Vinasun’s Profit Slump: Missing the Ride-Hailing Revolution

The sun sets on Vinasun’s dominance in Vietnam’s taxi industry as they struggle to adapt to the rise of ride-hailing apps.

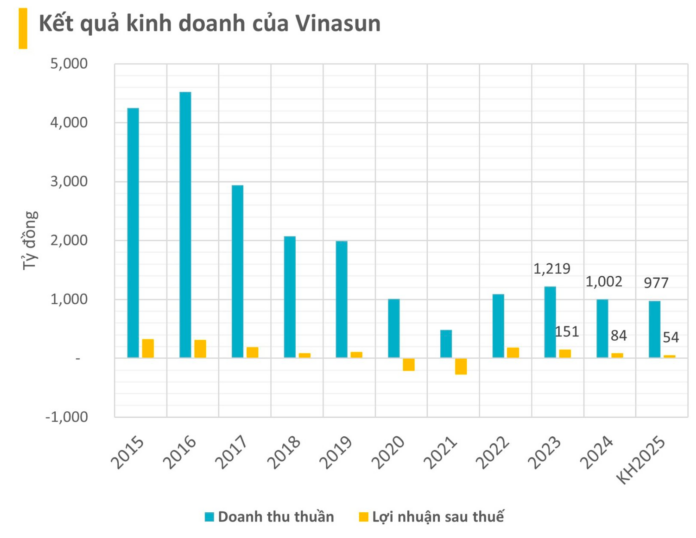

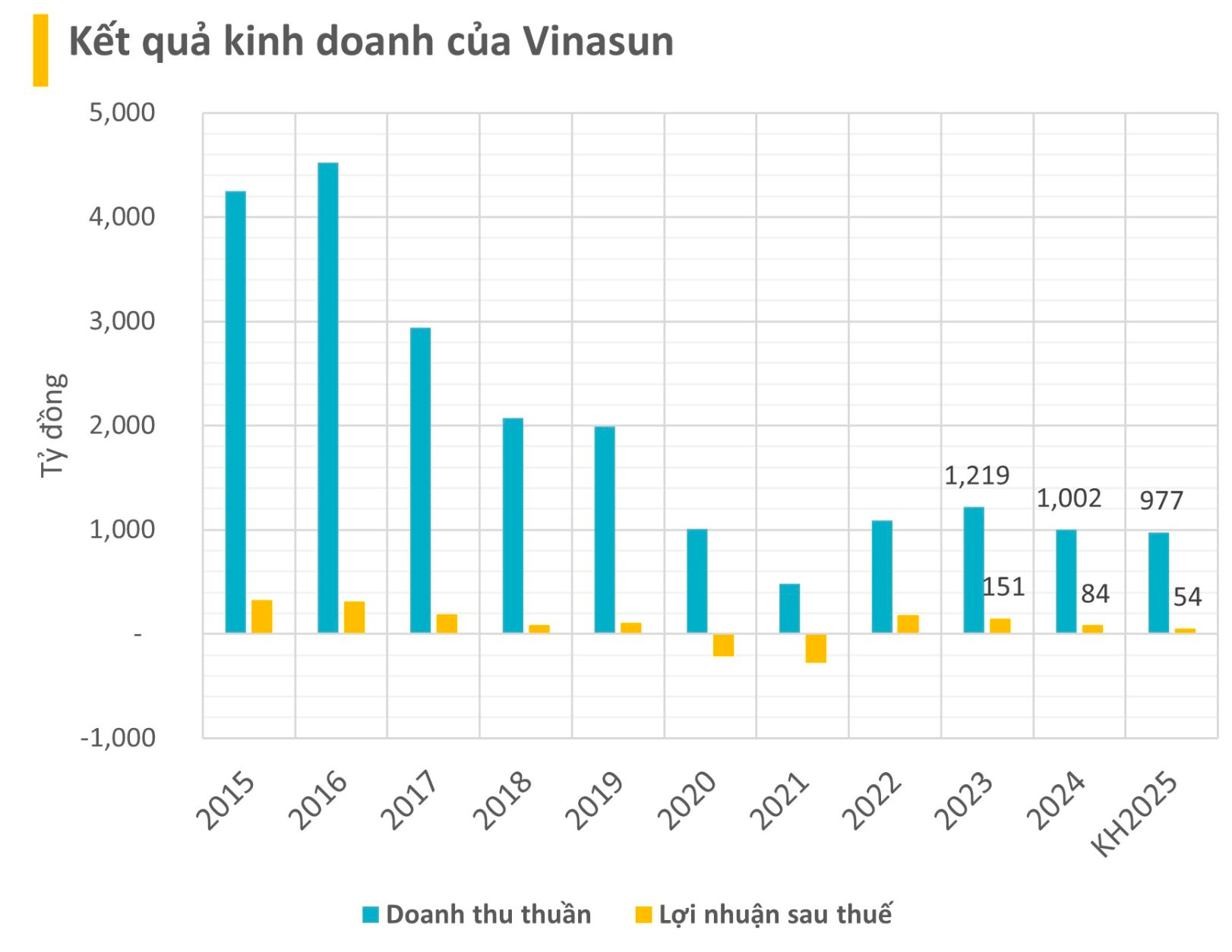

Vietnam’s once-dominant taxi company, Vinasun (VNS), has released its Q1 2025 financial report, revealing a meager after-tax profit of just 14 billion VND – the lowest since Q2 2022. Vinasun, which once boasted thousands of taxis and a stronghold in Ho Chi Minh City, has been left behind in the platform revolution that has swept the transportation industry.

Missing the Ride:

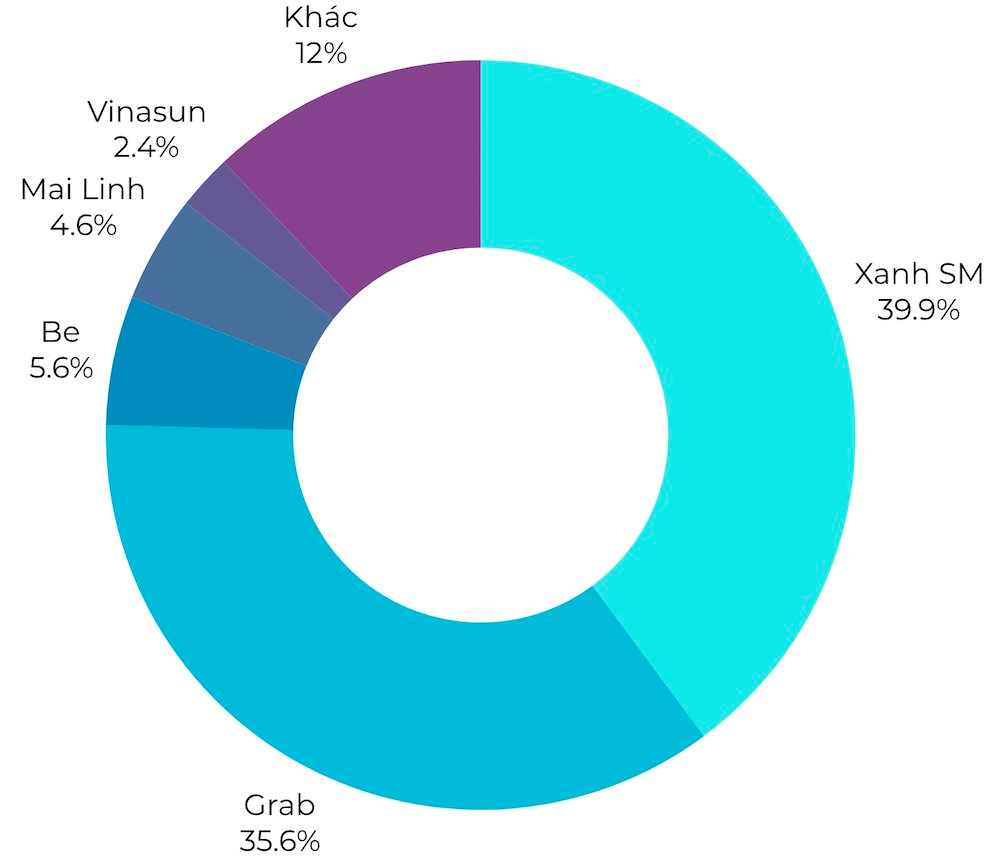

According to Mordor Intelligence, Vietnam’s taxi market is projected to reach 1.33 billion USD by 2025 and further expand to 3.7 billion USD by 2030, at a CAGR of 22.7%. However, Vinasun has been outpaced by its tech-savvy competitors, Xanh SM, Grab, and Be, who now dominate the market. Traditional taxi companies like Vinasun and Mai Linh lag behind, relying on their established networks, trained drivers, and brand recognition to stay afloat.

At Vinasun’s recent annual meeting, Vice President Tran Anh Minh acknowledged the company’s challenges, noting that their capital ownership pales in comparison to their rivals. While Xanh SM has raised capital to 18 trillion VND and Grab has attracted 12 billion USD, Vinasun’s capital ownership stands at just over 1.1 trillion VND, leaving them at a significant disadvantage.

This has had a direct impact on Vinasun’s profits, which have plummeted from hundreds of billions each year to just 84 billion VND in 2024, a nearly 45% drop from 2023. As a result, TAEL Two Partners, Vinasun’s largest foreign shareholder, has decided to divest, incurring significant losses on their initial investment made in 2013. Vinasun’s 2025 outlook doesn’t look much brighter, with projected profits of less than 54 billion VND.

Betting on Hybrid Vehicles:

In 2024, Vinasun made a surprising decision to invest in 700-800 hybrid vehicles, a choice that raised eyebrows amid the global shift towards electric cars. Hybrid vehicles, which combine a gasoline engine with electric power, were touted as a cost-effective solution. The company poured 800 billion VND into this initiative and plans to add approximately 400 new vehicles in 2025, mostly hybrid Toyotas.

“We are about to launch a new line of vehicles with no competitors. The management hopes that shareholders will understand and accompany us on this journey,” Vinasun representatives pleaded. However, shareholders expressed concerns about the financial burden of investing in hybrid vehicles, especially given the lack of significant financial improvements.

In response, Mr. Minh justified the choice of hybrid vehicles, citing their superior fuel efficiency – up to 1.5-2 times that of conventional cars. Additionally, Vinasun believes that hybrid vehicles are a better fit for the current infrastructure and eliminate the need for electric charging stations. The company acknowledges that the number of charging stations is currently insufficient for their fleet size.

However, the choice between electric, gasoline, or hybrid vehicles is not Vinasun’s biggest concern. Customers are flocking to Grab, Xanh SM, and Be for their convenience, large driver pools, transparent pricing, and attractive discounts. App-based ride-hailing has become the new normal, and Vinasun’s late entry and limited financial resources make it challenging for them to regain market share.

To survive and thrive, taxi industry experts suggest that traditional companies like Vinasun should collaborate with existing ride-hailing apps to expand their customer reach and integrate additional services. It’s a matter of adapting to survive in this rapidly evolving industry.

“Maybank Securities Revises VN-Index Forecast, Bullish Scenario Could Reach 1,500 Points”

In Maybank Securities’ May strategy report, the brokerage assesses that the easing of trade tensions continues to be a positive factor for market valuations. On this basis, Maybank Securities revises up its 2025 full-market earnings forecast by 5-10% and adjusts its year-end VN-Index target according to three scenarios: 1,300 points (base); 1,500 points (bull case); and 1,050 points (bear case).

“Mobilizing Resources and Infrastructure for Vietnam’s International Financial Center”

The Government Office has released Announcement No. 227/TB-VPCP, conveying the conclusions of Deputy Prime Minister Nguyen Hoa Binh regarding the preparations for the development of an international financial center in Vietnam.