As of Q1 2025, credit growth reached 3.93%, 2.5 times higher than the 1.42% of the same period last year. This is a result of the banking industry’s efforts to continue reducing lending rates to boost credit demand for production, business, and consumption, meeting the economic growth target for 2025.

However, deposit rates are still being kept low to create room for further lending rate cuts while remaining attractive enough to retain depositors. This puts significant pressure on commercial banks, especially affecting NIM, making the equation of maintaining profit growth even more challenging.

Banks navigate the NIM decline vortex

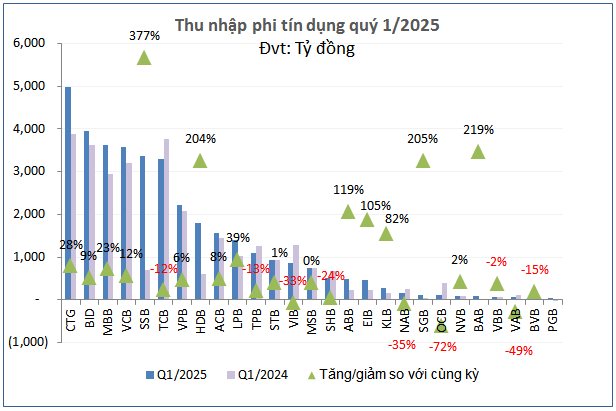

Facing the pressure of declining net interest margin (NIM), banks have no choice but to focus on exploiting non-credit income – a crucial factor in maintaining profit growth in the first quarter.

Source: VietstockFinance

|

Source: VietstockFinance

|

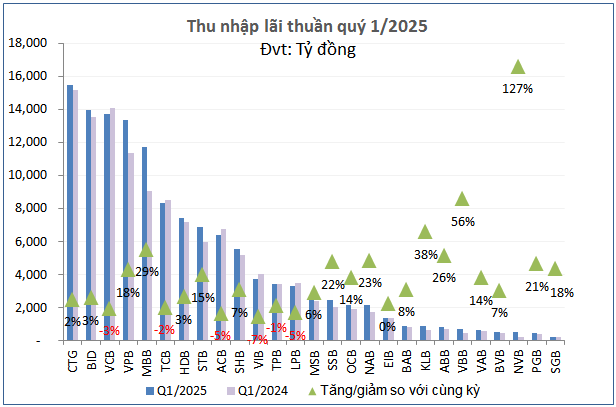

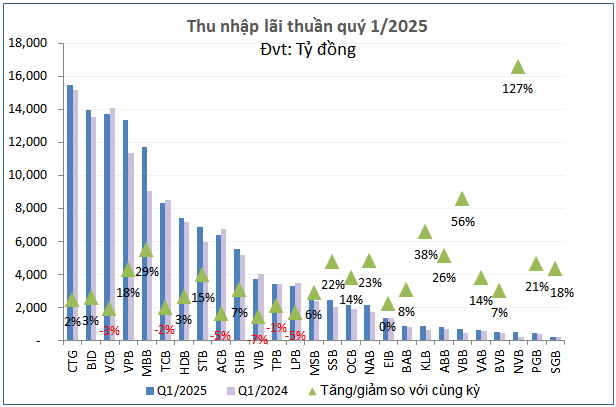

According to data from VietstockFinance, 27 banks reported net interest income of VND 129,179 billion, up 7% over the same period last year, lower than the 11% growth in the previous quarter. Notably, non-credit income increased by 21% to VND 35,941 billion. The main drivers were profits from securities trading (up 17%), net income from other activities (2.5 times), and income from capital contributions and stock purchases (13.3 times).

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

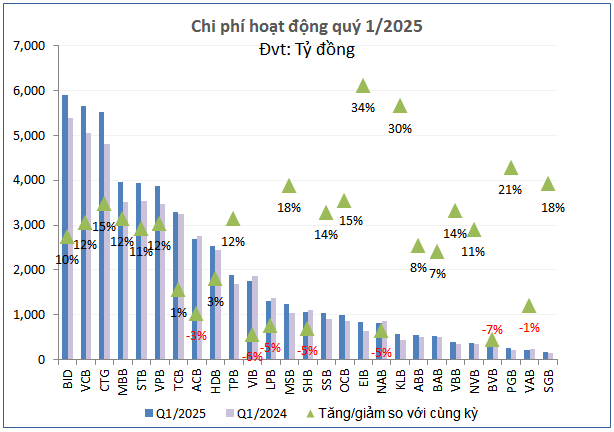

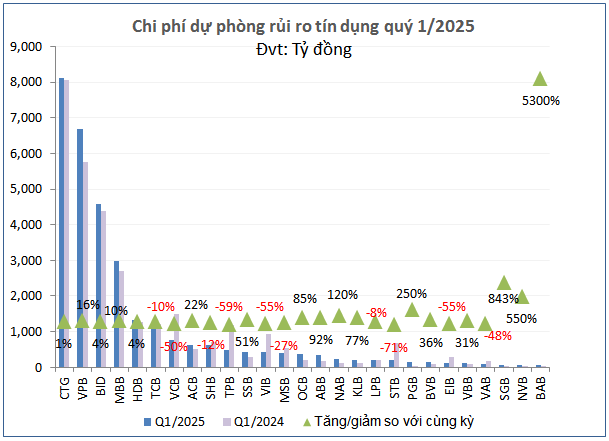

Total operating expenses increased by 8% to VND 51,724 billion, resulting in a net profit from business operations of VND 113,397 billion, up 10% over the same period. At the same time, risk provision expenses were well controlled, maintained at VND 30,863 billion (down slightly by 1%), thereby helping pre-tax profit of the industry grow by 14%, reaching VND 82,531 billion.

Source: VietstockFinance

|

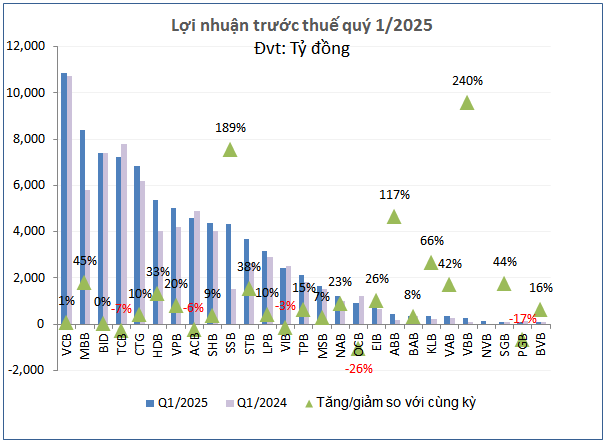

In the context of the entire banking industry facing NIM compression, pre-tax profits in Q1/2025 of the banks showed a clear differentiation. Most banks still increased profits thanks to higher net interest income as credit growth accelerated compared to the same period last year. Some banks recorded profit declines due to net interest income or risk provision.

For example, PGB reduced profits due to higher risk provision expenses. Meanwhile, VIB, ACB, and TCB all recorded pre-tax profits “downshift” by 3%, 6%, and 7%, respectively, due to lower net interest income than the same period.

Notably, VCB and LPB maintained profit growth despite lower net interest income. For VCB, the reason was a significant reduction in risk provision expenses, which were half of the same period. LPB had a sudden profit from other activities, 16.1 times higher than in Q1/2024.

Vietbank (VBB) was the bank with the highest profit growth in Q1/2025, reaching VND 248 billion, 3.4 times higher than the same period. This result was mainly due to a 56% surge in net interest income to VND 703 billion, while non-credit income decreased slightly by 2%. Operating expenses increased by 14% to VND 398 billion, and risk provision expenses for credit increased by 31% to VND 118 billion.

According to Vietbank’s explanation, the growth momentum came from the expansion of core business scale. Specifically, customer lending in Q1 increased by 3.91% – much higher than the 0.9% of the same period last year – helping to significantly improve net interest income from the beginning of the year.

Ranking second in profit growth was SeABank (SSB) with pre-tax profit in Q1 reaching VND 4,350 billion, 2.9 times higher than the previous year. This result was not only due to the growth of the main income but also thanks to the transfer of Post and Telecommunications Finance Company Limited (PTF) to AEON Financial Service, which was completed in Q1/2025, helping the bank record a sudden income from capital contribution and stock purchase of up to VND 2,607 billion – 217.3 times higher than the same period – making an important contribution to the profit in the first quarter. Thanks to this, SeABank has entered the top 10 most profitable banks in the quarter.

Q1 profit surprise: MBB temporarily surpasses 2 state-owned giants

Source: VietstockFinance

|

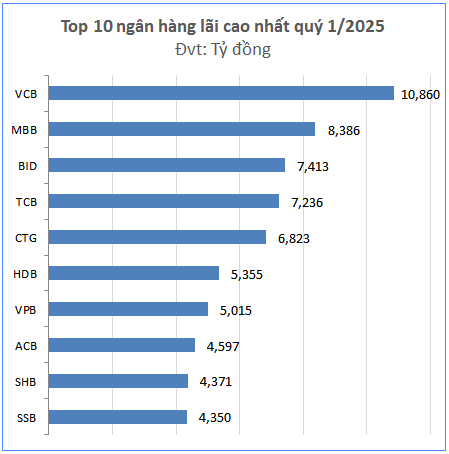

The focus of the banking industry’s profit race in Q1/2025 was the impressive sprint of MBB. With a profit growth of 45% over the same period, MBB jumped from 5th place last year to the runner-up position in pre-tax profit in the first quarter of this year.

Notably, MBB surpassed 2 state-owned banks, BIDV and VietinBank, with a profit margin of VND 973 billion and VND 1,563 billion, respectively.

Bank pioneering to reach nearly 70% of the year plan after Q1

Source: VietstockFinance

|

Except for the “Big 4” group, which has not announced its 2025 profit plan, most of the remaining banks set pre-tax profit targets higher than the results achieved in 2024.

Source: VietstockFinance

|

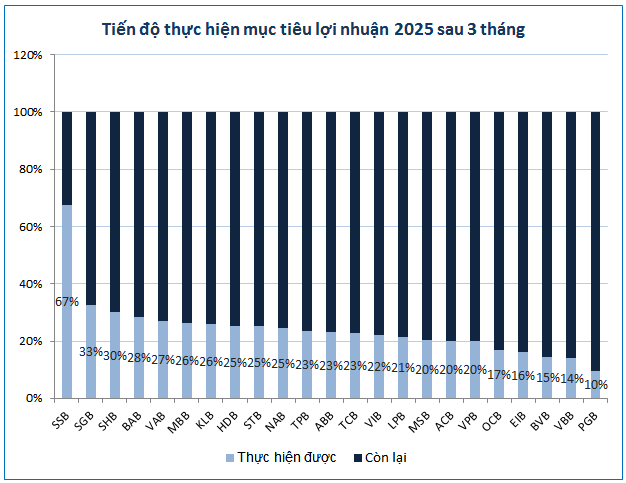

Notably, SeABank surprised the market by being the first bank to approach its full-year target, with a completion rate of up to 67% after the first quarter.

The progress of the remaining banks in implementing the plan is relatively even, ranging from 20% to 33%. Meanwhile, PGB is having a slow start, with only 10% of the year’s target completed.

NIM reduction but still many “bright spots”?

According to experts from ACB Securities Company (ACBS), the net interest margin (NIM) is under pressure due to fierce competition among banks to boost credit growth. However, the real estate market recovery and the government’s policy to promote public investment are expected to stimulate credit demand in the second half of 2025, thereby supporting lending rates and improving bank profit margins.

Meanwhile, Goutai Junan Securities Company (Vietnam) believes that while bank profits continue to be pressured by declining NIM, this will be offset by higher profitability in potential segments such as mortgage and consumer lending… There is also room for improvement in the lending rate as some preferential programs end, allowing banks to widen their profit margins.

In addition, non-interest income such as service fees, investment, and bad debt processing are expected to continue to grow. Especially if bad debts peak this year as expected, the pressure of risk provision will decrease, contributing to profit improvement. At the same time, digitization is helping banks improve operational efficiency, thereby reducing the cost-to-income ratio (CIR).

Experts from MBS Securities Company (MBS) have also adjusted down their forecast of net interest income for banks due to difficulties in improving the net interest margin (NIM), despite the expectation of accelerating credit growth in 2025. According to MBS, lending rates are likely to remain low this year to support borrowers in the context of fierce competition in promoting credit growth.

On the other hand, the deposit rate is expected to inch up slightly as credit growth outpaces deposit growth, forcing banks to raise deposit rates to ensure liquidity.

Regarding non-interest income, MBS expects this segment to grow strongly in 2025. The rapid expansion of retail credit improves fee efficiency, while the low-interest rate environment encourages banks to expand investment activities, including securities and other financial products. Most non-interest income will come from payment fees, card services, and notably bad debt collection – a factor that can create more room for asset quality improvement and profit increase for banks.

– 12:00 15/05/2025

Bad Debt Rises: Bank’s Non-Performing Loans Surge 16% in Q1 2025

The rise in non-performing loan ratios for banks in Q1 2025 can be attributed to a multitude of factors, including the lingering effects of the COVID-19 pandemic, natural disasters, the conclusion of Circular 02, and a lack of uniformity in secured debt management systems.

Is There an End in Sight to the Declining Interest Rates?

According to analysts, deposit interest rates have continued their downward trend, albeit at a slower pace. It is predicted that input interest rates will gradually increase towards the end of the year, with expectations of positive economic growth and credit growth reaching or even surpassing the set target of 16%.

Will Deposit Rates Rise Again?

The slight upward trend in deposit interest rates since the beginning of May 2025 is not merely a temporary fluctuation, but a reflection of the intricate interplay between systemic liquidity, credit growth targets, policy expectations, and global macroeconomic shifts.