The fast-food industry in Vietnam is abuzz with recent developments as prominent brands such as Jollibee, Lotteria, KFC, Popeyes, and McDonald’s find themselves in a peculiar situation. A series of fake brand accounts have emerged, sparking a lighthearted “chicken war” on social media, complete with witty banter and playful jabs at competitors. However, things took a turn when these fake accounts started making disparaging comments about rival brands, ultimately urging consumers to choose their chicken offerings over their competitors’ products.

Sensing the situation spiraling out of control, the aforementioned brands quickly responded, clarifying that these accounts were not affiliated with them and that they did not condone such behavior. They urged their partners and customers to interact only with their official channels and exercise caution when encountering unverified sources of information, underlining the importance of being vigilant against fake news on social media.

The battle for customers among chicken chains has never been more lively, thanks to the vibrant social media landscape.

In reality, these chicken chains have been locked in an intense battle to capture customers over the past few months. Social media has become their primary arena, where they deploy strategic communications and promotional tactics to attract customers and stir up the market.

The Combo War

According to YouNet Media, a social media and e-commerce data analytics firm, the first quarter of 2025 witnessed an all-out effort by chicken brands to capture market share. A deluge of promotions and discounts flooded both online and offline channels, enticing customers with irresistible deals.

Customers found themselves spoilt for choice amid this “combo war,” with prominent players like KFC, Jollibee, Lotteria, and McDonald’s offering neck-and-neck pricing for combos catering to various group sizes at different times of the day.

Particularly noteworthy were the promotions right before and after the Lunar New Year, a prime time for stimulating consumption. In addition to in-store discounts and gifts, these brands jumped on the livestream bandwagon, offering an array of combo deals catering to diverse budget segments.

Lotteria took the lead in terms of quantity, boasting 15 distinct combos. KFC and McDonald’s followed closely behind with 10 package deals each, catering to individuals and groups of up to ten people.

Jollibee, Popeyes, and Texas Chicken refused to be left behind, strategically promoting their signature combos throughout the first quarter. Moreover, these brands strategically “scattered” their deals, aligning with the spending trends of their youthful customer base.

For instance, KFC introduced the “waiting for salary” combo during the last week of the month, catering to customers looking to stretch their budget before the next payday. Jollibee, on the other hand, targeted office workers and students with its lunch combos, available from Monday to Friday.

McDonald’s focused on weekly specials and tasty Tuesdays and Thursdays, while Popeyes offered deals on Tuesdays, Wednesdays, and Fridays, with varying promotions each week.

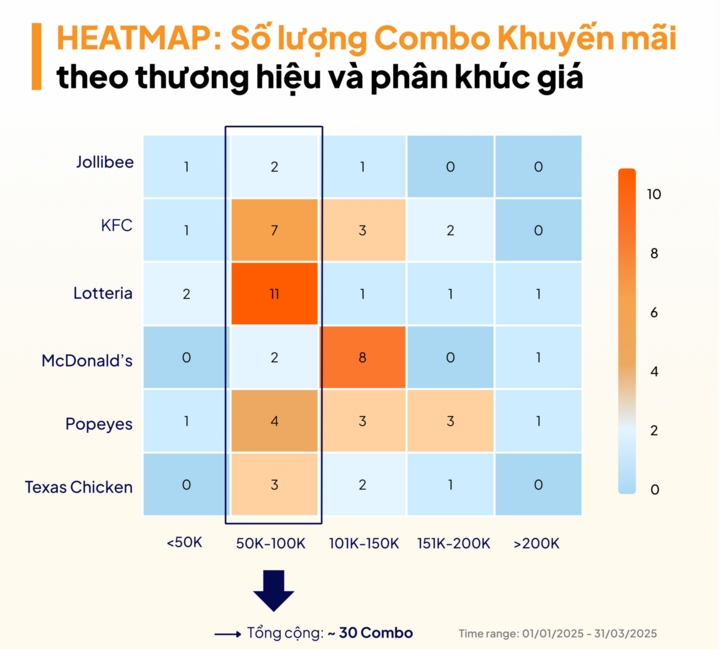

A plethora of combos catering to different price segments were introduced by brands at the beginning of 2025. (Source: YouNet Media)

In total, these seven prominent chicken brands offered over 60 combo deals in the first quarter alone. The competition extended beyond mere timing and pricing, as each brand strived to deliver creative and compelling promotional messages. With 8-15 combos per brand, they indirectly crafted impressive communications, providing diverse options across various price points.

The Price War

Amid this frenzy of promotions, price segmentation emerged as the core battleground for these chicken brands.

Lotteria stood out with its comprehensive combo coverage, spanning from budget-friendly to premium offerings. Notably, they captured the hearts of thrifty lunch-goers with their ultra-affordable lunch combo, priced at just 39,000 VND, available from mid-February to mid-March.

YouNet Media’s data reveals that the 50,000 – 100,000 VND segment witnessed the fiercest competition, with 29 combos offered by six brands. This segment is deemed versatile and appealing to individuals or pairs of customers seeking a quick, affordable bite.

Lotteria, KFC, and Popeyes dominated this segment, each presenting over three options. However, the abundance of choices also meant that customers were more likely to be fickle, displaying less brand loyalty.

The second most competitive segment, priced at 101,000 – 150,000 VND, attracted all brands, resulting in 18 combos. McDonald’s stood out here, contributing eight combo deals within this price range.

For larger groups or families seeking a bargain, the 151,000 – 200,000 VND segment offered fewer choices, approximately seven combos, but Popeyes and KFC made their mark. These two brands consistently offered deals across all price segments.

Jollibee, which entered the Vietnamese market later than KFC and Lotteria, has been rapidly expanding, with a store count on par with KFC. (Photo: Jollibee)

Notably, Don Chicken remained silent throughout the first quarter of 2025, refraining from introducing any new promotions on social media, except during the Lunar New Year holiday.

The brands also engaged in a culinary arms race, with Don Kitchen introducing four new dishes and Jollibee adding two new items to their menu. Lotteria swiftly capitalized on the matcha latte craze, offering it as a beverage option.

Beyond the promotional frenzy, the first quarter of 2025 also witnessed these chicken brands aggressively expanding their physical footprints.

Lotteria ventured into emerging markets with untapped potential and lower operating costs, establishing a presence in Dong Ha (Quang Tri), Nam Dinh, and Nha Trang (Khanh Hoa). Jollibee maintained its focus on urban centers, rapidly expanding in Ho Chi Minh City and Hanoi to maximize its reach within these populous cities.

Texas Chicken, on the other hand, targeted consumers with stable incomes and a preference for convenient dining experiences by opening new outlets in shopping malls and luxury apartment complexes.

“The first quarter showcased intense competition in capturing the attention of potential customers, both online and offline, through diverse promotional formats and communications strategies,” stated a YouNet report. “Notably, the combo promotions across various price segments stood out, offering attractive ‘bargains’ for diverse customer segments without solely relying on a ‘continuous discount’ message.”

The Race for Store Openings

Vietnam’s fast-food market, particularly the chicken segment, is witnessing rapid expansion. Familiar brands like Jollibee, KFC, and Texas Chicken are aggressively expanding their presence in the central areas of various provinces and cities. However, the intense competition makes it challenging to achieve effortless business success.

Jollibee Vietnam, a subsidiary of Jollibee Foods Corporation, reported impressive financial results for 2024, with a 20.2% year-over-year increase in pre-tax profits, amounting to 904 million pesos (approximately 424 billion VND). This performance surpasses that of other Jollibee markets outside the Philippines (excluding China).

Jollibee entered Vietnam in 2005, offering a range of chicken, burgers, and spaghetti. By the end of 2024, the chain operated 213 stores nationwide. This number has since grown to 226 stores, making Vietnam the second-largest market for Jollibee globally, just behind the Philippines, which boasts 1,279 outlets.

In contrast, Lotteria Vietnam, a member of Lotte GRS (the food division of the Lotte Group from South Korea), experienced another year of financial losses in 2024, marking the second consecutive year of negative performance. The chain recorded a loss of 6.903 billion won (approximately 106.7 billion VND) in the 2024 fiscal year, representing a 23% increase from the previous year’s loss of 86.8 billion VND. It is worth noting that Lotteria Vietnam was profitable in 2022, with earnings of 2.292 billion won (approximately 35.4 billion VND).

In 2024, KFC, Jollibee, and other fast-food chains were included in the ranking of reputable catering companies. (Source: Vietnam Report)

Lotteria Vietnam, which entered the market in 1998, currently leads in terms of store count, operating approximately 250 outlets. Their menu focuses on chicken, burgers, and sausages, and they own two processing plants in Long An and Binh Duong provinces to ensure a stable supply chain.

KFC, the American fast-food giant that debuted in Vietnam in 1997, operates around 218 stores specializing in chicken, burgers, and side dishes. They are known for regularly introducing new items that cater to local tastes.

McDonald’s, a more recent entrant to the Vietnamese market in 2013, primarily offers burgers, fries, and chicken. Their initial goal of opening 100 stores within a decade fell short, as they currently operate only 38 outlets, 17 of which are in Ho Chi Minh City.

Texas Chicken, another American brand that arrived in Vietnam in 2012, has established 35 branches in major cities, 21 of which are located in Ho Chi Minh City.

The Heart of Hanoi Cafe Shuts Down Abruptly, Leaving Many to Wonder Why

“Just when the bizarre name “lòng se điếu” was cooling down on social media, the sudden closure of two Lòng Chát Quán shops in Hanoi has sparked curiosity among netizens. They are wondering: What’s the story behind this unexpected turn of events?”

“Stock Exchange of Ho Chi Minh City (HoSE) Falls Prey to Scammers”

The image in question, according to HOSE, is a fabrication and does not reflect any official information from the Department.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)