China’s gold demand, however, may weaken in the coming months, according to Ray Jia, head of research at the World Gold Council (WGC), as US-China tensions ease.

“Our model suggests that a weak US dollar, heightened geopolitical/economic uncertainty, and strong inflows into gold ETFs drove gold prices higher in April,” Jia wrote in a report. London gold prices in USD terms saw their strongest April gain since 2011, while Shanghai gold prices in CNY terms had their best April in 19 years.”

BREAKING RECORDS

Jia stated that gold prices in CNY had increased by 24% year-to-date, marking a record four-month high, while London prices rose by 27% in the same period. “The difference in these gains is mainly due to the appreciation of the CNY. The currency has gained 1% so far this year,” the expert explained.

Wholesale gold demand in China continued to rise in April. “The country’s gold industry withdrew 153 tons of gold from the Shanghai Gold Exchange, up 27% from the previous month and 17% from a year earlier. The improvement in wholesale gold demand is also reflected in the growing price differential between gold in China and the global market, averaging $37/oz in April, much higher than the $2/oz in March,” Jia said.

He attributed the strong growth in China’s wholesale gold demand in April to two factors.

“Demand for gold bars and coins remained high” as gold was the “highest-yielding asset amid the tense US-China trade war.” Additionally, jewelry companies were stockpiling for the upcoming Labor Day holiday shopping season.

However, it was the ETFs that truly stood out in April, as China’s gold ETFs saw their highest quarterly net purchases ever. The net gold purchases of these funds in April amounted to 49 billion CNY, equivalent to 6.8 billion USD.

“This is the third consecutive month of net gold purchases by China’s gold ETFs. Moreover, the rising gold prices contributed to increasing the total assets under management of these ETFs to 158 billion CNY, or 22 billion USD, a surge of 57% from April and an all-time high. The amount of gold held by these funds increased by 65 tons to 203 tons, also a record,” Jia informed.

“This unprecedented surge in gold demand was mainly driven by the increased attractiveness of domestic gold prices, concerns about the trade war, and falling domestic bond yields due to easing expectations. In the first four months of 2025, the value and volume of gold held by China’s gold ETFs increased by 125% and 77%, respectively,” Jia added.

He warned that while China’s gold ETF demand remained robust in May, it had significantly decreased compared to April. “This could be because the previous trade uncertainties were largely reflected in gold prices, and uncertainties have diminished following the US-China talks in Geneva, coupled with the stabilization of domestic gold prices,” Jia assessed.

In April, Chinese investors’ interest in gold futures contracts also reached unprecedented levels. “The average daily trading volume of gold futures contracts on the Shanghai Futures Exchange hit 859 tons, nearly double the previous month. We believe that the increased gold price volatility and the outperformance of gold prices attracted the attention of traders, significantly boosting the volume of gold futures contracts,” Jia evaluated.

Although gold futures trading in China has slowed down in early May, the average trading volume for the first five days of the month remained high at 756 tons, close to the record high. “This indicates the continued enthusiasm of traders for gold futures contracts despite the recent price adjustments,” Jia added.

GOLD INVESTMENT DEMAND MAY EASE

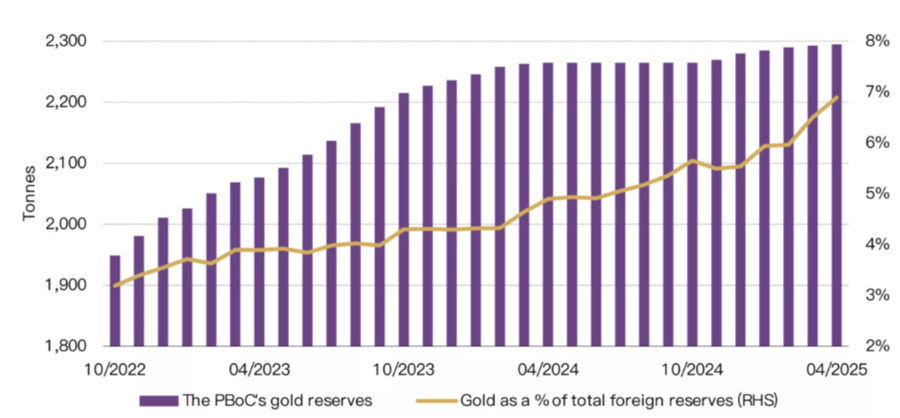

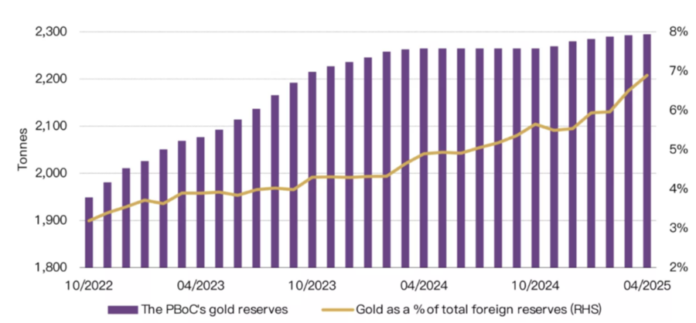

The People’s Bank of China (PBOC) contributed to the country’s gold demand in April by purchasing gold for the sixth consecutive month. “Official data shows that China’s gold reserves increased by 2.2 tons in April, reaching 2,295 tons, or 6.8% of foreign exchange reserves. In value terms, China’s gold reserves stood at $243.6 billion, a 6% increase from March. Year-to-date, China has announced an increase of $14.9 billion in gold reserves,” Jia said.

However, China’s gold imports in the first quarter of this year were rather cautious. The latest data shows that China imported 46 tons of gold in March, an increase of 14 tons from March but much lower than the 183 tons imported in the same period last year.

“China’s net gold imports in the first quarter were 73 tons, the lowest since 2021 when COVID-19 restrictions slowed imports, and well below the 545 tons in the first quarter of 2024,” Jia informed.

He stated that a primary reason behind China’s slow gold imports was weak jewelry demand in the first quarter. “This caused the retail gold price differential in China to sometimes turn negative, making importers hesitant,” he said.

Looking ahead, Jia shared that WGC analysts “forecast that China’s jewelry gold demand will remain subdued as we enter the low season following the Labor Day holiday, despite the potential boost from recent gold price adjustments.”

“Gold investment demand may soften in the short term, possibly due to profit-taking, range-bound gold prices, and easing US-China tensions. But in the long run, investment demand for gold in the country is further supported by profit attractiveness, lingering global economic and geopolitical risks, and the allocation of gold by Chinese insurance companies,” Jia concluded.

Gold Price Plunges to Five-Week Low, Falls Below $3,200/oz Mark Amid Strong Selling Pressure

This morning (May 15th), the global gold price dipped below the threshold of VND 100 million per tael…

The Golden Outlook: Unveiling the World Gold Council’s Insights on the Year-End Gold Market Trends

The World Gold Council offers insightful recommendations for gold investors, delving into the factors influencing gold prices for the remainder of the year. This insightful analysis provides a strategic outlook for those navigating the precious metal market, offering a glimpse into the potential future of gold investments.

Oil Slump, Gold’s Gloomy Outlook, and Iron Ore’s Rise: A Market Update for May 15th.

As of May 14, 2025, oil prices dipped as U.S. crude inventories rose beyond expectations, sparking concerns about oversupply. Gold prices fell to their lowest in over a month amid rising trade optimism. Meanwhile, iron ore prices surged to their highest in more than five weeks, buoyed by positive U.S.-China trade sentiments.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)