4 out of 5 positive sessions. After positive news about the trade agreement between the US and China, buying demand returned strongly, helping the VN-Index continuously conquer important resistance thresholds. However, profit-taking pressure increased in the last session, pulling the index back to near the 1,300-point level. The VN-Index ended the week at 1,301.39 points.

In terms of impact, VCB, FPT, and BID were the main drags in the last session, taking away nearly 5 points from the VN-Index. On the other hand, VPL, GEE, and GEX retained more than 2 points for the index.

Most industry groups adjusted downwards in the last session. The information technology group ranked at the bottom with a drop of more than 3% due to strong selling pressure from the two leading stocks, FPT (-3.2%) and CMG (-3.18%). The financial group also put considerable pressure on the market as red dominated, notably with many stocks falling by more than 2%, including VCB, BID, VPB, STB, SSB, VIB, EIB, BVH, MSB, and NAB. In addition, the energy, materials, and consumer staples groups also lost more than 1%.

On the opposite side, non-essential consumer goods were a rare bright spot, thanks to the breakthrough of GEE, which hit the ceiling price, along with VPL (+3.38%), GEX (+3.71%), MSH (+1.59%), STK (+1.2%), etc. The real estate and utilities groups also maintained a slight gain thanks to VRE (+1.45%), VPI (+1.24%), TCH (+2.54%), DXG (+1.53%); GEG (+1.94%), NT2 (+2.17%), and PPC (+1.63%).

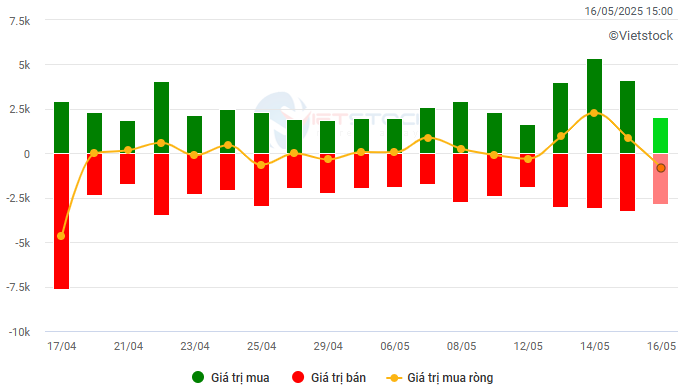

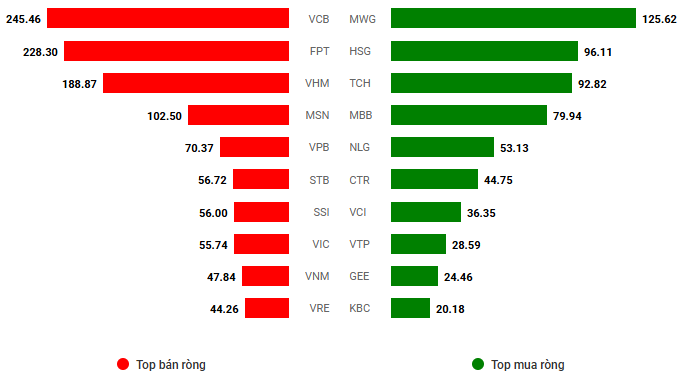

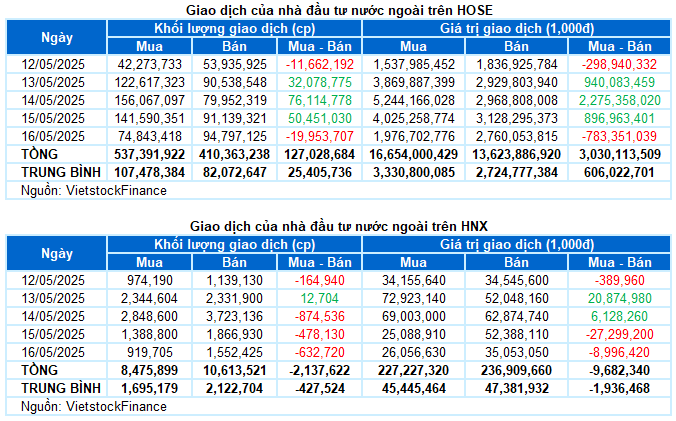

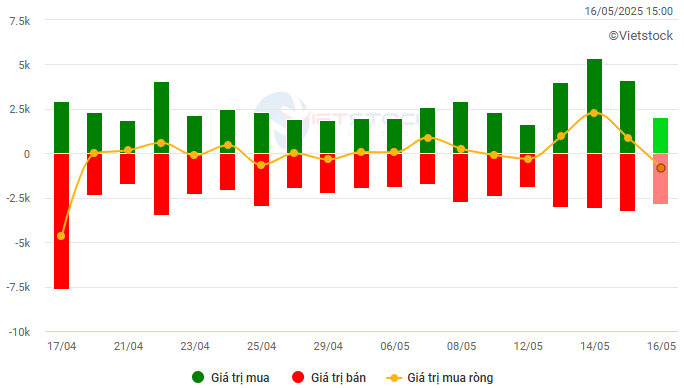

Foreign investors net bought over VND 3,020 billion on both exchanges during the week. Of which, they net bought more than VND 3,030 billion on the HOSE and net sold nearly VND 10 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

Stocks with outstanding performance last week: VNE

VNE increased by 38.59%: VNE witnessed a brilliant trading week with a gain of 38.59%. The stock continuously surged strongly with the appearance of the Rising Window candlestick pattern while surpassing the SMA 200-day average. In addition, trading volume surged strongly above the 20-day average, indicating strong participation of cash flow. In the coming time, if VNE continues to maintain its positive momentum, it is likely to advance towards the old peak of May 2024 (equivalent to the range of 5,600-5,850).

However, the Stochastic Oscillator indicator is heading deep into the overbought zone. Investors should be cautious in their investment decisions if this indicator shows a sell signal again.

Stocks with strong declines last week: TCO

TCO decreased by 7.06%: TCO stock faced quite negative selling pressure last week and dropped below the SMA 100-day average. In addition, trading volume remained below the 20-day average, reflecting the increasing caution of investors. Currently, the Stochastic Oscillator indicator continues to fall after giving a sell signal. If, in the coming sessions, the MACD indicator also shows a similar signal, the situation will become even more pessimistic.

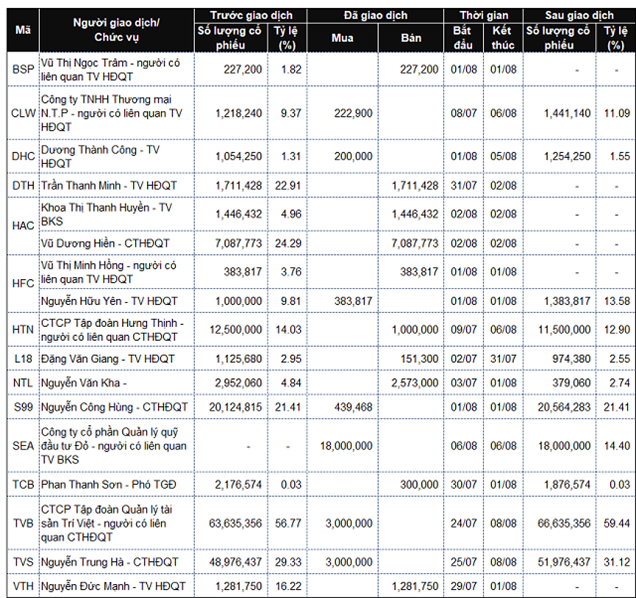

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic and Market Strategy Division, Vietstock Research Team

Has the Vietnamese Stock Market Ended its Three-Week Correction?

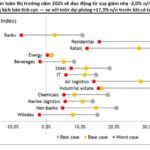

The VN-Index has staged a remarkable comeback, with losses from the 2025 peak narrowing to under 10% since the April 23 trading session. This marks the third consecutive year of growth for the index. In the aftermath of the 2025 tariff shock, over 1,000 stocks have rebounded from their lows, although the recovery has been uneven across sectors.

The Ultimate Guide to Banking Stocks: How G-Dragon’s Return to Vietnam Caused a Frenzy Among Foreign Investors

The surge in VPB stock occurred amidst a robust market recovery, with the benchmark VN-Index rallying past the 1,300-point mark.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)