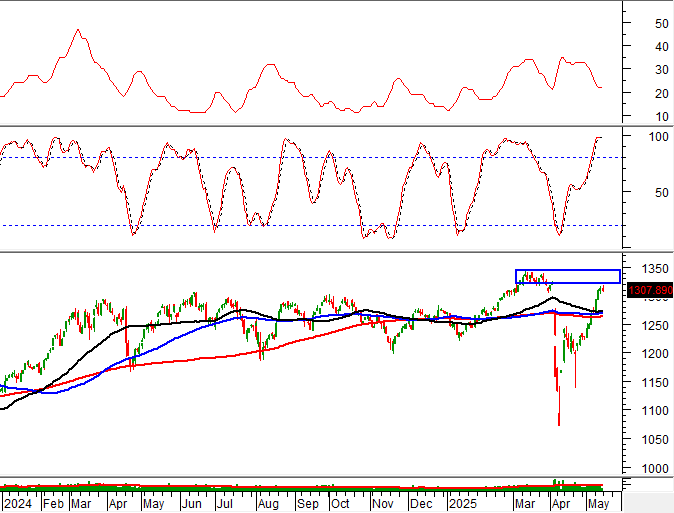

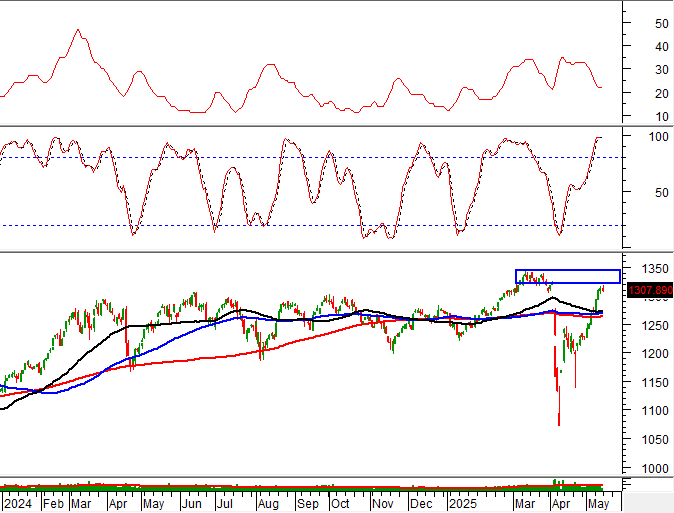

Technical Signals for VN-Index

During the morning trading session of May 16, 2025, the VN-Index witnessed a decline, accompanied by a significant drop in trading volume. This cautious sentiment among investors was evident in the market.

Additionally, the VN-Index is approaching a re-test of the March 2025 high (equivalent to the 1,320-1,345 point region) as the ADX indicator traverses the gray area (20 < adx < 25).

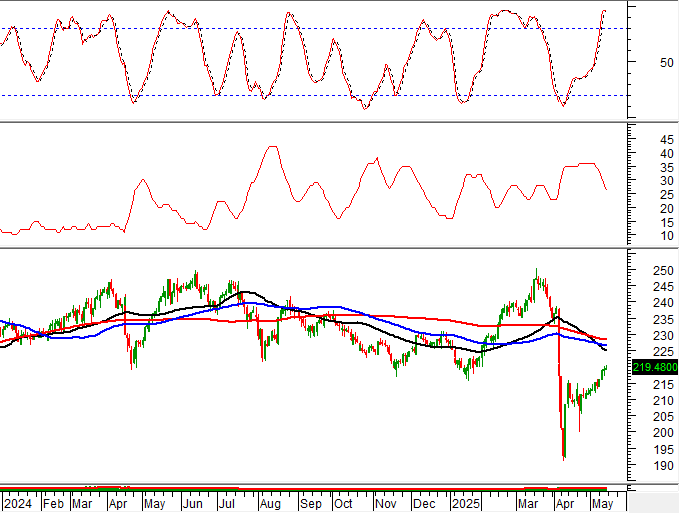

Technical Signals for HNX-Index

On May 16, 2025, the HNX-Index experienced an increase, coupled with a slight dip in liquidity during the morning session, indicating investors’ cautious approach to trading.

Presently, the HNX-Index exhibits a ‘Death Cross’ formation, where the SMA 50-day line intersects with the SMA 100-day and SMA 200-day lines, suggesting that the mid-to-long-term outlook is gradually losing its luster.

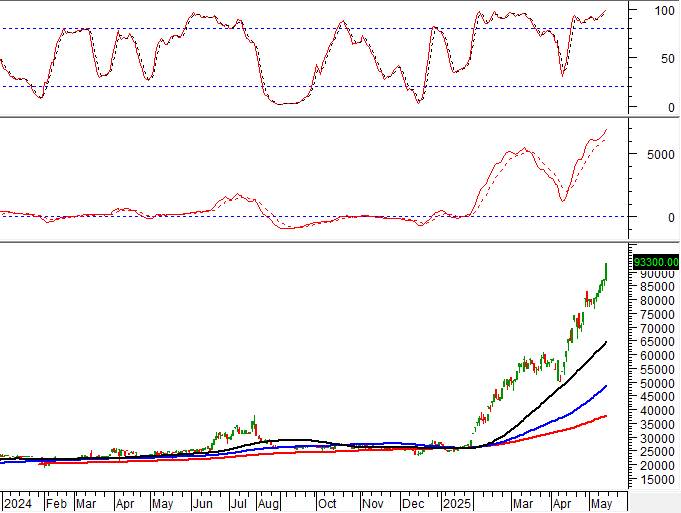

GEE – Gelex Electricity Joint Stock Company

On the morning of May 16, 2025, GEE witnessed a dramatic surge, forming a White Marubozu candlestick pattern, and trading volume surpassed the 20-session average, indicating vibrant investor activity.

Furthermore, the stock price consistently forms higher highs and higher lows, and the MACD indicator continues its upward trajectory after generating a prior buy signal, reinforcing the bullish long-term outlook for the stock.

HSG – Hoa Sen Group Joint Stock Company

During the morning session of May 16, 2025, HSG witnessed a price increase, accompanied by a substantial rise in trading volume, which is expected to surpass the 20-day average by the session’s end, reflecting investors’ optimistic sentiment.

On another note, the stock price closely follows the upper band of the Bollinger Bands, and the MACD indicator maintains its upward trajectory after a previous buy signal, suggesting that the short-term recovery may extend into the upcoming sessions.

Technical Analysis Team, Vietstock Consulting

– 12:04, May 16, 2025

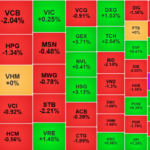

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

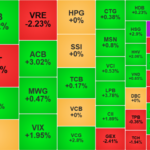

The Flow of Foreign Capital Continues: VN30-Index Peaks at a 3-Year High During Derivatives Expiry

The foreign bloc ramped up selling in the afternoon session, with notable dumps in VHM and VRE. Despite this, buyers remained robust, resulting in a net position of nearly VND 236 billion. This pushed the overall net buying for the day to VND 919 billion, with approximately VND 656 billion worth of stocks in the VN30 basket being snapped up.

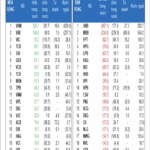

The Foreign Block: A Surprising Sell-Off of Nearly VND 1,000 Billion, With Personal Investors Holding Steady

The foreign bloc reversed course and locked in profits after a record-breaking buying spree. Today, they offloaded 970.7 billion VND, with a net sell-off of 771.4 billion VND in matched orders alone.