Banks Slash USD Rates

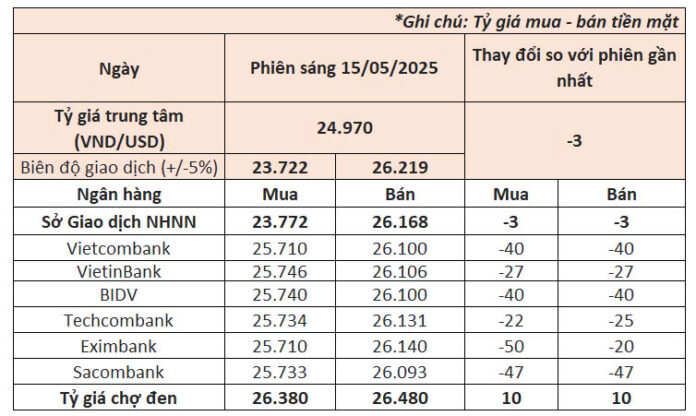

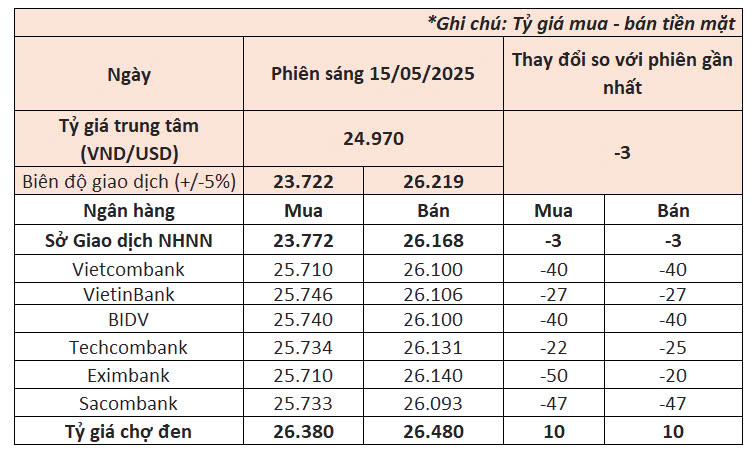

Today, May 15th, the State Bank of Vietnam set the daily reference exchange rate at 24,970 VND/USD, a decrease of 3 VND from the previous day’s listing.

With a 5% fluctuation band, the ceiling and floor rates that commercial banks are allowed to trade are 23,722 VND/USD and 26,219 VND/USD, respectively.

The buying and selling rates were also adjusted downward by the State Bank of Vietnam’s Trading Centre to 23,772 VND/USD and 26,168 VND/USD, respectively.

This morning, commercial banks simultaneously lowered their USD rates, with more significant adjustments compared to previous sessions.

Vietcombank, the largest currency trader in the system, listed the buying rate at 25,710 VND/USD and the selling rate at 26,100 VND/USD as of 9:00 am, a reduction of 40 VND for both rates compared to the previous day.

VietinBank and BIDV also followed suit, decreasing their rates by 27 VND and 40 VND, respectively, for both buying and selling.

In the group of private banks, Techcombank lowered its buying rate by 22 VND and its selling rate by 25 VND. Sacombank reduced its rates by 47 VND for both buying and selling, while Eximbank decreased its buying rate by 50 VND and its selling rate by 20 VND.

In the interbank market, the exchange rate ended the May 14th session at 25,920 VND/USD, a significant drop of 42 VND from the previous day’s rate of 26,062 VND/USD.

Contrary to the official market, the black market rate for USD showed an upward trend. A survey at 9:00 am today revealed that the buying and selling rates were 26,380 VND/USD and 26,480 VND/USD, respectively, an increase of 10 VND from the previous day’s rates.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, hovered around 100.8 points, slightly lower than the previous day’s close.

The DXY started the week with a gain of over 1% on Monday and hit a one-month high as the US and China reached a temporary agreement to cut tariffs, easing concerns about a potential global recession due to the trade war between the world’s two largest economies.

However, the greenback retreated after the US consumer price index for April fell short of economists’ expectations.

Since late April, the US dollar has been recovering against other major currencies as trade tensions between the US and China eased.

Currently, the US dollar remains nearly 3% lower than its level on April 2nd when President Donald Trump first announced tariffs, triggering a foreign investor exodus from US stocks and bonds.

Gold Prices Tumble by 2-2.5 million VND per tael

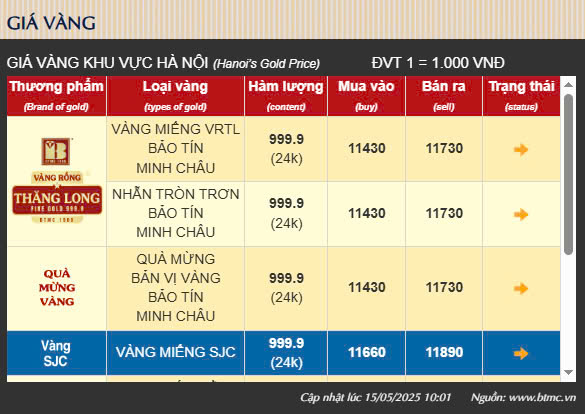

Gold bar prices at major gold shops dropped sharply this morning from the previous day’s close.

At 10:30 am, gold bars at Bao Tin Minh Chau, PNJ, SJC, and DOJI were all adjusted downward to the buying and selling range of 116.6-118.9 million VND per tael, a decrease of 1.1 million VND per tael for both buying and selling compared to the previous trading session.

Gold ring prices also witnessed a similar decline. Currently, gold rings are listed at 111-114 million VND per tael at SJC, PNJ, and DOJI, with the buying rate dropping by 1.5 million VND per tael and the selling rate falling by 1 million VND per tael.

Bao Tin Minh Chau listed their rates at 114.3-117.3 million VND per tael, a decrease of 1.2 million VND for both buying and selling.

By 2:30 pm, gold rings and gold bars continued their steep decline. The gold bar prices at these enterprises dropped further to 115.5-118 million VND per tael, a decrease of about 2 million VND compared to the previous day’s close.

At Bao Tin Minh Chau, gold ring prices were listed at 113-116 million VND per tael, a reduction of 1.3 million VND per tael from the morning session and a drop of 2.5 million VND per tael from the previous day’s close.

DOJI, PNJ, and SJC listed their rates at 110.5-113.5 million VND per tael, a decrease of 500,000 VND from the morning survey and a 2 million VND drop from the previous day’s close.

The decline in domestic gold prices occurred as international gold prices plunged following the easing of trade tensions between the US and China, which alleviated concerns about a potential global economic recession. This shift in sentiment encouraged investors to embrace riskier assets, diminishing the appeal of gold as a safe-haven investment.

The Golden Rush: Gold Prices Plummet, SJC Gold Down by 3 Million VND per Tael

As of this morning, gold ring prices have taken a significant dip, with a maximum drop of 3 million VND per tael. Several gold trading businesses have lowered their buying prices below the 110 million VND per tael mark.

The Golden Outlook: Unveiling the World Gold Council’s Insights on the Year-End Gold Market Trends

The World Gold Council offers insightful recommendations for gold investors, delving into the factors influencing gold prices for the remainder of the year. This insightful analysis provides a strategic outlook for those navigating the precious metal market, offering a glimpse into the potential future of gold investments.