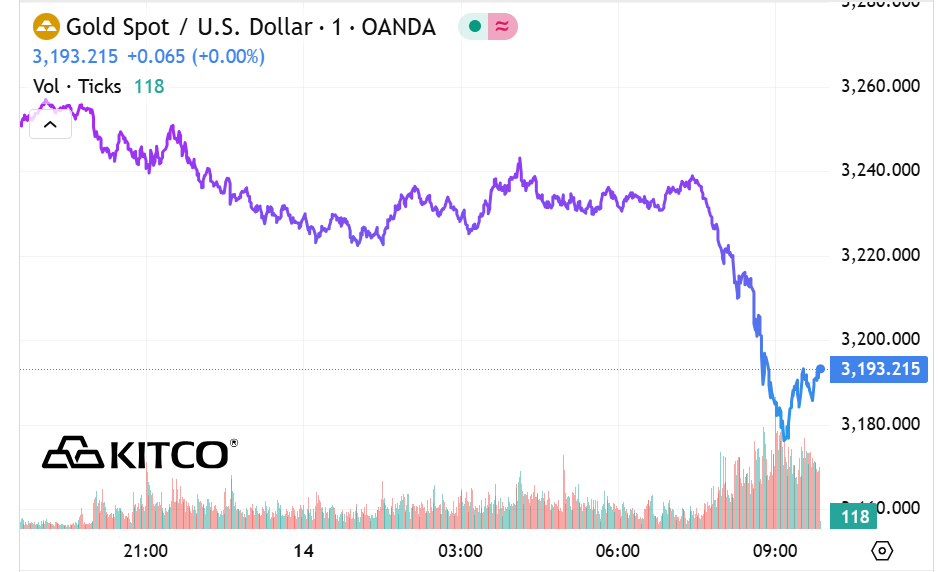

Gold prices experienced a notable drop on Tuesday evening, falling by approximately $70 per ounce within a 24-hour period and reaching its lowest level in over a month. Specifically, at 6:30 pm, the spot gold price was $3,239 per ounce. However, by 8:15 pm, the price had dropped to $3,175 per ounce.

The decline in gold prices can be attributed to easing trade tensions between the United States and China, which has lessened concerns about a potential global economic recession. This shift in sentiment has encouraged investors to embrace riskier assets, diminishing the appeal of gold as a safe-haven investment.

The downward pressure on gold prices continued as the United States and China agreed to a temporary truce on tariffs for 90 days following discussions in Geneva last weekend. According to a White House executive order and industry experts, the United States is expected to reduce “de minimis” taxes on low-value shipments from China to 30%.

Ole Hansen, head of commodity strategy at Saxo Bank, provided his insights to Reuters: “Following the tariff ceasefire announcement last weekend, equity markets have rallied strongly, and at least in the near term, this has reduced the appeal of gold as a safe-haven asset, which had pushed prices to multi-month highs in recent months. If we break below $3,200, there’s a risk of a deeper correction, possibly quickly heading towards $3,165.”

Global stock markets have rallied as worries about the US-China trade war subsided, supported by relatively mild US inflation data. Traders are now awaiting the release of the US Producer Price Index (PPI) report on Thursday for insights into the Federal Reserve’s interest rate trajectory. The lower-than-expected April Consumer Price Index (CPI) data has sparked speculation about the possibility of a Fed rate cut later this year. Markets currently anticipate a 53-basis-point reduction in interest rates by the Fed this year, commencing in September.

Gold, traditionally considered an inflation hedge, also tends to benefit from a low-interest-rate environment as the opportunity cost of holding non-yielding bullion decreases.

The Dollar and Gold Prices Plummet: May 15th’s Market Shockwave

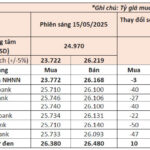

The morning witnessed a unanimous drop in USD exchange rates across banks, with fluctuations more pronounced than previous sessions. Domestic gold prices also took a hit, plunging by 2 to 2.5 million VND per tael.

What’s the Strategy Behind Foreign Investors’ Sudden $6 Billion Stock Purchase in Vietnam?

After relentlessly selling for almost two years with a net value of VND 1.25 quadrillion, foreign investors have officially reverted to a net buying trend in the Vietnamese stock market, marked by a record-breaking buying session of VND 2,400 billion yesterday.