Gold prices continued their steep decline this afternoon, with gold rings and SJC gold taking a significant hit. Bao Tin Minh Chau quoted gold ring prices at 112.8 – 116 million VND per tael, a decrease of 2.7 million VND on the buying side and 2.5 million VND on the selling side compared to this morning’s opening.

DOJI followed suit with a reduction in gold ring prices to 107.7 – 111 million VND per tael, representing a 2 million VND drop on purchases and a 2.5 million VND dip on sales. Meanwhile, PNJ and SJC Company maintained identical rates, listing their gold rings at 110.5 – 113.5 million VND per tael, indicating average declines ranging from 2.5 to 3 million VND per tael.

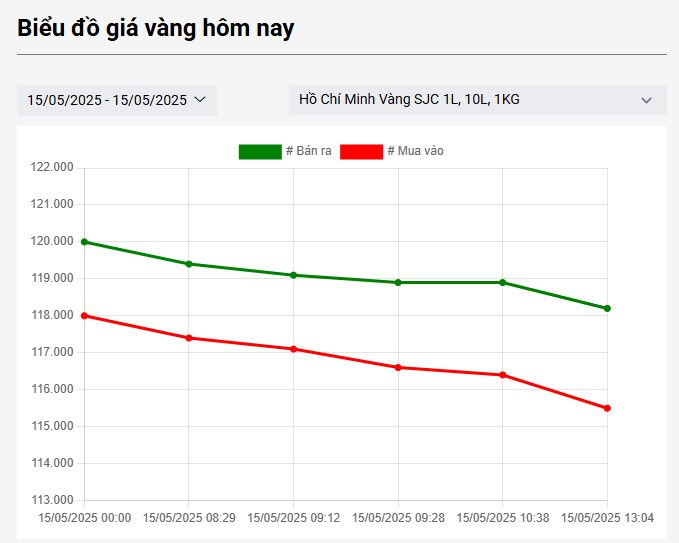

Gold bar prices at these enterprises also witnessed uniform adjustments, currently trading at 115.5 – 118 million VND per tael, reflecting a decrease of 2.5 million VND on purchases and 2 million VND on sales.

Price movements of gold bars at SJC Company. (Source: SJC Company)

—

During today’s trading session, gold businesses unanimously made substantial adjustments to their gold ring and SJC gold prices. Bao Tin Minh Chau led the way with gold ring quotes of 114.3 – 117.3 million VND per tael, marking a decrease of 1.2 million VND per tael on both buying and selling sides compared to yesterday’s close.

PNJ displayed gold ring prices at 111 – 114 million VND per tael, reflecting a drop of 2 million VND on purchases and 1.5 million VND on sales. SJC Company followed suit, lowering their rates to 111 – 114 million VND per tael, indicating a reduction of 1.5 million VND per tael on buys and 1 million VND per tael on sells.

DOJI listed gold ring prices within the range of 108.6 – 111.9 million VND per tael, noting a decrease of 1.1 million VND on the buying side and 600,000 VND on the selling side.

Gold bar prices at these enterprises also underwent significant cuts, fluctuating between 116.6 – 118.9 million VND per tael, signifying decreases of up to 1.6 million VND on purchases and 1.1 million VND on sales.

—

Kicking off the trading session this morning, VBĐQ Mi Hồng in Ho Chi Minh City witnessed a substantial decline in gold bar prices, now quoted at 117.2 – 119.2 million VND per tael, translating to decreases of 800,000 VND and 500,000 VND on the buying and selling sides, respectively, compared to yesterday’s close.

Gold ring prices at Mi Hồng also experienced a sharp drop of 800,000 VND per tael on both sides, currently trading at 112.2 – 114.5 million VND per tael.

Meanwhile, as of this morning’s survey, gold bar prices at prominent enterprises such as Bao Tin Minh Chau, SJC, DOJI, and PNJ remained steadfast at the 118 – 120 million VND per tael mark.

Gold ring prices at these companies also held steady from the previous session’s close. Specifically, Bao Tin Minh Chau quoted prices at 115.5 – 118.5 million VND per tael, while PNJ retained its range of 113 – 115.5 million VND per tael. SJC Company listed prices at 112.5 – 115 million VND per tael, and DOJI presented the lowest rates, fluctuating between 109.7 – 112.5 million VND per tael.

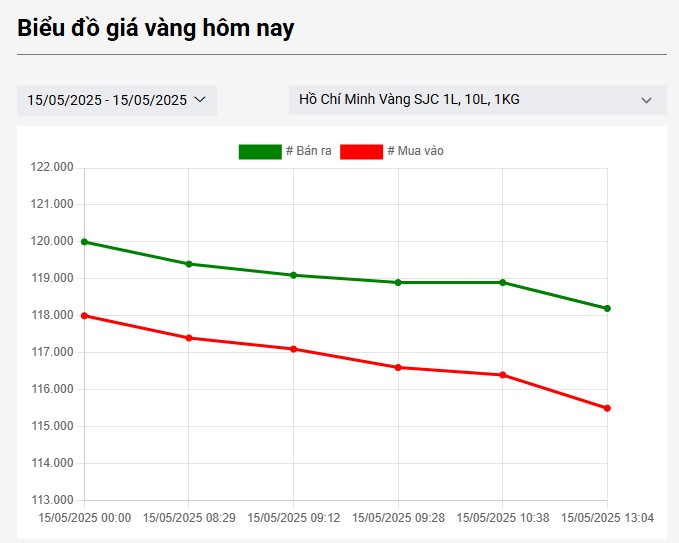

On the global front, spot gold prices hovered at the $3,182 per ounce mark, reflecting an $8 increment compared to yesterday’s trading close. Prior to this, during the trading session last night (Vietnam time), gold prices plummeted, dipping below the $3,200 per ounce threshold and touching a five-week low.

24-hour price movements of gold in the global market. (Source: Kitco News)

According to Kitco News, the gold market continues to face challenges as prices dip below the $3,200 per ounce level. However, an analyst asserted that gold still holds significant upside potential, given that inflationary pressures and economic deceleration would likely erode the purchasing power of the US dollar.

In an interview with Kitco News, George Milling-Stanley, Chief Gold Strategist at State Street Global Advisors, opined that despite the fluid nature of the US government’s tariff and trade policies, the ensuing economic instability would ultimately fuel inflationary pressures.

Gold prices witnessed a steep decline this week as sentiments in global financial markets improved following advancements in trade negotiations between the US and China. Over the weekend, the US administration announced a temporary reduction in tariffs on Chinese imports for 90 days to facilitate ongoing negotiations.

The more optimistic market mood dampened the appeal of gold as a safe-haven asset. Spot gold prices currently hover around $3,186.40 per ounce, reflecting a nearly 2% dip for the day and a five-week low. Compared to last month’s all-time high of $3,500 per ounce, prices have retreated by approximately 9%.

Despite the prevailing selling pressure, Mr. Milling-Stanley maintained a bullish outlook on gold, arguing that the US dollar has yet to benefit from the recent positive trade developments. While the US Dollar Index reclaimed the 100-point threshold, it has been volatile and has largely moved sideways, currently hovering around 100.94 points.

“I don’t anticipate the US dollar to strengthen in the near future due to the current policies and economic circumstances,” he asserted. “The prospect of rising inflation, slowing growth, and a weakening US dollar bodes well for gold.”

Typically, higher inflation would bolster the US dollar as it prompts the Federal Reserve (Fed) to tighten monetary policy. However, Mr. Milling-Stanley contended that the current context runs contrary to this notion. The decelerating economic growth has led the Fed to maintain interest rates, even as expectations grow for a rate cut by the Fed this summer.

“For now, Fed Chairman Jerome Powell remains focused on curbing inflation, but who knows what will happen when the labor market starts to weaken and unemployment rates climb,” he added.

While unsure if the US economy will slip into a recession this year, Mr. Milling-Stanley shared that this question has been frequently posed in the past few months. Despite the resurgence of positive investor sentiments, he doesn’t foresee the safe-haven demand for gold dissipating anytime soon.

“More and more people are buying gold, not because they expect prices to rise and enable them to sell for a quick profit tomorrow, but because of its protective value,” he remarked. “Gold has a long history of effectively safeguarding against prolonged high inflation, stock market downturns, and geopolitical turmoil, and these risks are certainly prevalent today.”

The Golden Opportunity: Exploring China’s Shifting Gold Investment Landscape

The Chinese gold market witnessed unprecedented growth in April, with a surge in prices and demand for both physical and paper gold investments.

The Golden Outlook: Unveiling the World Gold Council’s Insights on the Year-End Gold Market Trends

The World Gold Council offers insightful recommendations for gold investors, delving into the factors influencing gold prices for the remainder of the year. This insightful analysis provides a strategic outlook for those navigating the precious metal market, offering a glimpse into the potential future of gold investments.

Oil Slump, Gold’s Gloomy Outlook, and Iron Ore’s Rise: A Market Update for May 15th.

As of May 14, 2025, oil prices dipped as U.S. crude inventories rose beyond expectations, sparking concerns about oversupply. Gold prices fell to their lowest in over a month amid rising trade optimism. Meanwhile, iron ore prices surged to their highest in more than five weeks, buoyed by positive U.S.-China trade sentiments.

Prime Minister Demands “Urgent” Action: Gold Trading Business Inspection Results to be Reported by May

“The latest directive, Government Telegram No. 64, signed by Prime Minister Pham Minh Chinh, outlines critical measures for effective management of the gold market. This comprehensive strategy aims to bring stability and order to the industry, addressing key concerns and laying the foundation for a robust and transparent gold market in the country.”