According to Vietstock Finance, Ms. Doan Hoang Anh – daughter of Mr. Doan Nguyen Duc (also known as Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL) – was unable to purchase any shares of HAG during the registered trading period from April 14, 2024, to May 13, 2024. The reason cited was a lack of personal financial arrangement.

Following the unsuccessful transaction, Ms. Hoang Anh still holds a 1.32% ownership stake, equivalent to 14 million HAG shares. Previously, from December 30, 2024, to January 21, 2025, she successfully purchased one million HAG shares through order matching, bringing her ownership to the current level.

Mr. Doan Nguyen Duc (Bầu Đức), Chairman of HAGL. Source: Vne

|

Currently, Mr. Doan Nguyen Duc is the largest shareholder of HAGL, holding 30.26% of the company’s shares, equivalent to nearly 320 million shares. Combined, the Duc family holds nearly 334 million HAG shares, representing approximately 31.58% of the company’s charter capital.

On the stock market, HAG shares are currently in the warning status. The market price is trading around VND 13,300 per share, a recovery of 36% from the lows below VND 10,000 recorded when the market reacted negatively to the news of the US imposing a 46% tax on Vietnamese goods in early April.

| HAG Share Price Movement since the Beginning of 2025 |

Amid these concerns, Chairman Doan Nguyen Duc reassured shareholders in a letter, stating that the company’s production and export activities remain unaffected. He emphasized that bananas, their key product, are mainly consumed in markets such as China, South Korea, and Japan, which are not impacted by US tax policies. The company maintained its regular production and export activities and pledged to uphold transparency in information disclosure, providing timely updates in case of significant developments.

HAGL also adjusted the schedule for its 2025 Annual General Meeting of Shareholders to June 6, 2025, in Ho Chi Minh City, earlier than the previously planned date of June 18. The company stated that it had completed the necessary preparations and needed to select an audit firm to perform the semi-annual 2025 financial statement review promptly.

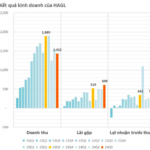

First-quarter profit increased by 59%

Regarding the first-quarter financial results for 2025, HAGL’s net revenue reached nearly VND 1,380 billion, a 11% increase compared to the same period last year. The fruit segment contributed over VND 1,000 billion (72% of total revenue), a 13% increase. The merchandise sales segment recorded VND 311 billion, nearly seven times higher than the previous year. However, the pork sales segment witnessed a significant 74% decline, generating only VND 76 billion.

The first-quarter profit reached nearly VND 341 billion, a 59% increase compared to the same period, thereby reducing the accumulated loss as of March 31, 2025, to nearly VND 83 billion. The gross profit margin improved to 40.9%, better than the 40.1% recorded in the previous year.

| HAGL’s Financial Performance for the Last Five Quarters |

According to HAGL, the increase in gross profit was mainly due to the improved performance in the banana business. Additionally, financial expenses decreased as the company repaid a significant portion of its bond debt, and financial losses decreased by VND 53 billion. There was also a reversal of provisions for long-term financial investments and a reduction in operating expenses.

The company expects to further enhance its business performance in the coming quarters, aiming to eliminate accumulated losses and address the warning status of its shares.

By Thế Mạnh

– 12:58, May 17, 2025

“A Billion-Dollar Deal: The Astonishing Transaction Between Two Vietnamese Business Giants”

As of December 30, 2024, HAGL had repaid a total of VND 1,030 billion in principal on the bond issuance to BIDV. This significant repayment showcases HAGL’s commitment to fulfilling its financial obligations and strengthening its relationship with BIDV, a key financial partner.