Foreign investors notably increased selling in the afternoon session compared to the morning, with particularly large sell-offs in VHM and VRE. However, buyers were even more aggressive, resulting in a net buying position of nearly VND 236 billion, bringing the total buying value for the session to VND 919 billion. Specifically, stocks in the VN30 basket witnessed net buying of approximately VND 656 billion.

Today’s net buying was slightly lower than that of May 13th (over VND 981 billion) but still impressive, marking the third consecutive session of strong buying. Combined, foreign investors poured a net VND 4,172 billion into HoSE-listed stocks over these three sessions.

There was significant selling pressure on VHM and VRE in this session. Foreign investors continuously sold these stocks from morning to afternoon. In the morning session, VHM witnessed net selling of VND 211.6 billion, and in the afternoon, it saw additional net selling of VND 422.9 billion. VRE experienced further net selling of about VND 80.6 billion, bringing the total net selling for the day to VND 237.7 billion. The total selling value for HoSE-listed stocks in the afternoon session reached VND 1,759.4 billion, a 12.5% increase compared to the morning session.

Buying demand in the afternoon was slightly weaker, decreasing by about 11% from the morning session, reaching VND 1,995.3 billion. MBB continued to attract buying interest but at a slower pace, with a net buying value of VND 98.1 billion for the afternoon session and VND 554.4 billion for the entire day. SHB witnessed additional net buying of VND 117 billion, resulting in a total net buying value of VND 295 billion for the day. FTP (+VND 158.5 billion), MWG (+VND 155.1 billion), VPB (+VND 121.8 billion), BID (+VND 92 billion), PNJ (+VND 67.8 billion), VPL (+VND 64 billion), and STB (+VND 54.4 billion) were among the other notable net bought stocks.

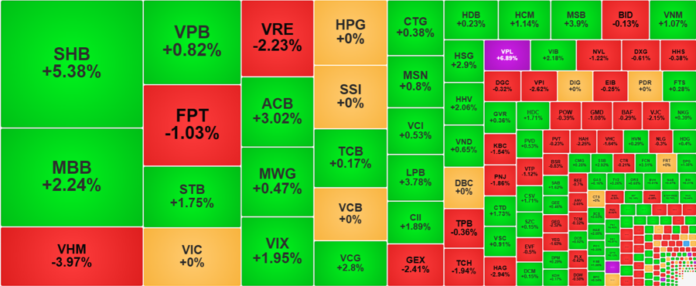

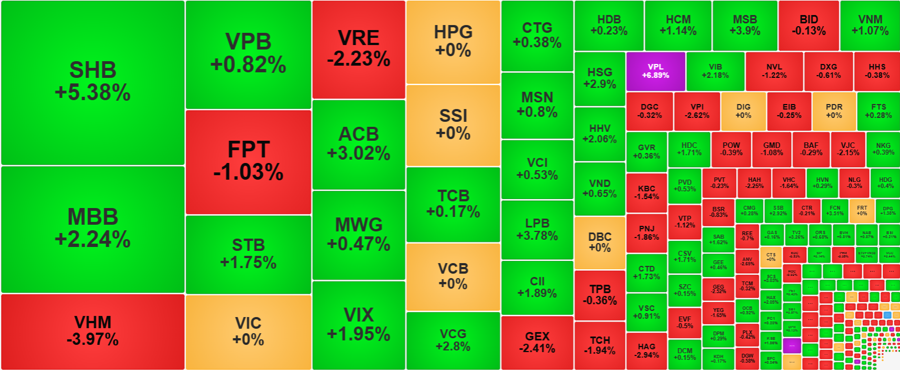

Although foreign investors’ activity was not as enthusiastic as the previous day, the market still performed positively in the afternoon session. After a dip towards the end of the morning session, the VN-Index gradually climbed higher and closed with a gain of 3.47 points, or 0.26%. The market breadth improved to a balanced level, with 162 gainers and 150 losers (compared to 112 gainers and 189 losers at the end of the morning session). The majority of blue-chip stocks in the VN30 index witnessed price increases, with 26 stocks rising compared to only four declining.

Both VIC and VHM performed better in the afternoon session, with VIC gaining 1.01% and closing at the reference price. VHM recovered by 0.52%, reducing its loss to 3.97%. VRE also climbed 2.77%, narrowing its loss to 2.23% at the close. While VIC played a role, the strength of the VN-Index was mainly driven by banking stocks: except for VCB, which dipped slightly by 0.51% from the morning session, all other banking stocks witnessed notable gains.

While MBB surprised in the morning session, SHB was the standout performer in the afternoon. As soon as the afternoon session began, a significant amount of money pushed SHB’s price to the daily limit of 6.92%, a sharp increase from the 2.31% gain at the end of the morning session. Although selling pressure also intensified, buying support for this stock remained robust. SHB’s afternoon trading volume surged to nearly VND 1,259 billion, and its closing price was 5.38% higher than the reference price. Other banking stocks, including CTG, HDB, LPB, STB, and VIB, also performed well in the afternoon, with most of them gaining over 1% compared to the morning session. While VPL remained the strongest performer at the daily limit, eight out of the top ten stocks leading the VN-Index’s gain were from the banking sector.

Out of the 27 banking stocks across all exchanges, only three were in the red: BID, EIB, and TPB, with minor losses. Seven out of the fourteen banking stocks in the VN30 index witnessed strong gains of over 2%, contributing to the VN30-Index’s recovery to 1,401.49 points, a 0.26% increase. This index surpassed its previous peak in March, marking a new 36-month high.

However, the strength of this peak-breaking session was not entirely convincing. The VN30 index’s breadth showed 18 gainers and eight losers. VHM’s 3.97% decline, FPT’s 1.03% dip, VRE’s 2.23% fall, and VJC’s 2.15% drop resulted in a loss of 6.5 points. Additionally, HPG, VCB, and VIC, which are influential stocks, failed to record gains today.

The rest of the market also witnessed some improvements in the afternoon session compared to the morning, with many stocks successfully reversing their losses. HoSE had 77 stocks rising over 1%, compared to 49 in the morning session. Meanwhile, the number of stocks falling over 1% decreased to 66, down from 86. Among the gainers, in addition to the aforementioned banking stocks like SHB, MBB, STB, and ACB, notable performers included VCG, which rose 2.8%, VIX (+1.95%), CII (+1.89%), HCM (+1.14%), HSG (+2.9%), and HHV (+2.06%), all of which recorded liquidity in the hundreds of billions of VND.

On the declining side, VHM stood out with a 3.97% drop and a liquidity of over VND 1,042.7 billion. Ten other stocks also witnessed declines of over 1% with liquidity exceeding hundreds of billions of VND, indicating significant selling pressure on certain stocks.

The market is currently witnessing robust liquidity, with the total trading value for the day reaching VND 25,656 billion on the two exchanges, excluding negotiated trades. Many stocks experienced significant declines with high liquidity, but there were also stocks that rose sharply with substantial trading volumes. This dynamic market indicates active participation from investors, with both buying and selling occurring with ease.

The Foreign Block: A Surprising Sell-Off of Nearly VND 1,000 Billion, With Personal Investors Holding Steady

The foreign bloc reversed course and locked in profits after a record-breaking buying spree. Today, they offloaded 970.7 billion VND, with a net sell-off of 771.4 billion VND in matched orders alone.

“The Power of Pillars: Market Shifts and Foreign Capital Inflows”

The pressure to secure profits this morning was widespread, coupled with weakness in some large-cap stocks, which caused significant market volatility. On the bright side, cash flow remains positive, particularly from foreign investors. As the VN-Index approaches its previous peak, a divergence of opinions is only natural.

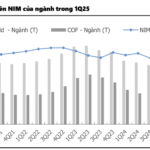

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

“US Tariff Deferral: Will the VN-Index Retreat to 1250 as Trade Talks Loom?”

The recent market rebound was a direct response to the temporary tariff truce between the US and other nations. Now, the market awaits official news on the outcome of tariff negotiations. During this waiting game, investors will be quick to take profits and exit the market.