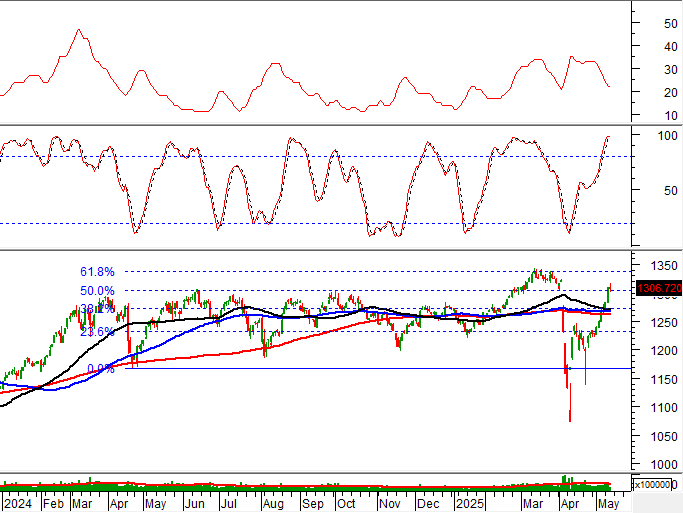

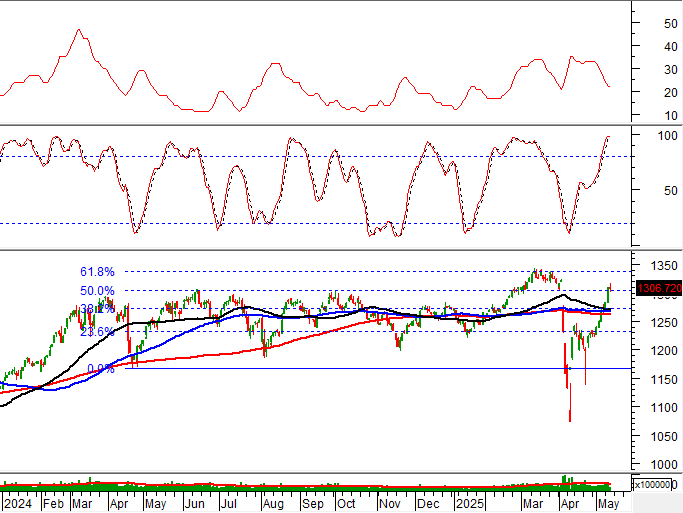

Technical Signals for VN-Index

In the trading session on the morning of May 15, 2025, the VN-Index declined, while trading volume showed a slight increase, indicating bearish investor sentiment.

Currently, the ADX indicator is showing signs of weakness and is moving within the gray area (20 < adx < 25).

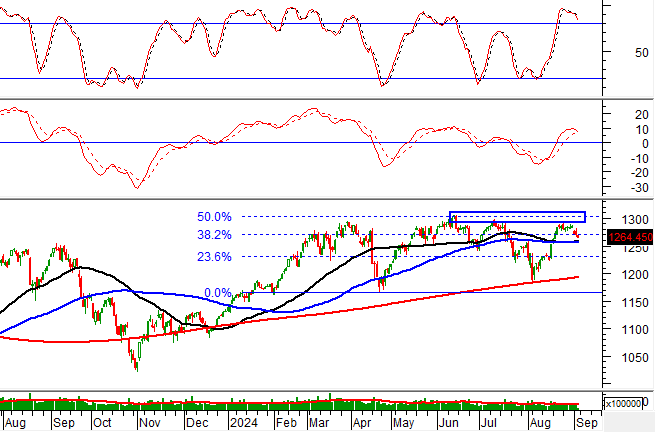

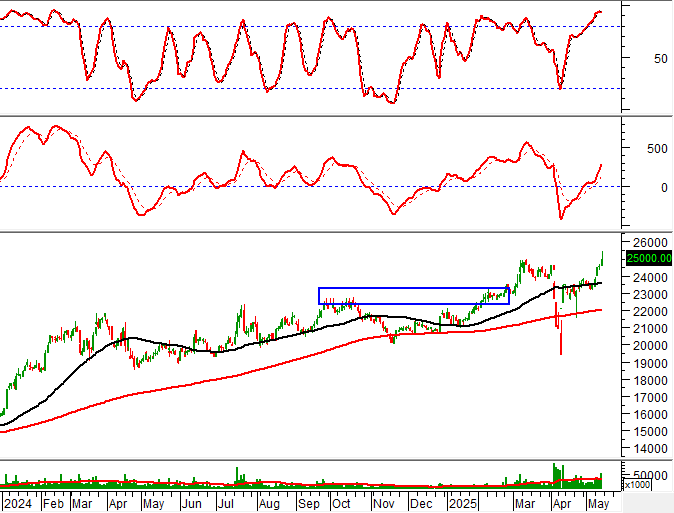

Technical Signals for HNX-Index

On May 15, 2025, the HNX-Index declined, and liquidity did not show any significant improvement in the morning session, indicating investor indecision.

In addition, the HNX-Index witnessed a death cross between the SMA 50-day and the group of SMA 100-day and SMA 200-day lines, suggesting that the mid- and long-term outlook is gradually weakening.

MBB – Military Commercial Joint Stock Bank

On the morning of May 15, 2025, MBB witnessed a price increase, along with a significant surge in trading volume, surpassing the 20-session average, indicating active trading by investors.

Currently, the stock price has reached a new 52-week high, while the MACD indicator continues to widen the gap with the Signal line after previously giving a buy signal, further reinforcing the long-term upward trend of the stock.

VRE – Vincom Retail JSC

On May 15, 2025, VRE witnessed a sharp decline and formed a Black Marubozu candlestick pattern, with trading volume exceeding the 20-session average, indicating bearish investor sentiment.

Additionally, the stock price returned to test the Fibonacci Retracement 23.6% threshold (corresponding to the 22,500-24,000 region) while the Stochastic Oscillator indicator gave a sell signal in the overbought region. If the sell signal is maintained and the price falls below this level, the risk of correction will increase in the coming sessions.

Technical Analysis Department, Vietstock Consulting

– 12:03, May 15, 2025

Stock Market Update for Week of May 12-16, 2025: Pausing the Uptrend

The VN-Index ended the week on a negative note, halting its four-day winning streak. In the coming weeks, the index is likely to face challenges as volatility persists around the 1,300-point mark. If the index can hold firm above this threshold and foreign investors maintain their net buying trend, the short-term uptrend is expected to continue.

Has the Vietnamese Stock Market Ended its Three-Week Correction?

The VN-Index has staged a remarkable comeback, with losses from the 2025 peak narrowing to under 10% since the April 23 trading session. This marks the third consecutive year of growth for the index. In the aftermath of the 2025 tariff shock, over 1,000 stocks have rebounded from their lows, although the recovery has been uneven across sectors.

The Ultimate Guide to Banking Stocks: How G-Dragon’s Return to Vietnam Caused a Frenzy Among Foreign Investors

The surge in VPB stock occurred amidst a robust market recovery, with the benchmark VN-Index rallying past the 1,300-point mark.