Illustrative image

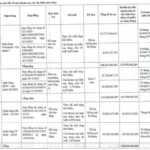

Asia Commercial Joint Stock Bank (ACB – Code: ACB) recently announced that May 26, 2025, is the record date for the 2024 cash and stock dividend. The ex-dividend date is May 23, 2025.

Accordingly, ACB shareholders will receive a cash dividend at a rate of 10% (one share receives VND 1,000). The amount ACB plans to use for dividend payment is VND 4,467 billion. Dividends will be paid on June 5, 2025.

For the stock dividend component, ACB plans to pay a dividend at a rate of 15% (an owner of 100 shares will receive 15 new shares). The timing of the stock dividend payment has not been announced.

Previously, Loc Phat Joint Stock Commercial Bank (LPBank – Code: LPB) announced that May 20, 2025, is the record date for cash dividend payment with a rate of 25% (one share receives VND 2,500). The ex-dividend date is May 19, 2025.

With the expected dividend payment amount of over VND 7,468 billion, LPBank is the bank with the highest cash dividend payment in the Vietnamese banking system in terms of both payment rate and scale. Dividends will be paid on May 28.

Vietnam Prosperity Joint Stock Commercial Bank (VPBank – Code: VPB) also announced that May 16, 2025, is the record date for cash dividend entitlement. The ex-dividend date is May 15, 2025.

Dividends will be paid on May 23. With a payout ratio of 5% par value (VND 500/share), the amount VPBank plans to use for dividend payment is VND 3,967 billion.

In addition to the above-mentioned banks, a number of other banks have also approved dividend payment plans for 2025 but have not yet announced the record date.

The State Bank of Vietnam has also approved Vietnam International Commercial Joint Stock Bank (VIB – Code: VIB) to increase its charter capital by a maximum of nearly VND 4,249 billion in the form of share issuance to existing shareholders and ESOP issuance.

Therefore, it is likely that VIB will soon issue shares to pay dividends to shareholders in the near future. As planned, VIB expects to issue nearly 417.1 million shares to existing shareholders, equivalent to a rate of 14%, increasing its charter capital by nearly VND 4,171 billion.

At the 2025 Annual General Meeting of Military Commercial Joint Stock Bank (MB), a dividend payout ratio of 35% was approved, including 3% in cash and 32% in shares.

Saigon – Hanoi Commercial Joint Stock Bank (SHB) also plans to distribute dividends with a total ratio of 18%, including 5% in cash and 13% in shares.

Orient Commercial Joint Stock Bank (OCB) has approved a cash dividend payout ratio of 7% of charter capital, equivalent to VND 1,726 billion. At the same time, the bank will issue bonus shares at a ratio of 8% of charter capital this year.

Vietnam Maritime Commercial Joint Stock Bank (MSB) was approved by the 2025 Annual General Meeting to pay dividends in shares at a rate of 20%. Accordingly, MSB plans to issue a maximum of 520 million shares to existing shareholders as dividends.

Nam A Commercial Joint Stock Bank (Nam A Bank) also plans to issue an additional 343.1 million shares as dividends, equivalent to a ratio of 25%.

Unlocking Shareholder Value: Mirae Asset Sets Date to Release Nearly VND 520 Billion in Dividends to Common Shareholders.

Mirae Asset Securities (Vietnam) JSC is planning an extraordinary general meeting in 2025 to approve a cash dividend payout for common shareholders for the year 2023, amounting to approximately VND 520 billion. The record date for shareholders entitled to this dividend is June 4th, with an expected payment date of July 7th.

Revolutionizing Travel Experiences: Vietravel’s Strategic Fundraising Endeavor to Settle Outstanding Debts

On May 7, Vietravel, a leading travel and transportation marketing company in Vietnam, announced its plans to offer nearly 28.7 million shares to the public. The company, traded on the UPCoM exchange under the ticker symbol VTR, aims to raise approximately VND 344 billion to repay its bank loans.

The Chairman of Hoa Phat Group is Planning to Transfer HPG Shares Worth $9.5 Million to Family Members

Hòa Phát has recently unveiled its plans for a 20% stock dividend, as per the latest Board of Management resolution. This development marks a strategic move by the company, offering a detailed roadmap for executing the 2024 dividend policy. Shareholders can anticipate the distribution of these dividends in the upcoming month of May.

“SHS Distributes 81.3 Million Shares as 2023 Dividend Payout and Capital Increase”

SHS has successfully distributed 81.3 million shares as a 2023 dividend payout and has increased its charter capital from equity. This move has resulted in a substantial boost to the company’s authorized capital, which now stands at VND 8,944.6 billion.