After a relentless rally that saw the benchmark index surge past the 1,309-point mark, the market finally faced profit-taking pressures. The VN-Index closed the week’s final trading session nearly 12 points lower, retreating to just above the 1,300 level. The large-cap VN30 suffered a more severe loss, plunging by 17.05 points to settle at 1,384.

Banks, in particular, witnessed an average decline of 1.76% today, with prominent lenders experiencing steeper drops: VCB by 2.04%, BID by 2.14%, CTG by 1.89%, VPB by 2.7%, and VIB by 2.4%. Information Technology also faced selling pressure from foreign investors, falling by 3.2%. These two sectors alone accounted for a loss of 8.66 points in the overall market.

The Export-Import and Transportation sectors rebounded strongly after Trump’s decision to postpone tariffs on Vietnam. Meanwhile, the Rubber sector saw GVR drop by 1.42%, and the Mining sector witnessed a 7.36% decline in KSV. Fertilizer and steel stocks, including HPG, fell by 1.34%.

Similarly, airline stocks in the SGP, SCS, PVT, GMD, HVN, and VJC groups declined. Securities firms also encountered substantial profit-taking pressures after a prolonged growth period, with an average decrease of nearly 1%. Several stocks in this sector, such as VND, SHS, and BSI, experienced more significant drops.

Real estate stocks rotated with banks to become today’s market leaders. VIC rose by 0.25%, and VRE climbed by 1.45%. Other stocks in this sector, including VPI, TCH, KBC, and NVL, also posted gains. However, compared to the banking sector, this group was relatively weak in terms of influencing the overall market trend.

Today’s market sentiment was subdued, with total matched transactions on the three exchanges reaching VND 22,800 billion. Foreign investors reversed their buying trend from previous record-breaking sessions, turning net sellers today. They offloaded VND 970.7 billion worth of shares, with a net sell value of VND 771.4 billion in matched transactions.

Foreign investors’ main net buying activities in matched transactions were in the Retail, Goods & Industrial Services sectors. The top net bought stocks included MWG, HSG, TCH, MBB, NLG, CTR, VCI, VTP, GEE, and KBC. On the net selling side, they offloaded Banking stocks, with VCB, FPT, VHM, MSN, VPB, SSI, VIC, VNM, and VRE being the top sold stocks.

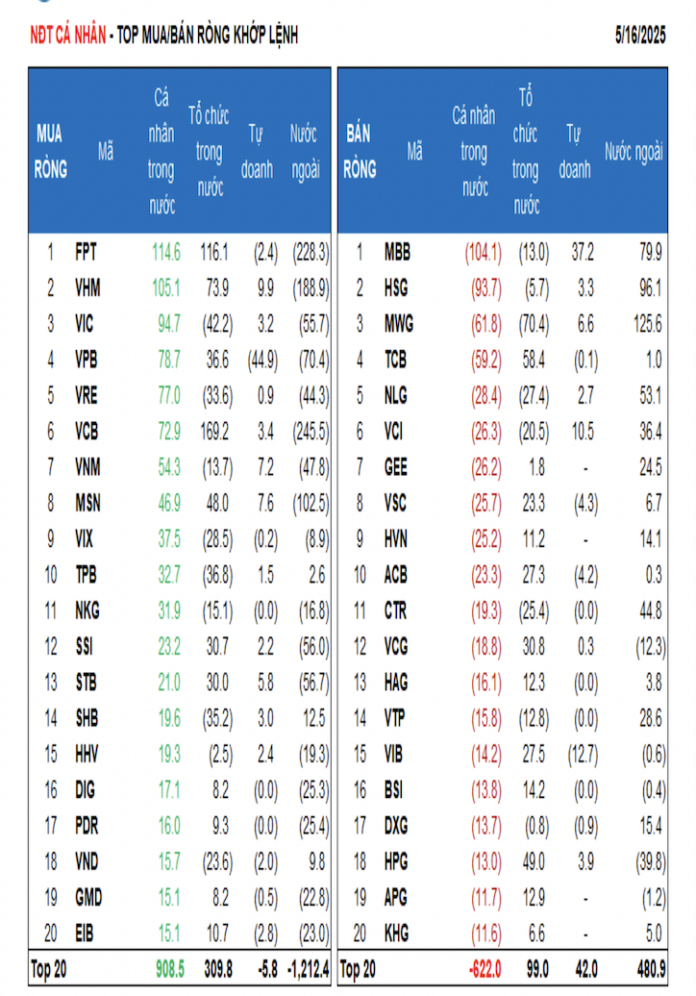

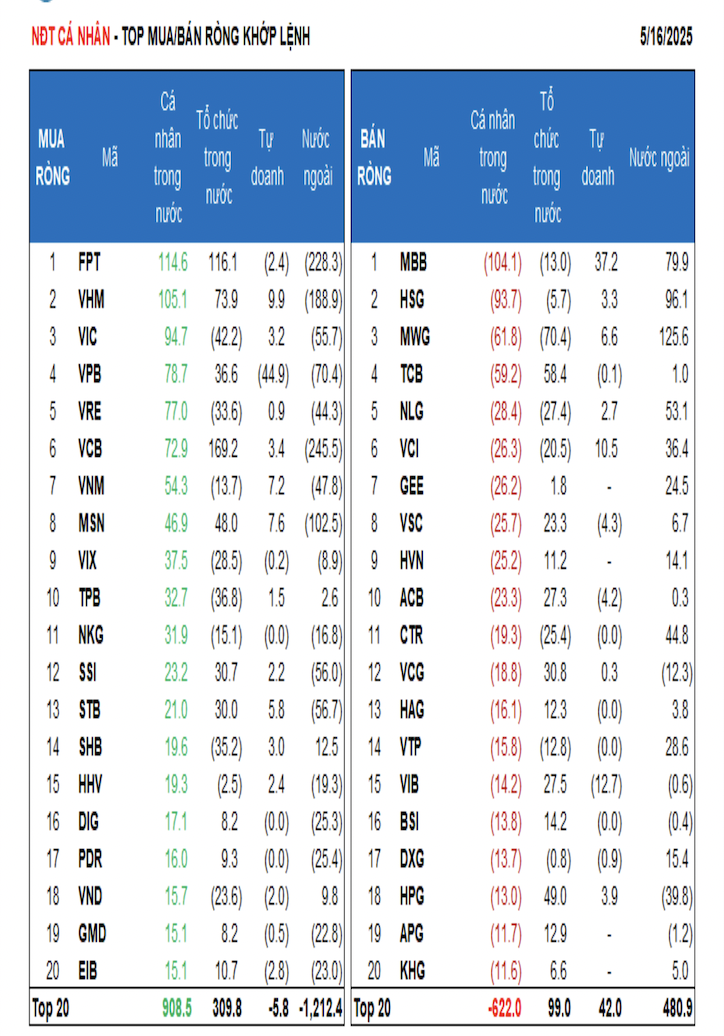

Individual investors net bought VND 766.2 billion worth of shares, with a net buy value of VND 348.4 billion in matched transactions. In matched transactions, they net bought 10 out of 18 sectors, mainly in the Real Estate sector. Their top net bought stocks included FPT, VHM, VIC, VPB, VRE, VCB, VNM, MSN, VIX, and TPB.

In terms of net selling, they offloaded stocks in 8 out of 18 sectors, primarily in the Basic Resources and Retail sectors. The top net sold stocks were MBB, HSG, MWG, TCB, NLG, VCI, VSC, HVN, and ACB.

Proprietary trading arms of securities firms net sold VND 192.4 billion worth of shares, with a net buy value of VND 30.9 billion in matched transactions. In matched transactions, they net bought 9 out of 18 sectors, with the Food & Beverage and Real Estate sectors witnessing the most substantial net buying. The top net bought stocks by these proprietary trading arms included MBB, VCI, VHM, MSN, VNM, MWG, HDB, LPB, VHC, and STB. On the net selling side, they offloaded Industrial Goods & Services stocks. The top sold stocks were VPB, VIB, REE, GEX, CTG, VSC, ACB, EVF, PC1, and HAH.

Domestic institutional investors net bought VND 380.3 billion worth of shares, with a net buy value of VND 392.1 billion in matched transactions. In matched transactions, these institutions net sold 6 out of 18 sectors, with the largest net selling observed in the Real Estate sector. The top net sold stocks were TCH, MWG, VIC, TPB, SHB, VRE, VIX, NLG, CTR, and VND. On the net buying side, they accumulated Banking stocks. The top net bought stocks included VCB, FPT, VHM, TCB, HPG, MSN, VPB, VCG, SSI, and STB.

Today’s matched transactions contributed 6.9% to the total trading value, with a value of VND 1,557.9 billion, a decrease of 12.8% compared to the previous session. Notably, there was a significant transaction in VPB, with domestic securities firms selling over 20.8 million shares worth VND 381.7 billion to individual investors.

Additionally, domestic securities firms purchased 3 million VCB shares (valued at VND 170.8 billion) from foreign organizations.

In terms of capital flow allocation, there was an increase in Securities, Construction, Steel, Food, Electrical Equipment, Software, Warehousing & Logistics, Power Production & Distribution, Special Finance, and Courier Services sectors. In contrast, the Banking and Retail sectors witnessed a decrease.

Specifically, in matched transactions, the capital flow allocation increased in the mid-cap VNMID and small-cap VNSML sectors, while it decreased in the large-cap VN30 sector.

“The Power of Pillars: Market Shifts and Foreign Capital Inflows”

The pressure to secure profits this morning was widespread, coupled with weakness in some large-cap stocks, which caused significant market volatility. On the bright side, cash flow remains positive, particularly from foreign investors. As the VN-Index approaches its previous peak, a divergence of opinions is only natural.

Stock Market Insights: The Short-Term Restructuring Opportunity

The derivatives expiry session yesterday pushed the VN30 to test the peak, reaching exactly 1404 points, but it turned downward today. F1 discounted this scenario early on, and when the bank stocks “confirmed”, the short-term profit-taking pressure increased significantly. This presents an opportunity to restructure and optimize costs.

Are Bank Stocks “Exhausted” After Leading the VN-Index Past the 1,300-Point Mark Last Week?

The banking sector has witnessed a stellar performance in the past week, with bank stocks surging ahead. Despite this recent rally, the industry’s valuation remains attractive for long-term investors. With a current price-to-book (P/B) ratio of 1.37x, the sector is trading below its five-year average of 1.73x, presenting a compelling opportunity for those seeking sustainable returns.

Market Beat: Foreigners Resume Net Selling, VN-Index Halts Rally

The market closed with the VN-Index down 11.81 points (-0.9%), settling at 1,301.39. The HNX-Index also witnessed a decline of 0.59 points (-0.27%), ending the day at 218.69. The market breadth tilted towards decliners, with 444 stocks falling against 332 advancing stocks. Within the VN30 basket, bears dominated as 24 stocks dropped, while only 4 rose, and 2 remained unchanged.