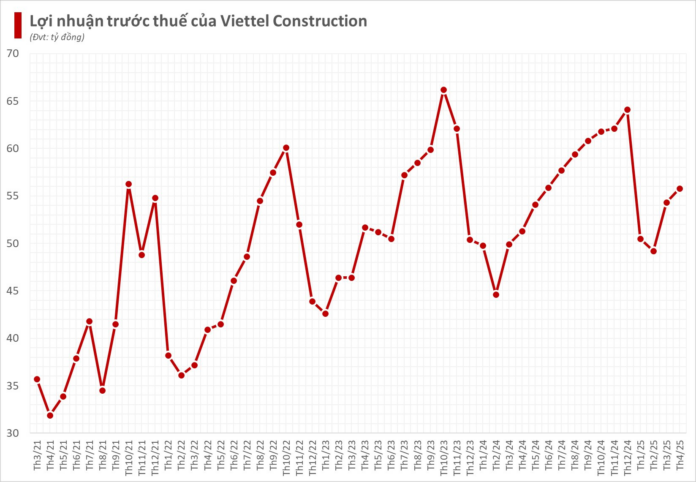

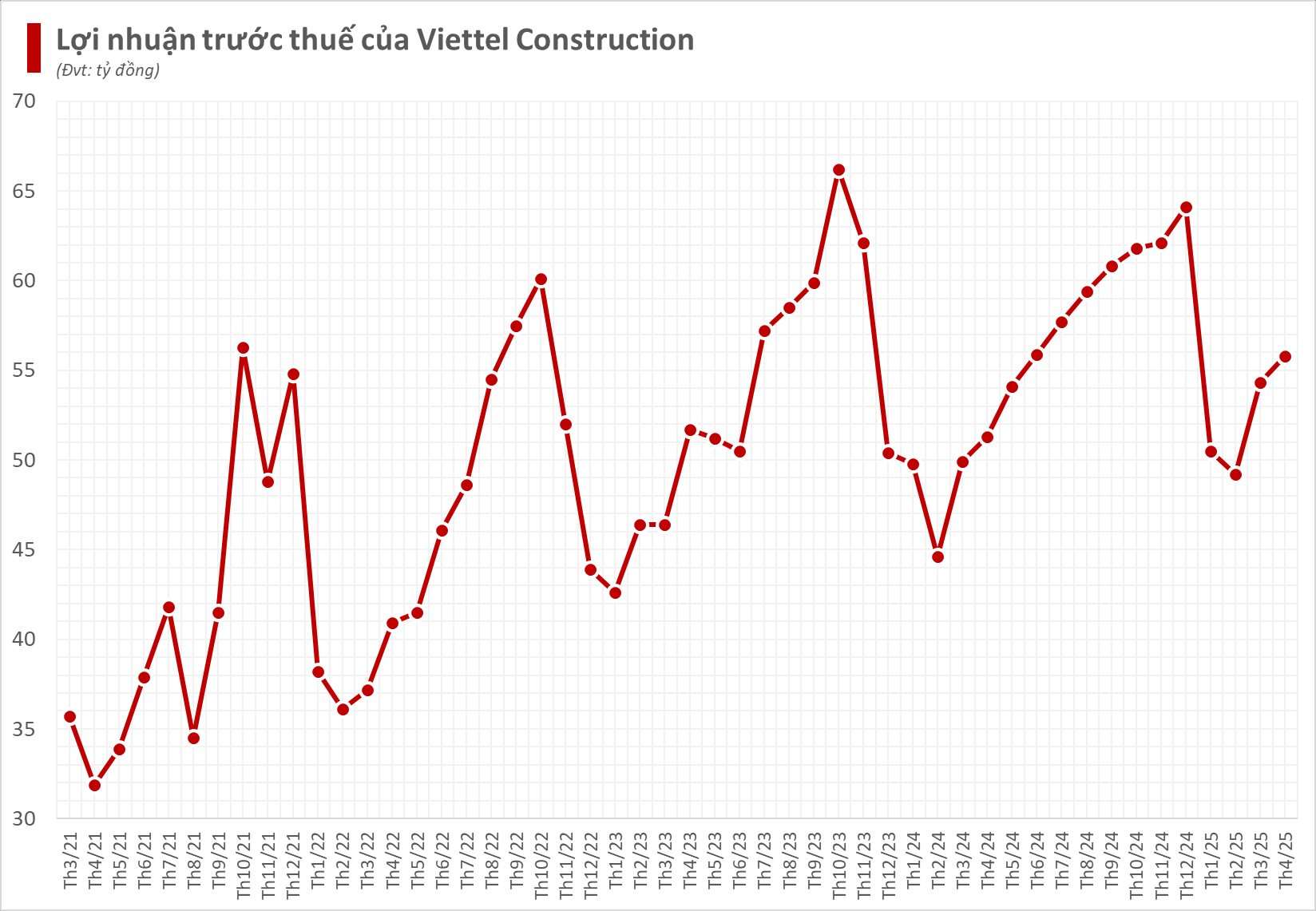

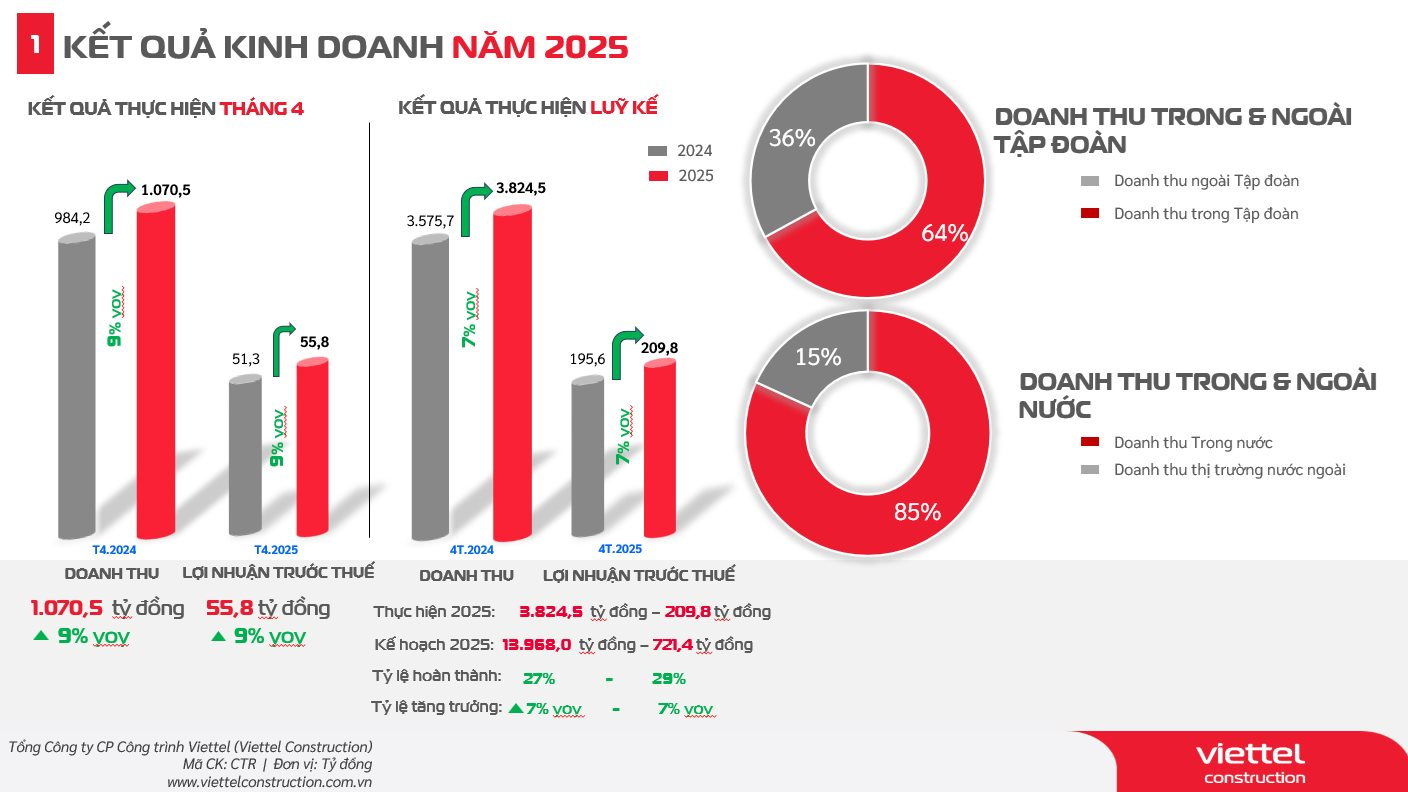

Viettel Construction JSC (Viettel Construction – code: CTR) has announced its business results for April 2025, with revenue reaching VND 1,070.5 billion, a 9% increase compared to the same period in 2024. Notably, off-group revenue reached VND 384.2 billion, a 7% year-on-year increase. Profit before tax reached VND 55.8 billion, marking the second consecutive month of growth.

For the first four months of the year, Viettel Construction recorded a revenue of VND 3,824.5 billion, a 7% increase, and a profit before tax of VND 209.8 billion, a 7% increase. With these results, the company has achieved approximately 29% of its full-year plan.

In 2025, Viettel Construction set ambitious business targets, aiming for a revenue of VND 13,968 billion and a profit before tax of VND 721.4 billion, representing a 10.3% and 6.7% increase, respectively, compared to the previous year. If these goals are met, the company will break its profit record set last year.

Viettel Construction is renowned as Vietnam’s leading TowerCo. As of the end of April 2025, the company owned 10,470 BTS stations, 2.45 million m2 of DAS, 2,716 km of transmission lines, and 16.92 MWp of solar power. A total of 350 BTS stations are shared by more than two telecom operators, resulting in a sharing ratio of 1.03.

In the Operations and Maintenance division, Viettel Construction ensured network quality and safety to support the production and business activities of the Viettel Group. The company successfully signed two maintenance contracts for antenna systems for army posts/border stations in Tra Vinh and repaired and maintained security and traffic cameras in Ninh Thuan. It also maintained 100% network KPIs and handled transmission incidents for Mytel (Myanmar), Metfone (Cambodia), and other TowerCos.

In the Construction division, the B2B project portfolio reached VND 73.8 billion. The company continued to expand its strategic partnerships with prominent entities such as Tran Anh Group, Sun Group, and BGI Group, undertaking notable projects like land leveling in CN3, Hung Phu Industrial Park, and the construction of the Sale Galary Complex.

Regarding the B2C&SME projects, the portfolio reached VND 188.2 billion (B2C: VND 15.9 billion; SME: VND 172.3 billion). Viettel Construction’s construction projects covered 698 out of 701 districts (equivalent to 99%) and 2,974 out of 10,609 communes (approximately 28%) in Vietnam.

In the Integrated Solutions division, Viettel Construction signed contracts and implemented solar power systems for 501 businesses and households in April, with a total capacity of 10.8 MWp and a value of approximately VND 108 billion. The company also secured 10 contracts for elevator implementation, totaling 30 contracts with a revenue of about VND 10.3 billion by the end of April.

In the Technical Services division, Viettel Construction signed two contracts for the operation and maintenance of solar power systems for two prominent partners: Yamaha Factory and BCG Group.

On the stock market, CTR shares closed at VND 96,000 per share on May 15, corresponding to a market capitalization of over VND 11,000 billion.

The Booming Agri-Business Mogul of Long An: A Sudden Surge in Profits, Surpassing Industry Giants

GreenFeed witnessed a remarkable surge in its financial performance, recording an impressive after-tax profit of over 2,106 billion VND in 2024, marking a substantial 382% increase compared to the previous year. This unprecedented achievement sets a new record for the company, highlighting its exceptional growth and success.

The Ultimate Windfall: Unveiling the Secrets Behind a Vietnamese Company’s Stellar Performance with a 444% Surge in Q1 Profits, Positioning Itself as a Global Leader in the Highly Coveted Mineral Industry.

“With this latest announcement, the total cash dividend for 2024 amounts to an impressive 138% (VND 13,800 per share), marking a historic high for the company. This unprecedented payout underscores our commitment to sharing our success with our valued shareholders and reinforces our position as a leader in the industry.”