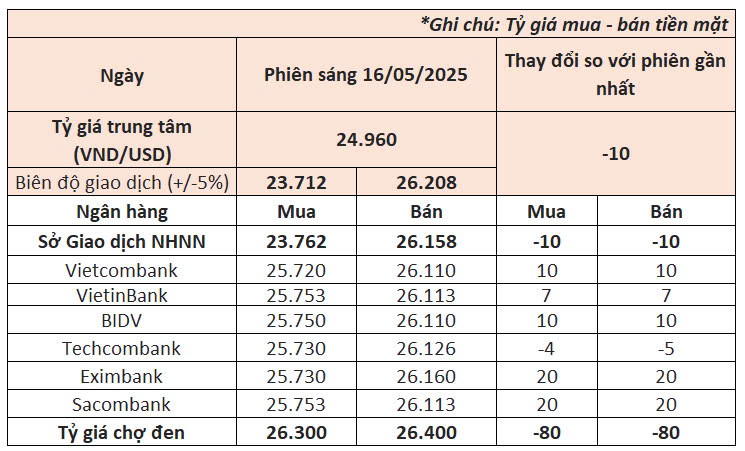

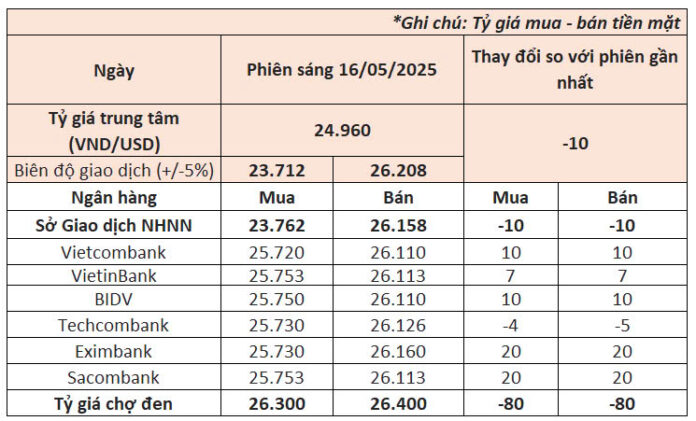

The State Bank of Vietnam has set the daily reference exchange rate for the US dollar at 24.960 VND/USD on May 16, a decrease of 10 VND from the previous day’s rate, marking the second consecutive day of decline.

With a permitted trading band of 5%., the exchange rate for commercial banks is now between 23.712 and 26.208 VND/USD.

The State Bank of Vietnam’s Trading Centre also lowered the buying and selling rates to 23.762 – 26.158 VND/USD.

This morning, after a decrease yesterday, the exchange rates at commercial banks showed an upward trend.

Vietcombank, the largest foreign currency trader in the system, quoted the dollar at 25.720 – 26.110 VND/USD at 9:00 am, an increase of 10 VND in both buying and selling rates compared to the previous day.

VietinBank and BIDV also raised their rates, with VietinBank increasing by 7 VND and BIDV by 10 VND for both buying and selling.

In the group of private banks, Sacombank and Eximbank both increased their buying and selling rates by 20 VND, while Techcombank lowered its buying rate by 4 VND and selling rate by 5 VND.

In the interbank market, the exchange rate closed at 25.934 VND/USD on May 15, an increase of 14 VND from the previous session on May 14.

In the self-traded market, the US dollar unexpectedly dropped sharply. At 9:00 am today, the dollar was traded at 26.300 – 26.400 VND/USD, with both buying and selling prices decreasing by 80 VND compared to the previous day.

Internationally, the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, hovered around 100.7 points, slightly lower than the previous day’s close.

The US dollar continued its downward trend following a series of economic data releases, notably a slowdown in retail spending in April due to uncertain economic prospects, as reflected in consumer health metrics.

The Commerce Department stated that total and core retail sales in the US rose by 0.1% in April, following increases of 1.7% and 0.8% in March, respectively. Year-over-year, retail sales and core retail sales rose by 5.2% and 4.2%, respectively, largely unchanged from the March figures of 5.2% and 5.4%.

The US Producer Price Index (PPI) for final demand fell by 0.5% in April, while the core PPI, which excludes food and energy prices, decreased by 0.4%. This was a departure from the previous month’s readings, which showed no change in the final demand PPI and an increase of 0.4% in the core PPI. Compared to the same month last year, the final demand PPI and core PPI rose by 2.4% and 2.9%, respectively, significantly lower than the March figures of 3.4% and 3.5%.

In the labor market, initial jobless claims for the week ending May 10 stood at 229,000, unchanged from the previous week and in line with expectations. The four-week moving average was 230,500, a slight increase of 3,250 from the previous four weeks.

At the Thomas Laubach Research Conference in Washington, DC, Fed Chair Jerome Powell commented, “Higher real interest rates may reflect the possibility of greater volatility in inflation in the future compared to the mid-2010s. We may be entering a period of more frequent and persistent supply shocks. This presents a significant challenge for economies and central banks.” Powell suggested that changes in trade policies could put the Fed in a difficult position as it strives to balance support for the labor market with inflation control.

The Exchange Rate in Vietnam: An Unusual Development

The US Dollar Index, a measure of the greenback’s strength against a basket of foreign currencies, fell nearly 9% in the first four months of the year on global markets. However, in Vietnam, the story is different, with the USD exchange rate appreciating. Since the beginning of the year, the USD has gained around 2.2% at commercial banks in the country.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)