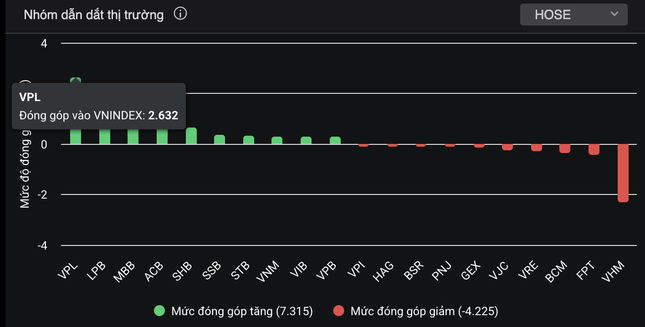

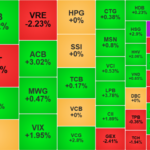

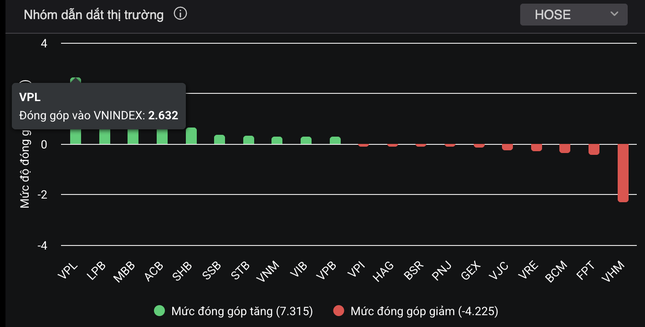

The VN-Index successfully surpassed the 1,300-point mark and continued its upward momentum today (May 15th). However, the gain was modest, with a mere 3-point increase, largely attributed to Vinpearl’s VPL soaring to the daily limit, contributing over 2.6 points to the VN-Index. In contrast, Vinhomes led the group with a negative impact on the index, as VHM dropped by 4% to 58,000 VND per unit. VIC, on the other hand, closed at the reference price.

Today’s trading dynamics.

Meanwhile, many large-cap stocks lost steam, leading to a clear market divergence. While the banking group witnessed vibrant trading, with SHB taking the lead among its peers, surging 5.4% to 13,700 VND per share. Over 167 million shares changed hands. A slew of other bank stocks witnessed gains ranging from 2-3%, including LPB, ACB, VIB, and MBB. In addition to domestic capital, the banking group also benefited from strong foreign investment inflows.

SHB’s counterpart, Hanoi-based Saigon Securities Incorporation (SSI), witnessed a 2.34% increase, closing at 13,100 VND per share – the highest level in the past seven months. This upward movement comes amidst new developments surrounding the proposed high-speed North-South railway project, which has positively impacted construction and contractor stocks. However, their influence on the broader market remained limited due to their smaller market capitalization and liquidity.

Yuanta Securities Vietnam (YSVN) attributed the potential for substantial contract work for construction firms, given the project’s substantial investment requirements. While the main contracts and consulting roles might go to foreign companies, local contractors could secure subcontracting opportunities.

At the market close, the VN-Index climbed 3.47 points (0.26%) to 1,313.2 points. The HNX-Index gained 0.4 points (0.18%) to reach 219.28 points, while the UPCoM-Index rose 0.65 points (0.69%) to 95.54 points. Foreign investors continued net buying, although the scale decreased compared to the previous record session. Net buying value reached VND 895 billion, focusing on MBB, SHB, FPT, MWG, and VPB.

The Great Bank Code “Flush”

The proprietary trading arms of securities companies offloaded a net sell value of VND1.92 trillion on the Ho Chi Minh Stock Exchange (HoSE).

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

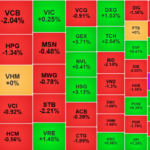

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

The Flow of Foreign Capital Continues: VN30-Index Peaks at a 3-Year High During Derivatives Expiry

The foreign bloc ramped up selling in the afternoon session, with notable dumps in VHM and VRE. Despite this, buyers remained robust, resulting in a net position of nearly VND 236 billion. This pushed the overall net buying for the day to VND 919 billion, with approximately VND 656 billion worth of stocks in the VN30 basket being snapped up.