Closing the week’s trading session, the VN-Index managed to hold on to the 1,300-point mark, but the domestic stock market was painted red. The benchmark index lost nearly 12 points, with VCB, FPT, BID, CTG, and TCB being the top negative influencers. Banking stocks witnessed a collective downward adjustment after consistently acting as market pillars in recent sessions.

In the VN30 basket, 24 out of 30 stocks witnessed a decline. Influential sectors witnessed simultaneous adjustments, with securities, insurance, oil and gas, technology, and retail sectors dominated by red.

VPL of Vinpearl halted its streak of ceiling-hitting prices since its debut and closed today with a 3.4% gain. Nonetheless, with just four trading sessions last week, VPL surged over 40%, attaining a market capitalization of more than VND181 trillion. While the market underwent corrections, the remaining stocks in the Vingroup cluster witnessed slight gains.

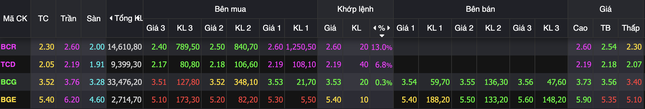

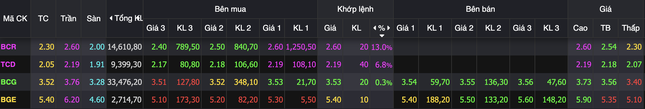

The Bamboo Capital group continued to move against the market tide. BCR and TCD witnessed ceiling-hitting prices again. Specifically, BCR of BCG Land rose by 13%, marking its fourth consecutive ceiling-hitting session. Over the week, the stock price escalated by more than 50%. If there is another ceiling-hitting session in the next trading session, BCG Land will have to provide explanations to the management authorities.

Bamboo Capital Group continues to buck the market trend.

BCG leaders are registering to sell a large number of shares. Mr. Nguyen Khanh Duy, a member of the BCG Board of Directors, registered to sell all 2.06 million BCR shares (a rate of 0.435%) from May 13 to June 6, due to personal financial needs. If the transaction is successful, Mr. Duy will no longer be a shareholder of BCR. Chief Accountant Huynh Thi Thao also registered to sell all 280,450 BCR shares from May 5-23.

Previously, Mr. Pham Huu Quoc, Vice President, and Mr. Nguyen Tung Lam, Vice Chairman of the Board of Directors, had sold all their owned shares. The BCR leaders’ massive sell-off comes as the business undergoes significant changes, and Bamboo Capital’s former chairman, Nguyen Ho Nam, was prosecuted. Following this event, the BCG group experienced a period of continuous floor prices. The stock prices are currently at “tea-and-ice-tea” levels.

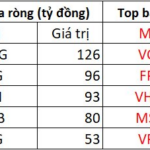

At the close on June 16, the VN-Index fell 11.81 points (0.9%) to 1,301.39 points. The HNX-Index decreased by 0.59 points (0.27%) to 218.69 points. The UPCoM-Index dropped by 0.04 points (0.04%) to 95.5 points. Liquidity declined, with the trading value on HoSE falling to over VND20,300 billion. Foreign investors net sold VND970 billion, focusing on VCB, FPT, and VHM…

The Big Buy: Foreign Investors Go on a Shopping Spree, Splurging on Vietnamese Bank Stocks

Foreign transactions continue to be a bright spot, with net buys of 891 billion VND in today’s session.

Breaking News: Foreign Investors Pour in Nearly VND 2.3 Trillion, Sending VN-Index Soaring Past 1,300 Points

The FPT stock witnessed a significant surge in buying activity during the afternoon trading session, with a staggering net buy value of VND 541 billion, making it the most actively bought stock across the market. This was followed by several other stocks that also experienced substantial net buying in the hundreds of billions of VND.

The Billion-Dollar Question: Unraveling the Foreign Block’s Strategy in Banking Stocks

Foreign transactions continue to be a bright spot, extending the net buying streak. Foreign capital inflows into the banking group, with MBB leading the way with net purchases of over 554 billion VND, followed by SHB with over 292 billion VND, and VPB, BID, STB, and LPB also among the top performers.